Highlights

- The Indian government has made it mandatory for all taxpayers to link their Aadhaar numbers with their PAN.

- The purpose of linking Aadhaar with PAN is to streamline the tax filing process and prevent fraudulent activities.

- The process of linking Aadhaar with PAN can be done online or offline.

- The government has set a deadline for linking Aadhaar with PAN, and failure to do so can result in a penalty.

- Linking Aadhaar with PAN is important to ensure compliance with government regulations and avoid any consequences.

- In this blog, we are sharing a complete guide on the Aadhaar-PAN link including how to check the status of the Aadhaar link with their PAN card, how to link the Aadhaar-PAN, the deadline to do so, and more.

The Indian government has made it mandatory for all taxpayers to link their Aadhaar number with their PAN (Permanent Account Number) in order to file their tax returns. The process of linking Aadhaar with PAN has been made simple and straightforward, with both online and offline methods available for taxpayers to choose from.

The purpose of linking Aadhaar with PAN is to streamline the tax filing process and reduce fraudulent activities. By linking the two, the government can verify the identity of taxpayers and prevent individuals from creating multiple PANs to evade taxes. Additionally, linking Aadhaar with PAN can also help in detecting black money transactions and improving tax compliance.

The process of linking Aadhaar with PAN can be done online through the Income Tax e-filing website. All that a taxpayer needs to do is visit the website and follow the instructions provided on the page. Alternatively, taxpayers can also link their Aadhaar with their PAN Card offline by visiting a PAN service centre or sending a request through the post.

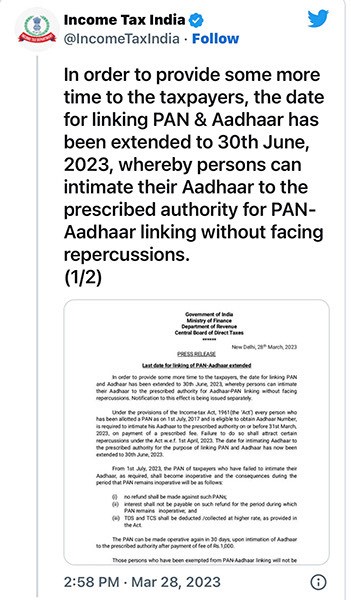

It is important to note that the government has set a deadline for linking Aadhaar with PAN, and failure to do so can result in a penalty or consequences. The deadline, which was previously 31st March 2023 with the penalty, has been recently extended till 30th June 2023 with the penalty. Therefore, it is recommended that taxpayers link their Aadhaar with their PAN as soon as possible to avoid any issues.

Linking Aadhaar with PAN is a crucial step in the tax filing process in India. By doing so, taxpayers can ensure compliance with government regulations and avoid any penalties or consequences. The process has been made simple and convenient, and taxpayers can choose the method that best suits their needs.

What is the Fees and Deadline for Aadhaar PAN Card Linking?

The PAN-Aadhaar linking was free till 31 March 2022.

If you linked PAN-Aadhaar after 31 March 2022, but before 30 June 2022, a penalty of Rs.500 was imposed.

However, after 30 June 2022, a penalty of Rs.1,000 is imposed to link PAN with an Aadhaar card.

Thus, you must first pay the penalty of Rs.1,000 to link your Aadhaar with your PAN before 30 June 2023. When the PAN and Aadhaar cards are not linked before 30 June 2023, PAN cards will become inoperative from 1 July 2023.

Who Should Link Aadhaar with a PAN Card?

- All Indian taxpayers are required to link their Aadhaar with their PAN card.

- This includes individuals, Hindu Undivided Families (HUFs), companies, and any other entities that are eligible to obtain a PAN card.

- Any person who wishes to file their income tax return must link their Aadhaar with a PAN card.

- If an individual has multiple PAN cards, they must link all their PAN cards with their Aadhaar and declare the inactive PAN cards as invalid.

- It is also mandatory for individuals who are not eligible to obtain an Aadhaar card to provide proof of enrollment or application for an Aadhaar to link it with a PAN card.

- Failure to link Aadhaar with a PAN card before the deadline set by the government can result in a penalty or consequences.

How To Check Aadhaar Card – PAN Card Link Status via the Income Tax Portal?

- Login into the Income Tax e-filing portal.

- Go to ‘Dashboard’ on the homepage and click the ‘Link Aadhaar Status’

- Next, navigate to the ‘My Profile’ option and click on the ‘Link Aadhaar Status’

If your Aadhaar number is linked to your PAN card, the Aadhaar number will be displayed. If your Aadhaar is not linked with your PAN card, ‘Link Aadhaar Status’ will be displayed.

In case the request to link your Aadhaar with your PAN card is pending with the Unique Identification Authority of India (UIDAI) for validation, you will have to check the status later.

How To Check Aadhaar Card – PAN Card Link Status Online?

Here is the direct link to check the Aadhaar PAN card link status https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status

- Enter your PAN.

- Aadhaar numbers.

- Click ‘View Link Aadhaar Status’.

The PAN-Aadhaar linking status will be displayed on the screen.

How To Check Aadhaar Card – PAN Card Link Status via SMS?

- Compose an SMS – UIDPAN <12 digit Aadhaar number> < 10 digit PAN number>

- Send the SMS to ‘567678’ or ‘56161’.

- Wait for the response from the government service.

If Aadhaar is linked with PAN, the message will appear as follows – “Aadhaar is already associated with PAN (number) in ITD database. Thank you for using our services.”

If Aadhaar is not linked to PAN, the message will appear as follows – “Aadhaar is not associated with PAN (number) in ITD database. Thank you for using our services.”

How to link Aadhaar with a PAN card online?

Anyone linking their Aadhaar with their PAN card after 31st March 2022 will have to first pay a late penalty of Rs.1,000 on the Income Tax website. So, there are two main steps for linking your Aadhar with your PAN now –

- Payment of fee on https://www.incometax.gov.in/iec/foportal/ under Major head (0021) and Minor head (500) for AY 2023-24.

- Submit the Aadhaar-PAN link request.

How to Submit the Fee Online?

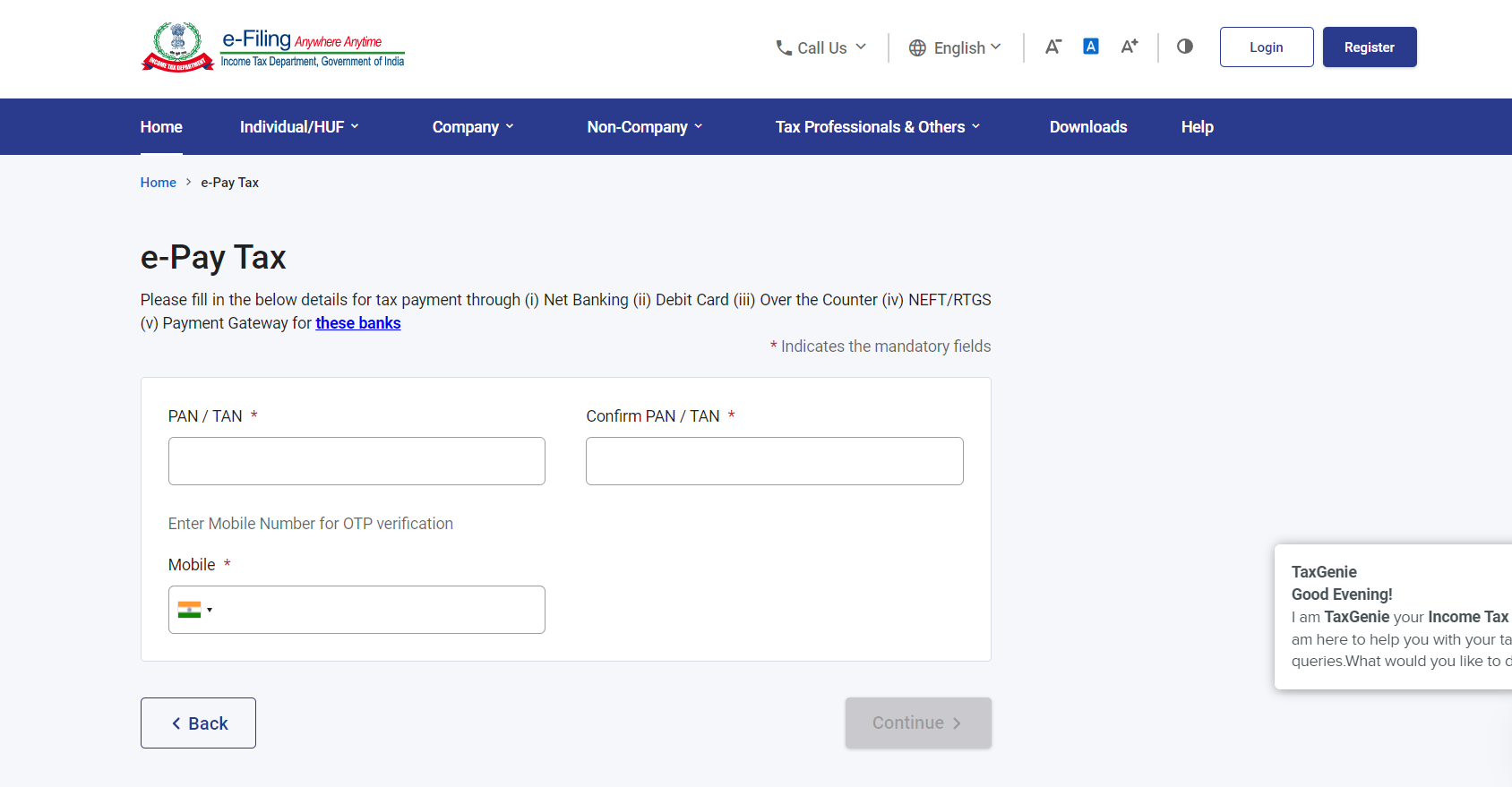

- Go to the e-Pay Tax page on E-filing page –

https://eportal.incometax.gov.in/iec/foservices/#/e-pay-tax-prelogin/user-details

- Enter Your PAN Card, Confirm PAN Card, and Enter Your Mobile Number linked with Aadhaar Card in the field provided. And click on Confirm.

- Verify OTP on next page and click on Continue.

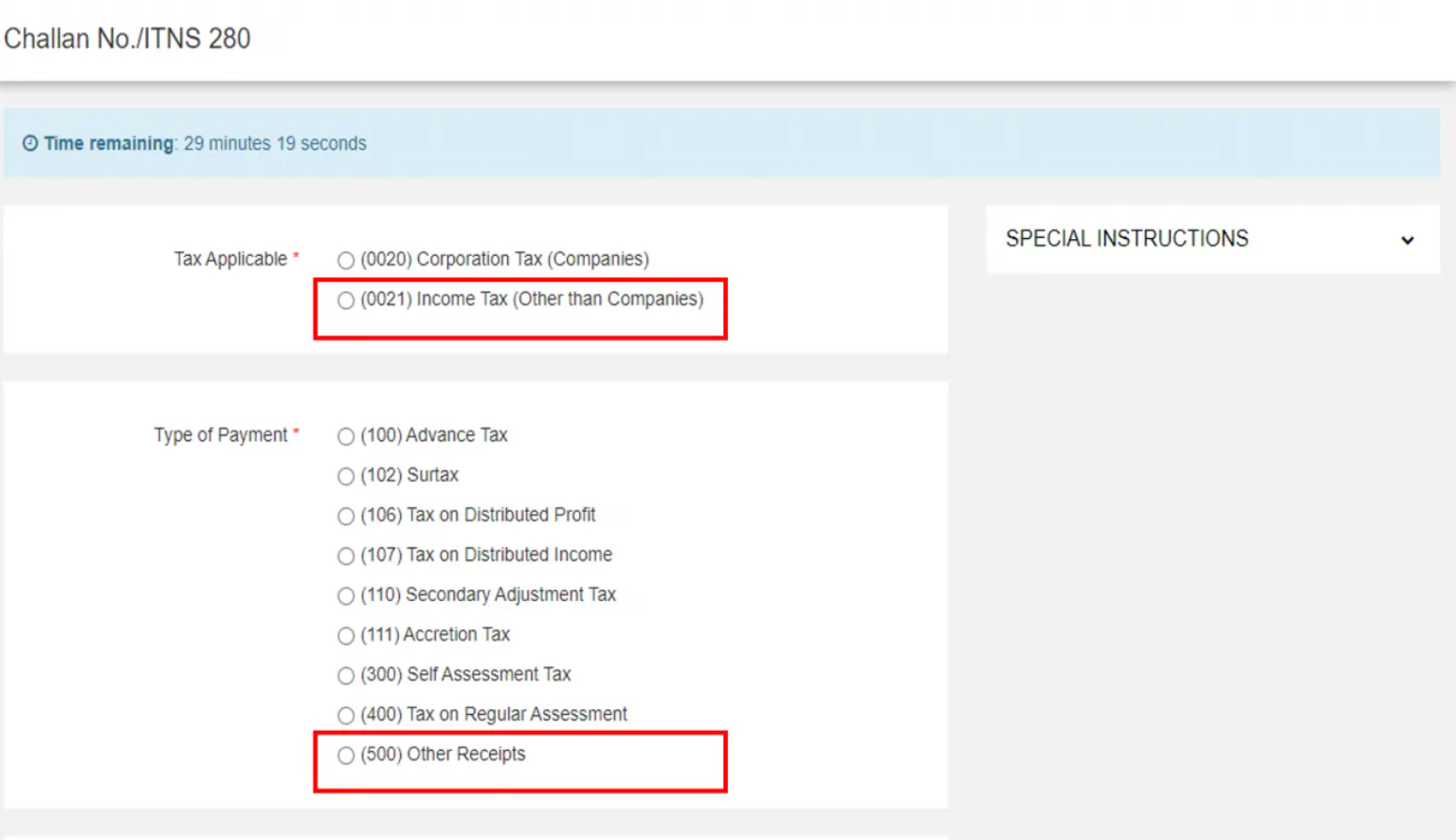

- On the next screen, select head ‘(0021)’ and then ‘(500)’

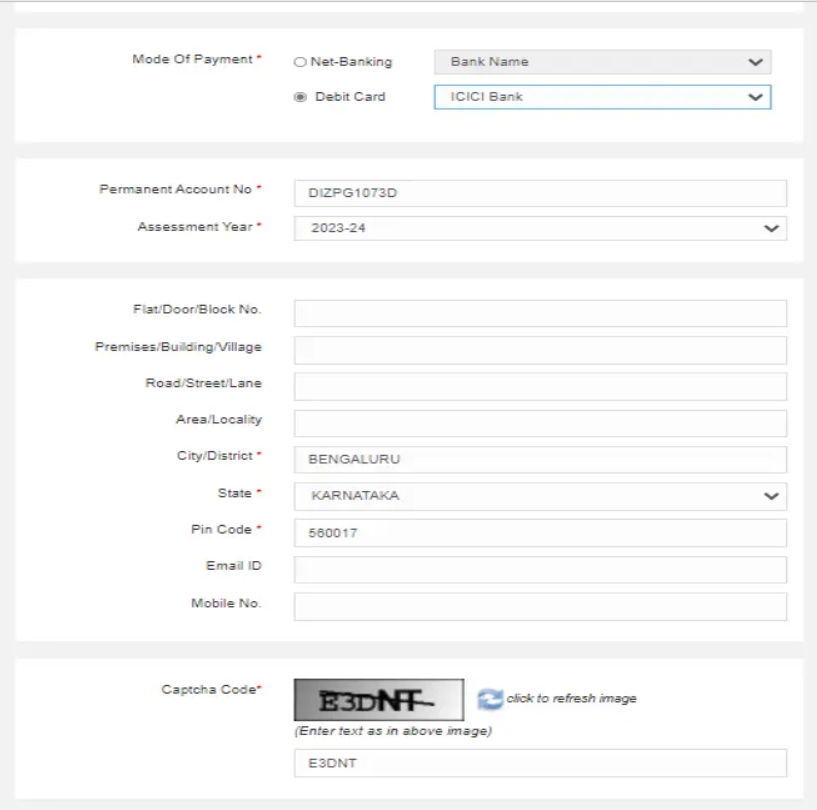

- Scroll down to select the mode of payment and enter the required details (like your PAN, for Assessment Year select 2023-24, address, etc.)

- Proceed to make the payment and follow the next steps to submit the PAN-Aadhaar link request.

NOTE – It is advisable to wait 4-5 days before submitting the request.

How to link Aadhaar with the PAN card?

There are three ways of linking your PAN to your Aadhaar:

- Linking of Aadhaar Number and PAN via SMS

- Without logging in to your account (2-step procedure)

- Logging in to your account (6-step procedure)

Let’s take a look at each one by one.

Linking of Aadhaar Number and PAN via SMS

Now you can link your Aadhaar and PAN through SMS.

The income tax department has initiated an SMS-based facility for linking Aadhaar with PAN. It can be done by sending an SMS to either 567678 or 56161.

Send SMS to 567678 or 56161 from your registered mobile number in the following format:

UIDPAN<SPACE><12 digit Aadhaar><Space><10 digit PAN>

Example: UIDPAN 123456789123 AKPLM2124M

Linking of Aadhaar Number and PAN Without Logging in to Your Account

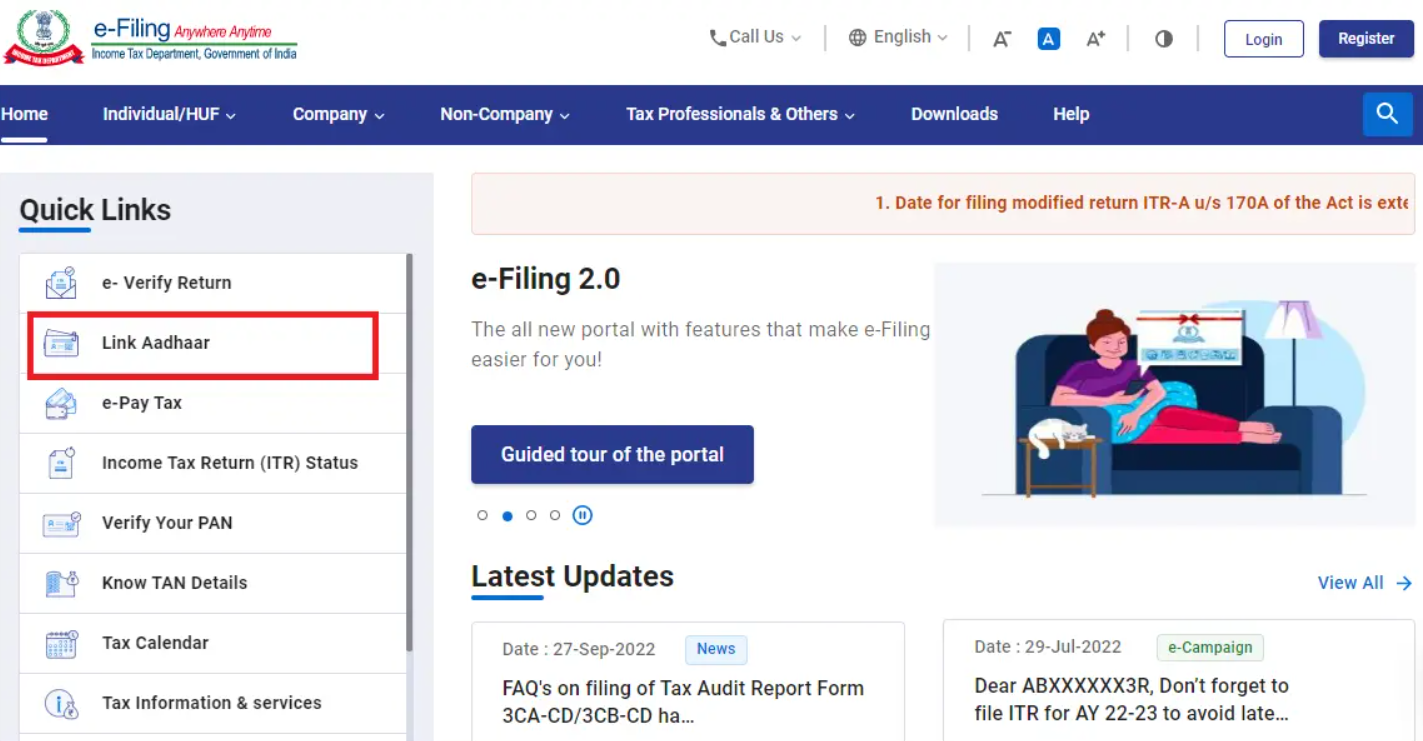

- Go to the Income Tax e-filing portal. Under quick links, click on the ‘Link Aadhaar’ tab.

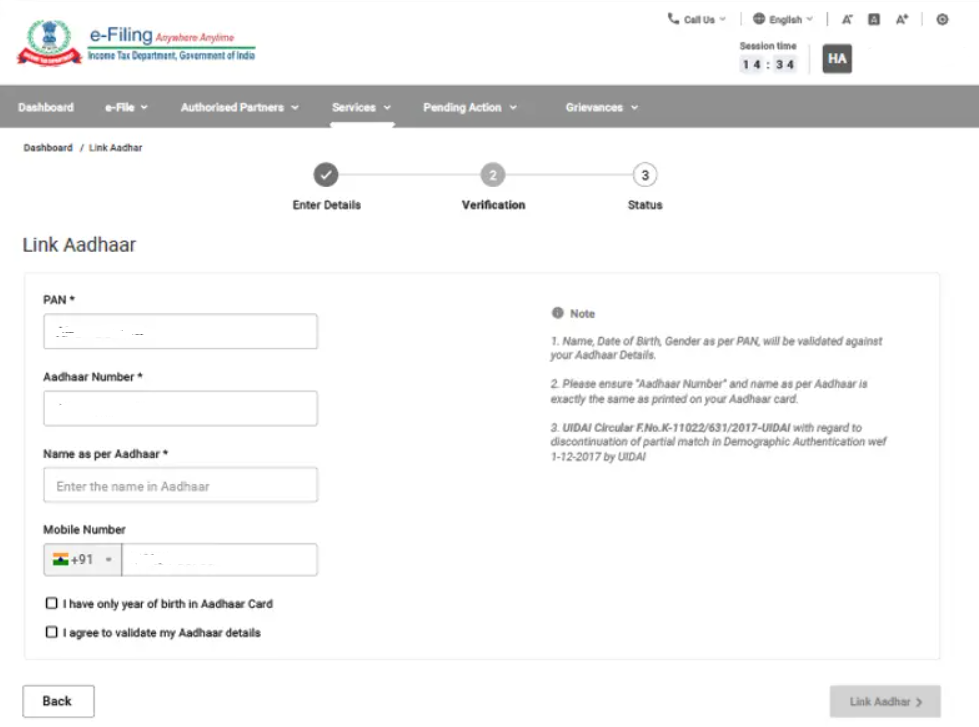

- Enter your PAN, Aadhaar number and click on Validate.

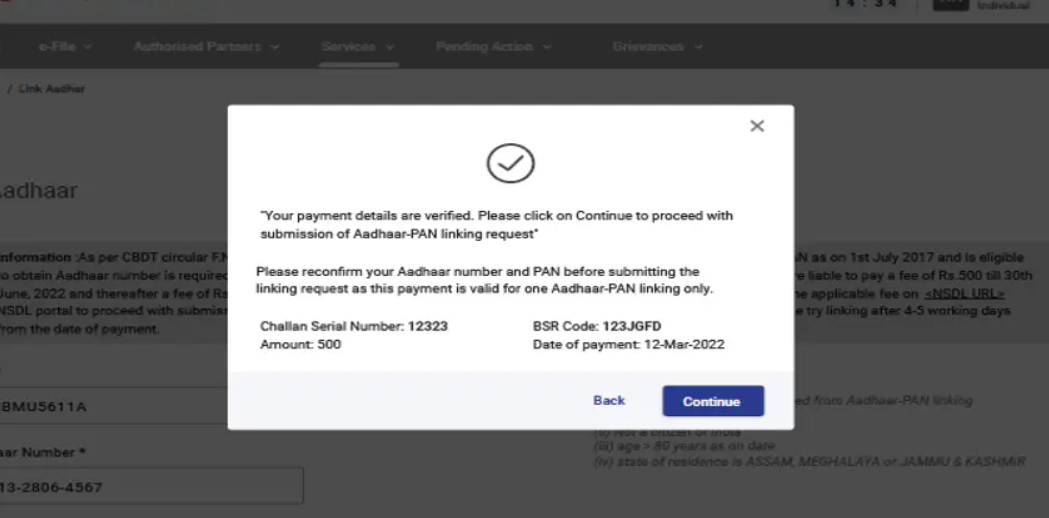

- After validating PAN and Aadhar, you will see a pop-up message “Your payment details are verified”. Click the ‘Continue’ button to submit the ‘Aadhaar link’

- Enter the required details and click the ‘Link Aadhaar’ button.

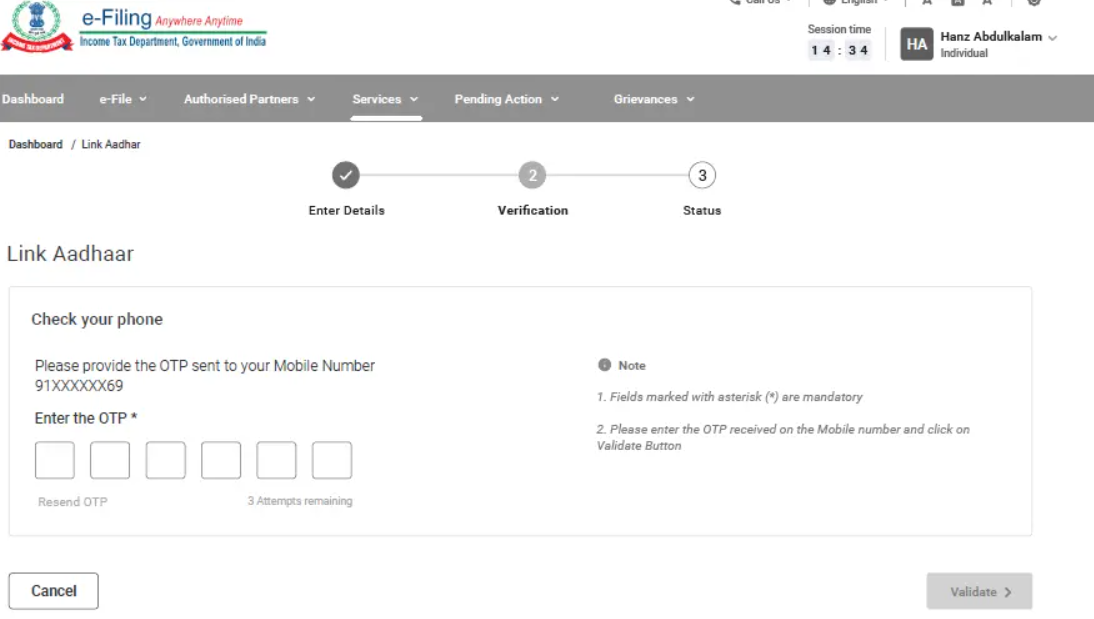

- Enter the 6-digit OTP received on your mobile number and validate.

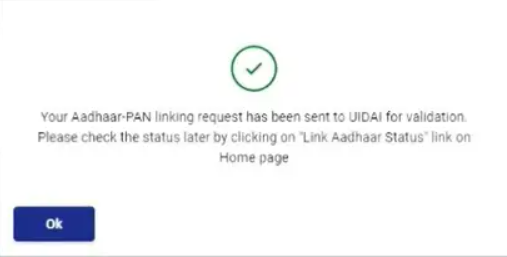

Your request see a success message on the screen. You may now check your Aadhaar-PAN link status.

Linking of Aadhaar Number and PAN Logging in to Your Account

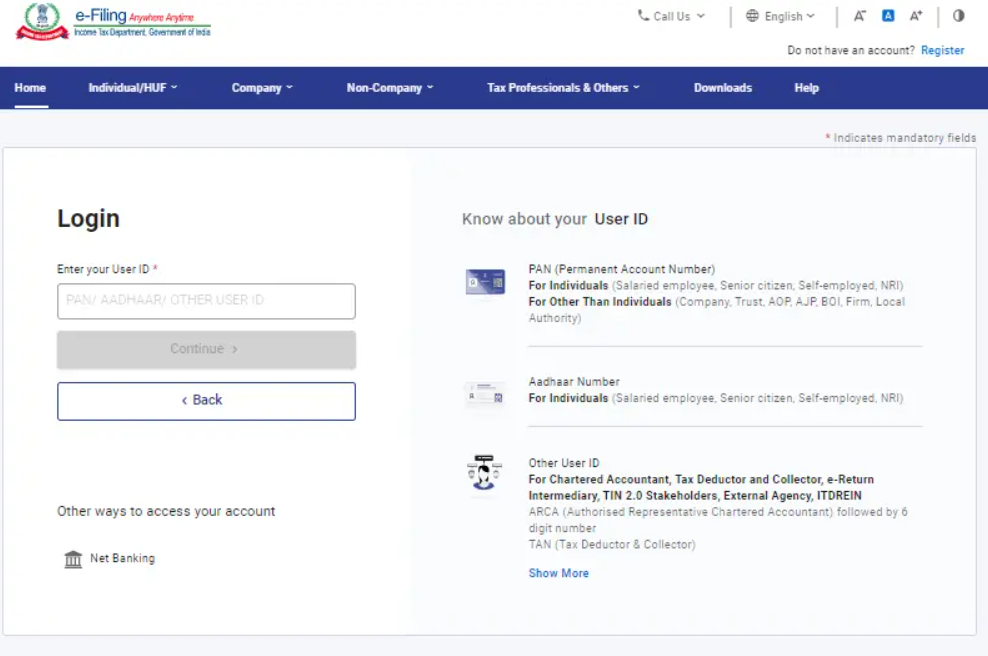

- Register yourself at the Income Tax e-filing portal, if you are not already registered.

- Log in to the e-filing portal of the income tax department by entering the user ID.

- Confirm your secure access message and enter the password. And click ‘Continue’ to proceed further.

- After logging in to the website, click on ‘Link Aadhaar’. Alternatively, go to ‘My Profile’ and select ‘Link Aadhaar’ under the ‘Personal Details’ option.

- Enter details, enter your Aadhaar number and name as per Aadhaar. Verify the details on the screen with the ones mentioned on your Aadhaar card.

- Click on the check box ‘I Agree to validate Aadhaar details’.

- In case only the year of birth is mentioned in your Aadhaar card, then select the check box asking ‘I have only year of birth in Aadhaar card’.

- Click on ‘Link Aadhaar’ button

A pop-up message will inform you that your Aadhaar number has been successfully linked to your PAN card.

Alternatively, you can also link your Aadhaar with your PAN while filing your income tax return. The process is similar to the one mentioned above and can be done at the time of filing the return.

It is important to note that you should ensure that the details entered while linking your Aadhaar with your PAN match the details mentioned on both documents. If there is any discrepancy, the linking process may fail, and you may need to rectify the details first. Also, ensure that your Aadhaar card and PAN are not linked with any other PAN or Aadhaar card to avoid any issues.

FAQs

1) Who should link Aadhaar with a PAN card?

Ans) According to Section 139AA of the Income Tax Act, taxpayers with a PAN card should link it to their Aadhaar cards. Thus, all taxpayers must mandatorily link their PAN with their Aadhaar cards by 30 June 2023 by paying the penalty of Rs.1,000 else their PAN cards will become inoperative.

However, Non-Residents Indians (NRIs), citizens aged above 80 years, and residents of Assam, Meghalaya and Jammu and Kashmir need not link their Aadhaar with PAN cards since they come under the exempt category. Thus, check your Aadhaar-PAN link status to find out if your Aadhaar is linked with your PAN card. If it is not linked, ensure to link it by 30 June 2023 to prevent your PAN card from being inoperative.

2) Is it mandatory to link PAN and Aadhaar?

Ans) Yes, it is mandatory to link PAN and Aadhaar as per the Income Tax India rules. Failure to link PAN and Aadhaar by June 30, 2023, can result in the deactivation of your PAN.

3) What is the deadline for linking PAN and Aadhaar?

Ans) The deadline for linking PAN and Aadhaar has been extended several times. The latest deadline to link PAN with Aadhaar is June 30, 2023.

4) Can I link multiple PAN cards to one Aadhaar card?

Ans) No, you cannot link multiple PAN cards to one Aadhaar card. Each individual can only link one PAN card to one Aadhaar card.

5) Can I link my Aadhaar card to someone else’s PAN card?

Ans) No, you cannot link your Aadhaar card to someone else’s PAN card. Each individual must link their own Aadhaar card to their own PAN card.

6) Can I link my Aadhaar card to my PAN card if there is a mismatch in my name?

Ans) No, you cannot link your Aadhaar card to your PAN card if there is a mismatch in your name. You will need to correct the name on either your Aadhaar card or PAN card before linking them.

7) How can I correct the name on my Aadhaar card or PAN card?

Ans) You can correct the name on your Aadhaar card or PAN card by visiting the respective official websites and following the instructions for name correction.

8) How to link Pan-Aadhaar with penalty

Ans)

Step:1 Visit e-Filing portal Home page and click on Link Aadhaar in Quick Links section.

Step:2 Enter your PAN and Aadhaar Number

Step:3 Click on Continue to Pay Through e-Pay Tax.

Step:4 Enter your PAN, Confirm PAN and Mobile number to receive OTP

Step:5 Post OTP verification, you will be redirected to e-Pay Tax page.

Step:6 Click on Proceed on the Income Tax tab.

Step:7 Select AY as 2023-24 and type of Payment as Other Receipts (500) and click Continue.

Step:8(a) Applicable amount will be pre-filled against Others.

Alternatively, if you have a Bank account which is not listed for payment through e-Pay Tax, please follow the steps as under:

Step:8b(i) Click on hyperlink given below on e-Pay tax page to redirect to Protean (NSDL) portal

Step:8b(ii) You will be redirected to Protean portal. Click Proceed under Challan No./ITNS 280

Step:8b(iii) Select Tax applicable as 0021 and Type of Payment as 500

Step:8 b (iv) Provide other mandatory details and Proceed.

Please select the Assessment Year 2023-24 for making late fee payment for Aadhaar PAN linkage.

Post payment of fee you can link your Aadhaar number with PAN on the e-Filing Portal.

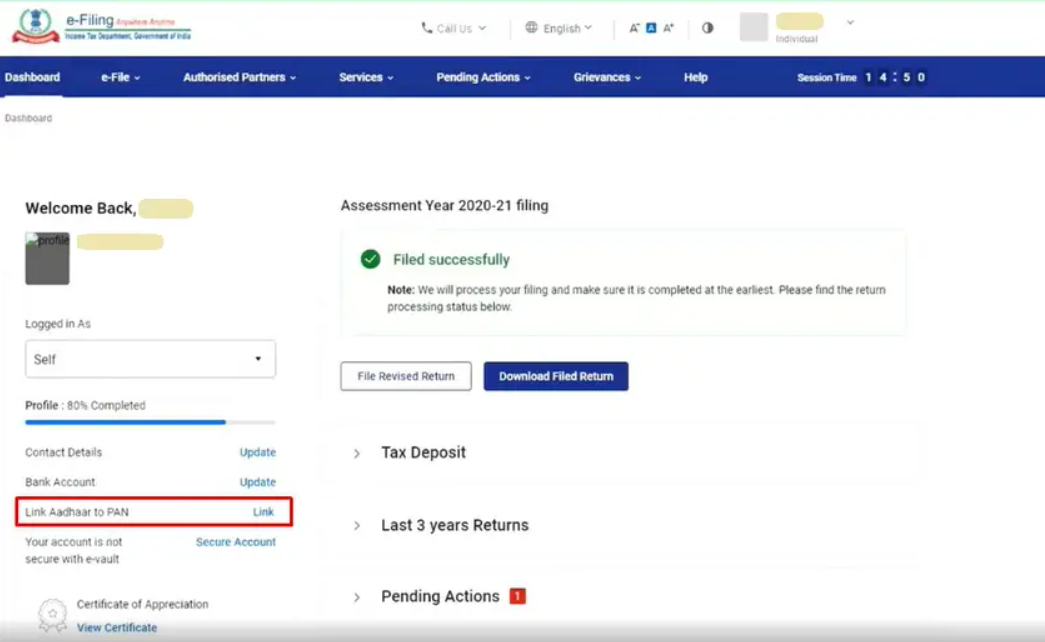

9) How to link PAN-Aadhaar after penalty payment?

Ans) Login income tax website, under Dashboard, in Profile Section under the Link Aadhaar to PAN option, click Link Aadhaar.

10) Who needs to link Aadhaar and PAN?

Ans) Section 139AA of the Income Tax Act provides that every individual who has been allotted a permanent account number (PAN) as on the 1st day of July, 2017, and who is eligible to obtain an Aadhaar number, shall intimate his Aadhaar number in the prescribed form and manner. In other words, such persons have to mandatorily link their Aadhaar and PAN before the prescribed date (31.03.2022 without fee payment and 31.03.2023 with prescribed fee payment For more details refer to CBDT circular No.7/2022 dated 30.03.2022.

11) For whom is Aadhaar-PAN linkage not compulsory?

Ans) Aadhaar-PAN linkage requirement does not apply to any individual who is:

Residing in the States of Assam, Jammu and Kashmir, and Meghalaya;

a non-resident as per the Income-tax Act, 1961; of the age of eighty years or more at any time during the previous year; or not a citizen of India.

Note:

1. The exemptions provided are subject to modifications depending on subsequent government notifications on this subject

2. For further details refer to Department of Revenue Notification No 37/2017 dated 11th May 2017”

3. However, for users falling in any of the above category, voluntarily desires to link Aadhaar with PAN fee payment of specified amount is required to be done.

12) How to link Aadhaar and PAN?

Ans) Both registered and unregistered users can link their Aadhaar and PAN on the e-Filing Portal, even without logging in. You can use the quick link Link Aadhaar on the e-Filing home page to link Aadhaar and PAN.

13) What will happen if I don’t link Aadhaar and PAN?

Ans) Kindly, refer to the Circular No. 7/2022 dated 30/3/2022

14) I cannot link my Aadhaar with PAN because there is a mismatch in my name/phone number/date of birth in Aadhaar and PAN. What should I do?

Ans) Correct your details in either PAN or Aadhaar database such that both have matching details. You can correct your PAN details on:

The TIN-NSDL website (https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html), or

UTIISL’s PANOnline Portal (https://www.pan.utiitsl.com/PAN/mainform.html;jsessionid=B3A9443C26F9755063EFD5A7B32B2E11).

In case of Query/Assistance, please contact on NSDL /UTI helpline number: 033 40802999 ,03340802999 or write on e-mail id: utiitsl.gsd@utiitsl.com

You can correct your Aadhaar details on the UIDAI website ).

In case of Query/Assistance, please contact on toll-free number 18003001947 or 1947

15) What should I do if my PAN becomes inoperative?

Ans) Kindly, refer to the Circular No. 7/2022 dated 30/3/2022.

Also Read: PAN Card Online Apply: How to Apply for PAN Card Online, Check Status, and Download e-PAN?

Also Read: How to Download Aadhaar, PAN card on Your WhatsApp