Highlights

- The UAN is a unique identification number assigned to every member of the EPFO.

- It simplifies the management of EPF accounts for employees and the EPFO by providing a single unique identification number that remains constant throughout an employee’s career.

- With the UAN, employees can easily access their EPF account information and perform various tasks online, making it a crucial element in the EPF system.

- After activating your UAN, users can log in to their accounts to access various services such as checking EPF balance, downloading the EPF passbook, and updating personal details.

- In this blog, we are looking at UAN activation with a comprehensive guide on how to activate UAN and every other related detail.

The Universal Account Number (UAN) is a 12-digit unique identification number assigned to every member of the Employees’ Provident Fund Organization (EPFO). The UAN serves as a single identification number for multiple member IDs that are allotted to a single member by different establishments.

This means that even if you change jobs, your UAN remains the same, and you can link all your EPF accounts under it.

The main purpose of the UAN is to simplify the management of EPF accounts for both employees and the EPFO. Previously, employees had to obtain separate member IDs from different employers, making it difficult to keep track of all their EPF accounts.

The UAN eliminates this problem by providing a single unique identification number that remains constant throughout an employee’s career.

To obtain a UAN, an employee must be registered with the EPFO by their employer. Once registered, the employee can obtain their UAN from their employer or directly from the EPFO website.

The UAN is linked to the employee’s Aadhaar number, bank account details, and PAN card details, making it easier to verify their identity and transfer EPF funds.

With the UAN, employees can easily access their EPF account information and perform various tasks online. These include checking their EPF balance, downloading their EPF passbook, submitting a claim for withdrawal or transfer of EPF funds, and updating their personal information such as their contact details and nomination information.

How to Know Your UAN through Employer?

To know your UAN, you can ask your employer who should have provided it to you during your EPF registration. Some employers also mention the UAN on the employee salary slips after the registration is complete.

How to Know Your UAN Through the UAN Portal using PF number/Member ID?

Alternatively, you can visit the EPFO website and click on the “Know Your UAN” option under the “Important Links” section. You will need to provide your personal information such as your name, date of birth, and registered mobile number or Aadhaar number.

After submitting this information, you will receive your UAN via SMS on your registered mobile number. Here is simple process to follow –

- Visit the UAN portal on

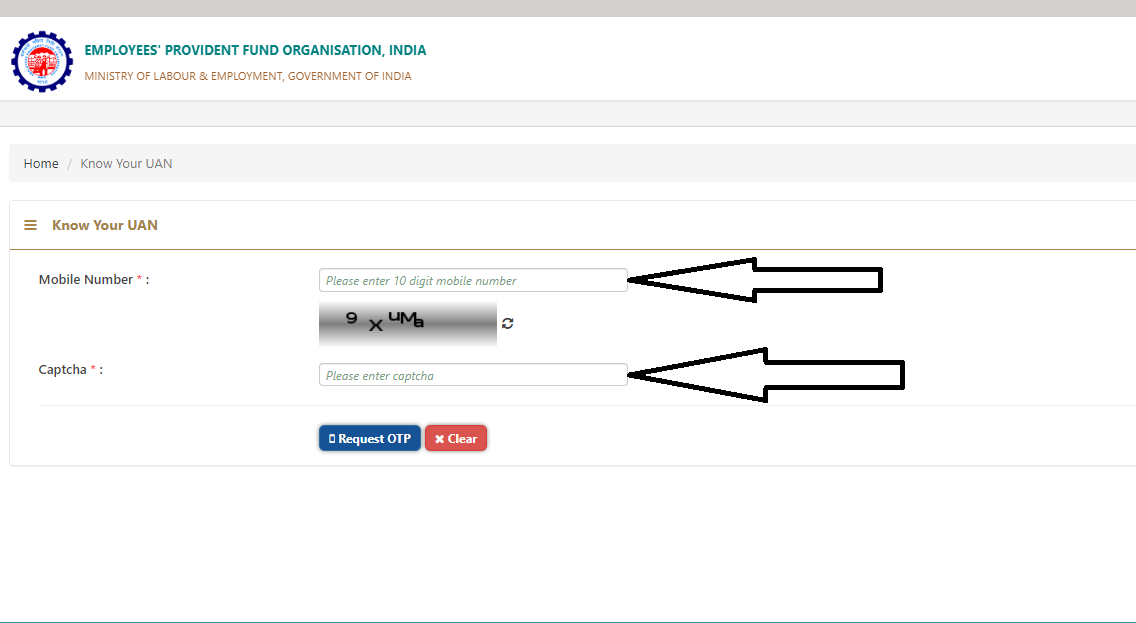

- Click on the tab ‘Know your UAN’.

- Enter your registered mobile number and captcha for verification. Click on the button ‘Request OTP’. Enter the OTP and captcha code and click on the ‘Validate OTP’ button.

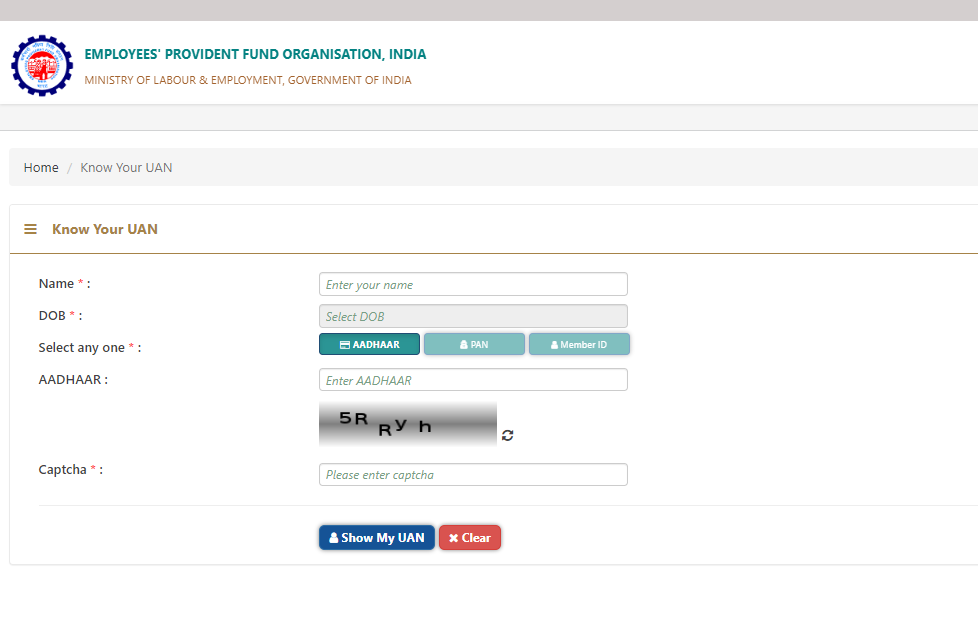

- It will redirect you to enter your name, DOB, PAN/Aadhaar/member ID, and captcha for verification. After entering all the details, click on the button ‘Show my UAN’.

- Your UAN number will be displayed on the screen.

What are Some Important Features of UAN?

Features

- The unique identification number is assigned to every EPFO member

- Single identification number for multiple member IDs

- Remains constant throughout an employee’s career

- Linked to Aadhaar number, bank account details, and PAN card details

- Accessible online through the EPFO portal

- Provides various services such as checking EPF balance, downloading EPF passbook, and updating personal details

- UAN-based system for filing claims and transferring funds

- KYC-compliant UAN accounts for faster claims settlement

What are the Benefits of UAN?

Here are the benefits of UAN

Simplifies management of EPF accounts: With UAN, employees no longer need to keep track of multiple member IDs as their EPF accounts from different employers can be linked to a single UAN. This simplifies the management of their EPF accounts and makes it easier to keep track of their retirement savings.

Facilitates seamless transfer of funds: The UAN-based system for filing claims and transferring funds makes it easy for employees to transfer their EPF balance from one employer to another without any hassle. This helps employees consolidate their EPF accounts and ensures that their retirement savings are not scattered across multiple accounts.

Enables faster claim settlements and withdrawals: KYC-compliant UAN accounts are processed faster, leading to the faster settlement of EPF claims and withdrawals. This reduces the time and effort required for employees to access their EPF funds and plan their finances.

Provides transparency and accessibility of EPF account information: Employees can easily access their EPF account information such as balance, contributions, and interest rates online through the EPFO portal. This provides transparency and enables employees to keep track of their retirement savings and plan accordingly.

Reduces paperwork and physical visits to EPFO offices: The UAN-based system allows employees to perform various tasks online such as checking their EPF balance, downloading their EPF passbook, and updating their personal details. This reduces the need for paperwork and physical visits to EPFO offices, saving time and effort for both employees and the EPFO.

Enhances efficiency and effectiveness of the EPF system: The UAN helps streamline the EPF system by providing a unique identification number that simplifies the management of EPF accounts, facilitates the seamless transfer of funds, and enables faster claim settlements and withdrawals. This enhances the efficiency and effectiveness of the EPF system and benefits both employees and the EPFO.

Overall, the UAN provides numerous benefits that help employees better manage their EPF accounts, access their retirement savings, and plan for their future.

What PF e-services Can Be Accessed through UAN?

There are several PF services available through UAN, which include:

Checking EPF balance: Employees can check their EPF balance by logging in to the EPFO portal using their UAN and password. They can view their current EPF balance as well as the details of their contributions and interest earned.

Downloading EPF passbook: Employees can download their EPF passbook, which contains the details of their contributions, withdrawals, and interest earned. This helps them keep track of their EPF account transactions.

Updating personal details: Employees can update their personal details such as their name, date of birth, and contact details using the UAN portal. This helps ensure that their EPF account details are up-to-date.

Applying for EPF withdrawal: Employees can apply for EPF withdrawal using the UAN portal. They can submit their withdrawal request online and track the status of their application.

Applying for EPF transfer: Employees can apply for EPF transfer using the UAN portal. They can request the transfer of their EPF balance from one account to another.

Updating KYC details: Employees can update their KYC details such as their Aadhaar number, PAN number, and bank details using the UAN portal. This helps ensure that their EPF account is KYC-compliant and enables faster claim settlements and withdrawals.

Overall, the PF services available through UAN provide employees with easy access to their EPF account information, enable faster claim settlements and withdrawals, and help streamline the EPF system.

Documents Required to Open UAN

If you have just joined your first registered company for a job, you need the following documents to get your Universal Account Number.

- Bank Account Info: Account number, IFSC code, and branch name.

- ID Proof: Any photo-affixed and national identity cards like driving license, passport, voter ID, Aadhaar, and SSLC Book.

- Address Proof: A recent utility bill in your name, rental/lease agreement, ration card or any of the ID proof mentioned above if it has your current address.

- PAN Card: Your PAN should be linked to the UAN.

- Aadhaar Card: Since Aadhaar is linked to a bank account and mobile number, it is mandatory.

How to Activate The UAN Number of Your EPF Account EPFO’s UAN Member Portal Online?

Step 1: Go to the EPFO portal.

Step 2: Select ‘employees’ under the services section.

Step 3: Click on the ‘Member UAN/Online Service’ option available under the services section.

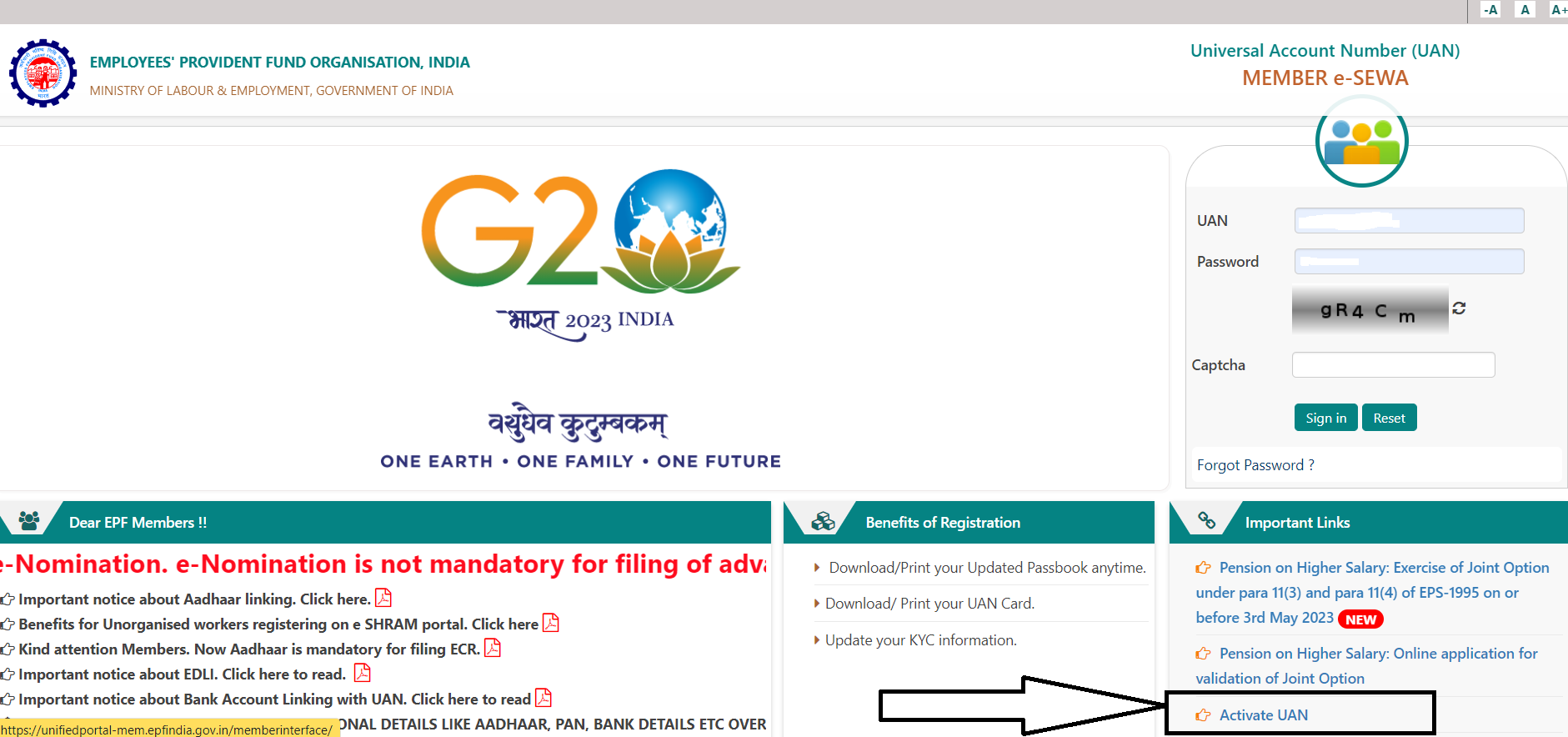

Step 4: Click on ‘activate UAN.’

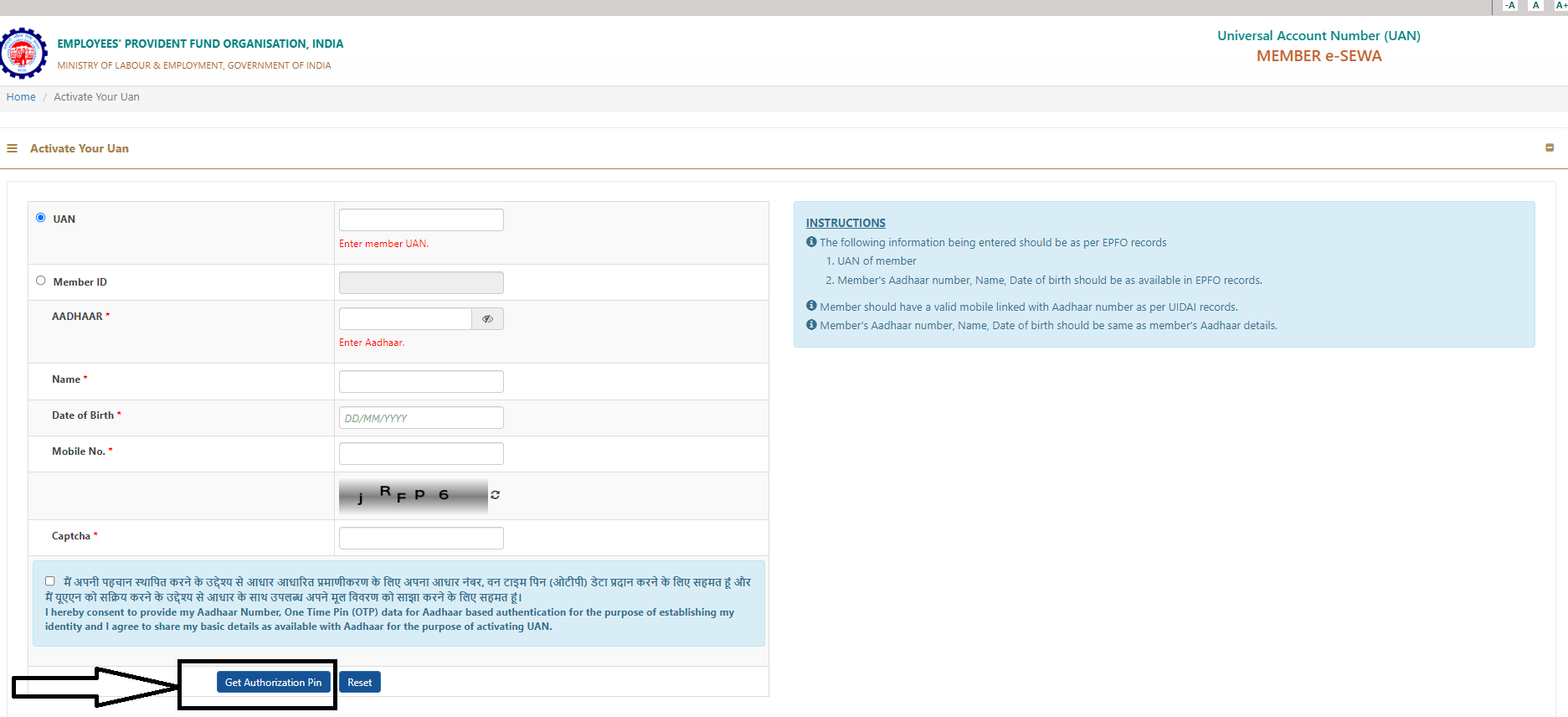

Step 5: Enter the details, including UAN, Member ID, and Aadhaar number.

Step 6: Request for the authorization PIN.

Step 7: Validate the OTP received on your registered mobile number and activate UAN.

Step 8: Once the process is complete, you will receive a password on your mobile number to log in to the UAN member portal and access your EPF account.

FAQs

Q1. How to Reset Your UAN Password?

Answer. Here is the entire process to reset your UAN password –

- Navigate to the UAN portal.

- Choose the ‘Forgot Password’ option.

- Enter your UAN and the displayed captcha details and click on the ‘Submit’ button.

- Enter your name, gender, and date of birth and click on the ‘Verify’ button.

- Enter your Aadhaar number, captcha code, and click on the ‘Verify’ option.

- Once the details you have entered get validated, key in the mobile number in the box provided and click on ‘Get OTP’.

- An OTP will be sent to the mobile number you have entered. Key in your OTP and click on ‘Verify’.

- You will now get an option to change your password. The password has to be entered twice in the boxes as provided. Once you enter the new password details, click on ‘Submit’.

- On clicking the ‘Submit’ option, the password will be updated on the EPFO portal.

Q2. What is the process to download UAN Card Online?

Answer. With a valid EPF number, you can easily download your UAN card by following the steps mentioned below:

- Make sure you have an active UAN with a valid password for logging into the EPFO portal.

- Visit the UAN portal.

- Enter your UAN number and password along with the Captcha Code information displayed and click on the ‘Sign in’ option.

- Under the ‘View’ tab, select ‘UAN Card’.

- The page will then display the card which is linked to your account.

- Click on the ‘Download UAN card’ from the options displayed on the top right-hand side of your screen.

- You can either save a soft copy of your UAN card or print a hard copy of it for future use.

Q3. How to Obtain UAN for EPF?

Answer. An employer must register on EPFO if there are 20 or more employees. If the old employer has already assigned the UAN, the employee should provide such details to the new employer. However, for employees joining the service for the first time, the employer needs to generate the UAN for the employee. To generate a new UAN for the employee, the employer has to follow the below steps:

- Sign in to Employer’s EPF Portal using the ID and password

- In the ‘Member’ section and click on the tab ‘Register Individual’,

- Enter the employee’s details such as Aadhaar, PAN, bank details, Aadhaar, etc.

- Approve all details in the ‘Approval’ section.

- EPFO generates a new UAN of the employee, and the employer can link the PF account with the UAN of the employee.

Q4. How to complete e-KYC for EPFO?

Answer. Below are the steps to complete e-KYC for EPF account:

- Log into the EPFO portal by entering your UAN and password.

- Click on the ‘Manage’ tab and select ‘KYC’ option.

- Select the box of the KYC document you want to add – ‘Bank’, ‘PAN’ or ‘Passport’.

- Enter the bank account number, IFSC number, PAN number or passport number and click on the ‘Save’ button.

- Your KYC details will be shown under the ‘KYC Pending for Approval’ heading.

- The EPFO will verify the details will be verified by the EPFO

- After it is verified, the KYC will be updated and will be shown under the ‘Currently Active KYC’ heading.

Q5. How to Change/Update Personal Details in the UAN Portal?

Answer. An employee can change or update his/her personal details, such as name, date of birth, mobile number and e-mail ID by logging into the UAN portal. However, the details to be updated should match the details on the Aadhaar card, else it will not be updated on the UAN portal. The employer must give their approval for updating the name and date of birth.

Q6. How to link Aadhaar number with UAN?

Answer. The employee should follow the below steps to link UAN with Aadhaar:

- Log in to the EPFO portal and click on ‘UAN Member e-Sewa’ under ‘For Employees’.

- Enter UAN, password, and Captcha to Sign in to the portal.

- Under the ‘Manage’ tab on the top panel, click on ‘KYC’

- Tick the check box in front of Aadhaar, enter your 12-digit Aadhaar number and name, and save the details.

- After submitting, your details will reflect under the ‘Pending KYC’ tab. Once the employer approves, it will reflect under the ‘Approved KYC’ tab (It will generally take 15 days for approval).

Linking your Aadhaar to the EPF account will help in faster processing of the withdrawal and transfer process. The present employer should approve and verify the KYC, including the employee’s Aadhaar details.

Q7. What is UAN Customer Care Number?

Answer. UAN Helpdesk Number is 1800-118-005. Users can also reach out to UAN Helpdesk via Email ID: employeefeedback@epfindia.gov.in. Timing – 9:15 a.m. to 5:45 p.m.

Q8. What is a UAN and PF account number?

Answer. UAN stands for Universal Account Number, which comprises information concerning all member IDs of an employee. UAN is eligible throughout an employee’s lifetime and will remain a permanent number. The 12-digit UAN will remain the same if an employee switches jobs.

A PF number comprises all PF information and details concerning the PF transaction of an employee with the issuing organisation. This number is mandatory for EPF withdrawals.

Q9. How to know the UAN number without a mobile number?

Answer. You can get your UAN through your employer. You need to contact your HR/accounts department to get your UAN without a mobile number. You can also check your payslips since some companies put the UAN numbers on payslips.

Q10. How to know the UAN number by missed call?

Answer. You can get the UAN number by giving a missed call when you are registered and activating your UAN on the UAN portal. Members registered on the UAN portal can get the UAN details by giving a Missed call to 9966044425 from their registered mobile number.

Q11. How to check UAN on your salary slip?

Answer. Some companies include the UAN number on the salary slips. Thus, check your salary slip and search if there is a mention of the UAN number on the salary slip. Employers will clearly mention the heading ‘UAN – (12 digit number)’ in the salary slip.

Q12. Will employers withhold EPF balance when changing jobs?

Answer. No, this cannot be done as the balance in EPF accounts is linked with the UAN which is transferable across all eligible employers.

Q13. Can I have two UANs?

Answer. No. An employee can have only one UAN that remains unchanged during the course of their employment and is transferable to all eligible employers. In the case where two UANs have been allotted to you, you need to report the issue to your current employer or drop in an e-mail to uanepf@epfindia.gov.in. Post verification, your older UAN will be blocked. You will then have to submit a request to transfer your funds to your latest active UAN number.

Q14. Can I change my personal details linked with UAN?

Answer. Yes, the UAN portal offers you the facility to change your personal details linked with UAN. However, please note that the changes will be made only if they match the details linked with your Aadhar card. So, any requisite changes need to be made to Aadhaar first.

Q15. Is there any fee for UAN registration and activation?

Answer. No, there is absolutely no fee involved in the UAN registration and activation process.

16) Linking Adhaar to UAN Online procedure

Answer. 1. Visit Member Home

2. Sign in to the MEMBER e-SEWA using UAN and password

3. Select “KYC” under the “Manage” tab

4. Select the option for “‘Aadhaar’” 5. Enter the required details (name and Aadhaar Number)

5. Click “Save” The process of Aadhaar link is completed when “verified” status is shown next to the Aadhaar number.

Offline procedure:

The offline procedure of linking Aadhaar to UAN is by visiting any of the EPFO’s branches or Aadhaar CSE (Common Service Centre). There, the member needs to submit a request form with a self-attested copy of their Aadhaar card. Upon verification, it will be done which shall be confirmed by a notification to the registered mobile number.

EPFO has come a long way since its inception in 1952. It has taken various steps along the way from providing a social security service to making EPF claim settlement easier, and UAN is one such significant step.

17) 8 Key Features of Universal Account Number (UAN)

Answer. The UAN for EPF serves as a one-of-a-kind identifier for all EPF members, allowing them to keep track of their EPF contributions, withdrawals, and transfer requests with ease. Here are the most noteworthy advantages of using UAN:

Single Window Access: Members can access their EPF account through a single-point window, avoiding the need to remember multiple account numbers.

Convenient Mobile Access: With the UAN Member Portal’s mobile application, members can view their EPF account details from anywhere, at any time.

Up-to-date Passbook: Members can view their transaction history through the UAN Member Portal’s instant passbook access.

Streamlined E-Nomination: Members can nominate a person to receive their EPF balance in the event of their death through the UAN Member Portal.

Seamless Transfer Process: Transferring EPF accounts from one organization to another is made easy with UAN, without the need for physical form submissions.

Real-time Claim Status: Members can check the status of their EPF withdrawals, transfers, and other claims through the UAN Member Portal.

Secure Online Contributions: Members can make secure online contributions to their EPF account through the UAN Member Portal.

SMS Alerts for Transactions: The UAN Member Portal sends SMS alerts for contributions, withdrawals, and other transactions, keeping members informed and up-to-date.

These UAN features make managing EPF accounts an effortless and efficient process for members.

18) Top 8 Benefits of Universal Account Number (UAN)

Answer. The Universal Account Number (UAN) for the Employees Provident Fund (EPF) is a revolutionary tool that offers a wealth of benefits to its members. Here are some of the top perks of using UAN:

One-Stop Access: Members can access all their EPF information from a single point, eliminating the need to remember multiple account numbers.

On-the-Go: The UAN Member Portal provides a mobile application that allows members to access their EPF account from anywhere, at any time.

Transparency: With the UAN Member Portal, members have instant access to their passbook, providing a clear view of all EPF transactions.

Peace of Mind: UAN gives members the option to nominate a person for their EPF account, ensuring that their savings will go to their intended recipient in the event of their death.

Hassle-Free Transfers: Members can transfer their EPF accounts from one organization to another without any inconvenience, thanks to UAN.

Real-Time Status: The UAN Member Portal provides members with an easy way to check the status of their EPF withdrawal, transfer, and other claims.

Online Convenience: Members can make online contributions to their EPF account with just a few clicks through the UAN Member Portal.

Instant Notifications: UAN sends SMS alerts for various transactions, such as contributions and withdrawals, so members always stay informed.

In conclusion, UAN brings a wealth of advantages to EPF members, making it a more convenient and efficient way to manage their accounts.

19) What is The Importance of Having a Universal Account Number (UAN)?

Answer. Having a Universal Account Number (UAN) for the Employees Provident Fund (EPF) is essential for various reasons. Here are some of the most significant ones:

Easy Access: UAN gives EPF members a single place to access their accounts, eliminating the need to remember multiple numbers and reducing stress.

Smooth Transfers: When you have a UAN, moving your EPF account from one company to another becomes a breeze, without the need for physical forms.

Centralized Control: The UAN platform lets you manage your EPF account from one place, making it easy to keep track of contributions and withdrawals.

Record Keeping Simplified: The UAN Member Portal provides quick access to your passbook, allowing you to keep a complete record of your EPF transactions in one place.

Peace of Mind: With e-nomination through UAN, you can ensure that your EPF balance goes to your nominated person in case of death.

Easy Contributions: UAN makes it simple to make online contributions to your EPF account, saving you time and effort.

Instant Updates: The UAN Member Portal sends SMS alerts for various transactions, including contributions and withdrawals, keeping you informed all the time.

In short, having a UAN gives EPF members control over their accounts and makes managing their EPF funds easier. With a centralized platform for EPF management, UAN helps members keep track of their savings and plan for the future.

20) How To Find/Check UAN Number?

Answer. The Universal Account Number (UAN) is a unique identification number issued by the Employee Provident Fund Organization (EPFO) to employees.

It is a vital component in accessing employee provident fund (EPF) accounts, and it is essential to have an active UAN to avail of various benefits related to the EPF.

To find your UAN, you can visit the EPFO portal or check your salary slip or provident fund statement.

On the EPFO portal, you can click on the ‘Know Your UAN Status’ option and enter your basic details like your name, date of birth, and mobile number to retrieve your UAN.

Alternatively, you can also generate your UAN number online by following a few simple steps on the EPFO portal.

Once you have obtained your UAN, you can activate it on the EPFO portal and link it to your Aadhaar and bank account details.

21) You can activate your UAN again if you change jobs?

Answer. Since UAN is a unique identification number that can be used only once, it need not be activated again any time you switch jobs.

22) Why is there a need to provide all the previous member IDs in the Universal Account Number?

Answer. The purpose of a Universal Account Number is to consolidate all the Member Identification Numbers that have been issued to an individual employee.

This consolidates the information about all the schemes under which an employer has made contributions on behalf of an employee, making it easier for the employee to check all his/her accounts.

As per the new proposed changes, employees would need to disclose their previous Member ID or UAN in Form-11.

23) Can employees on contract register for the UAN and avail online facilities?

Answer. Employers with 20 or more permanent employees are required to generate Universal Account Numbers for employees making ₹ 15,000 a month or more from the sixth of the following month onward. In addition, both full-time and contract employees can sign up for UAN online after their employers have activated the account number.

24) Is the application for UAN registration free of charge?

Answer. The Universal Account Number (UAN) is free to activate, and there is no fee of any kind associated with it.

25) Is it the employer or some government authority that assigns UAN?

Answer. The Employees’ Provident Fund Organization (EPFO) distributes Universal Account Number (UAN) to an employee when he or she enrolls with the EPF.

26) You can use your UAN to transfer funds even if you do not link Aadhaar with it?

Answer. You cannot transfer funds claim pension fund withdrawal unless your Aadhaar number is linked with your UAN. You must seed your Aadhaar number with your UAN.

27) For any online claims, is UAN mandatory?

Answer. For any kind of online claims associated with PF or pension, you need a valid UAN.

28) Is it possible to get more than just one UAN?

Answer. Only one UAN is assigned to each individual. It can be used by the employee while they are a part of any other eligible employer.

29) For an employee who is a PF subscriber, is the PAN linked with the UAN?

Answer. Yes, UAN has to be mandatorily linked with PAN. Moreover, a subscriber must also ensure that Aadhaar is also linked.

30) Are employers allowed to withhold employee provident fund (EPF) balances upon firing an employee or terminating a contract?

Answer. No, this cannot be done because EPF accounts are linked to UANs, which are transferable between eligible and registered employers.

31) What is a PF account number and a universal account number?

Answer. For withdrawals of EPF funds, a PF number is required. This comprises all PF information and details concerning the affected employee’s transactions with the organisation.

UAN stands for Universal Account Number. The UAN comprises information concerning all the Member Ids of an employee. A UAN is eligible throughout an employee’s lifetime and will remain a permanent number. If an employee switches jobs, the UAN will remain the same.

32) Can an employee have more than one UAN assigned under a single name?

Answer. Employees can only have one User Account Number (UAN) under a single name. It is transferable across eligible employers.

33) Can UAN be activated via a mobile app or through SMS?

Answer. You cannot activate your UAN through SMS at the moment. The only currently available method of activation is by registering online on the EPFO member portal, or through the Umang app.

34) Can personal details be updated for UAN? What is the process?

Answer. After updating their details in the universal account number portal, employees will receive an acknowledgement message with a unique verification code that they must enter before any update is made.

35) Can UAN activation be done offline?

Answer. To avail EPFO’s online services, employees have to register for UAN, the universal account number. This can be done only online.

Employees must provide updated information on their employment to their employers, which employers must confirm and submit to the concerned officers. After confirmation, the information will be available in the UAN portal

36) Employee-Specific Benefits of UAN

Answer. UAN has a number of benefits for employees. Some of them are mentioned below:

* You can easily keep a track of all your EPF accounts at a single place

* The employee can avail the facility of viewing EPF passbook online

* Partial PF withdrawal can be claimed online

* Transfer of EPF accounts can be done online

* EPFO claim status can also be checked online through the EPF member portal

37) e-KYC for EPFO

Ans) Below are the steps to complete e-KYC for EPF account:

Step 1: Log entering your UAN and password.

Step 2: Click on the ‘Manage’ tab and select ‘KYC’ option.

Step 3: Select the box of the KYC document you want to add – ‘Bank’, ‘PAN’ or ‘Passport’.

Step 4: Enter the bank account number, IFSC number, PAN number or passport number and click on the ‘Save’ button.

Step 5: Your KYC details will be shown under the ‘KYC Pending for Approval’ heading.

Step 6: The EPFO will verify the details will be verified by the EPFO

Step 7: After it is verified, the KYC will be updated and will be shown under the ‘Currently Active KYC’ heading.

38) How to Change/Update Personal Details in the UAN Portal?

Ans) An employee can change or update his/her personal details, such as name, date of birth, mobile number and e-mail ID by logging into the UAN portal.

However, the details to be updated should match the details on the Aadhaar card, else it will not be updated on the UAN portal. The employer must give their approval for updating the name and date of birth.

39) UAN Login Portal Services:Details?

Ans) The EPFO portal offers the below online services to the EPF account holders.

View Service

EPF account holders can get information related to their EPF accounts from this service.

EPF account holders can view the following information by clicking the ‘Profile’ option under the ‘View’ tab:

* UAN Number

* Name

* Date of birth

* Gender

* Father’s/Husband’s name

* Mobile number

* Email ID

* Whether you are an international worker

* Qualification

* Marital status

* Current and permanent address

* Differently abled or not

Service History

When employees change organisations, each organisation creates a different PF number under the same UAN. EPF account holders can view all the details of their PF numbers created under a UAN by clicking the ‘Service History’ option under the ‘View’ tab.

UAN Card

EPF account holders can view and download their UAN card by clicking on the ‘UAN card’ option.

EPF Passbook

When the employee clicks on the ‘EPF Passbook’ option, a new tab will open. On the new tab, employees have to enter their UAN, password and captcha code and login to view the EPF Passbook .

EPF passbook will contain details of the contribution amount to EPF and EPS, date of contribution and total amount.

Manage Service

EPF account holders can change their PF account details through the ‘Manage’ tab.

Basic details

Employees can change their name and Date of Birth recorded on the PF account by clicking on the ‘Manage’ tab and selecting the ‘Basic Details’ option.

Contact details

Employees can change their mobile number and Email ID recorded on the PF account by clicking on the ‘Manage’ tab and selecting the ‘Contact Details’ option.

KYC

A member can complete their KYC details for PF account online, such as bank account, PAN number, Aadhaar number and Passport by clicking on ‘KYC’ option.

E-Nomination

EPF account holders can add nominees online by clicking the ‘E-Nomination’ option. They can complete the e-nomination accounts by providing the required details online.

Account

Employees can change EPFO portal password, by clicking the ‘Password’ option on the ‘Account’ tab.

Online Services

Claim (Form 31, 19 and 10C&10D)

EPF account holders can apply for partial or full withdrawal of PF funds online through this option.

However, they must complete the KYC before applying for withdrawal of PF amount.

One Member One EPF Account (Transfer request)

Employees can apply for transfer & merger of their various PF accounts through this option. The KYC details should be updated before applying for transfer and merger of PF accounts.

Track EPF Claim Status

After applying for EPF withdrawal claim, employees can check their EPF claim status through this option.

Download Annexure K

When an employee wants to transfer PF amount from an exempted to an unexempted establishment, they must fill the Annexure K. They can download the Annexure K form through this option.

40) How to check whether UAN is active or not?

Ans) You can know the status of UAN by following the below process:

* Visit the UAN portal.

* Click on the tab ‘Know your UAN’. The following page will appear.

* Enter your registered mobile number and captcha for verification. Click on the button ‘Request OTP’. Enter the OTP and captcha code and click on the ‘Validate OTP’ button.

* It will redirect you to enter your name, DOB, PAN/Aadhaar/member ID, and captcha for verification. After entering all the details, click on the button ‘Show my UAN’.

* Your UAN number will be displayed on the screen.

41) How to know the UAN number without a mobile number?

Answer. You can get your UAN through your employer. You need to contact your HR/accounts department to get your UAN without a mobile number. You can also check your payslips since some companies put the UAN numbers on payslips.

42) How to know the UAN number by missed call?

Ans) You can get the UAN number by giving a missed call when you are registered and activating your UAN on the UAN portal. Members registered on the UAN portal can get the UAN details by giving a Missed call to 9966044425 from their registered mobile number.

How to check UAN on your salary slip?

Some companies include the UAN number on the salary slips. Thus, check your salary slip and search if there is a mention of the UAN number on the salary slip. Employers will clearly mention the heading ‘UAN – (12 digit number)’ in the salary slip.

Can I give my old UAN to my new employer?

Yes, you must give your old UAN to a new employer when you are joining a new company/employer. Your new employer will open a new EPF account and link it with your existing UAN.

43) Why update your mobile number on the EPFO portal?

Ans) You can check your EPF balance by sending an SMS from your registered mobile number.

* You can check your claim status using your registered mobile number.

* Contributions made to your EPF account will be updated to you via SMS on your registered mobile number.

* When an EPF withdrawal process starts, once the process of crediting the amount to your bank account begins, a notification will be sent via SMS to your registered mobile number.

* To transfer the EPF amount from your previous member ID to your current one.

* The validation process completes only when an OTP that is sent to your registered mobile number is entered.

44) UAN activation: Why is it needed?

Ans) *To check your PF accounts.

* To check PF balance and know the exact amount in your pension fund.

* To withdraw PF.

* To check PF claim status.

* For EPFO member nomination.

* To get regular alerts about your PF account

45) Are PF member ID and UAN the same?

Ans) No, an EPFO member can have multiple member IDs, allocated by various employing companies. The UAN, on the other hand, is an umbrella ID allocated by the EPFO. One member can have only one UAN.

46) What’s the procedure for UAN activation?

Ans) An employee can perform UAN activation at the UAN member portal by following the steps below:

1. Visit the UAN eSewa portal

2. Click on the link “Activate UAN”

3. Enter the required details (PAN or Aadhar or Member ID)

4. Click on “Get Authorization Pin” to get an OTP to the registered mobile number.

5. Enter OTP and click on Activate UAN to make UAN active.

Once the UAN activation process is completed, the member will receive a password in their registered mobile number which can be changed as per their choice.

Using the UAN as user id and password a member can log in to MEMBER e- SEWA to avail the EPF passbook service. The UAN passbook service lets the member keep track and manage their EPF balance from the comfort of their home.

47) Can contractual employees register their UAN and avail online facilities?

Ans) An organisation with 20 or more employees has to generate UAN for its employees (with a salary of ₹ 15,000/- and above). Both contractual, as well as full-time employees, can avail UAN facilities online after activation.

48) I have not linked Aadhaar with UAN. Can I transfer funds online?

Ans) You cannot transfer funds or claim PF withdrawal if your Aadhaar is not linked with UAN. You have to mandatorily seed your Aadhaar with UAN.

49) I have changed my job. Should I activate my UAN again?

Ans) UAN has to be activated only once. You do not have to re-activate it every time you switch jobs.

50) Do I have to pay any fee for UAN registration?

Ans) No, UAN registration is free of cost and you do not have to pay any fee to activate it.

Also Read: Ten steps guide to generate UAN in your EPF account online

Also Read: Aadhaar must be linked to PF by this month: Here’s how to do it

Also Read: PAN-Aadhaar linking deadline extended till June 30, 2023: CBDT