Highlights

- RBI restricts Paytm Payments Bank from onboarding new customers and accepting fresh deposits.

- Paytm Payments Bank prohibited from conducting debit and credit transactions via wallets and FASTags.

- One97 Communications to shift operations and partner with other banks, excluding Paytm Payments Bank.

- Paytm UPI and mutual fund services remain operational, with some uncertainty about UPI linked to Paytm Payments Bank.

Big developments are happening in India’s financial sector that could have major implications for millions of users.

The Reserve Bank of India (RBI) has imposed a set of restrictions on Paytm Payments Bank (PPBL), a significant move that directly impacts the operations of one of India’s prominent digital banking services.

This development is part of an audit report citing “persistent non-compliances” by PPBL.

RBI has given PPBL a deadline of 29th February to cease all operations. Will Paytm Stop Working? The answer is both yes and no.

Gaurav Goel, Founder – Director, Fynocrat Technologies said, “As of February 29, the Reserve Bank of India (RBI) has taken measures against Paytm Payments Bank Limited (PPBL), restricting its ability to receive deposits or top-ups in customer accounts, including wallets and FASTags.

The central bank has highlighted ongoing non-compliance and supervisory concerns, prompting apprehensions about the operational integrity of Paytm Payments Bank.”

Here is what you need to know.

What Did RBI Say About Paytm?

So is Paytm going to stop working from 29th February?

Not really.

RBI’s announcement details significant restrictions on Paytm Payments Bank’s operations which is a separate entity from Paytm itself.

These restrictions are said to include a prohibition on onboarding new customers and a halt on accepting fresh deposits.

Moreover, the bank is barred from conducting any debit or credit transactions through various instruments like wallets, FASTags, and NCMC cards.

The directive also includes a stipulation for PPBL to terminate all nodal accounts associated with One97 Communications Ltd and Paytm Payment Services Ltd.

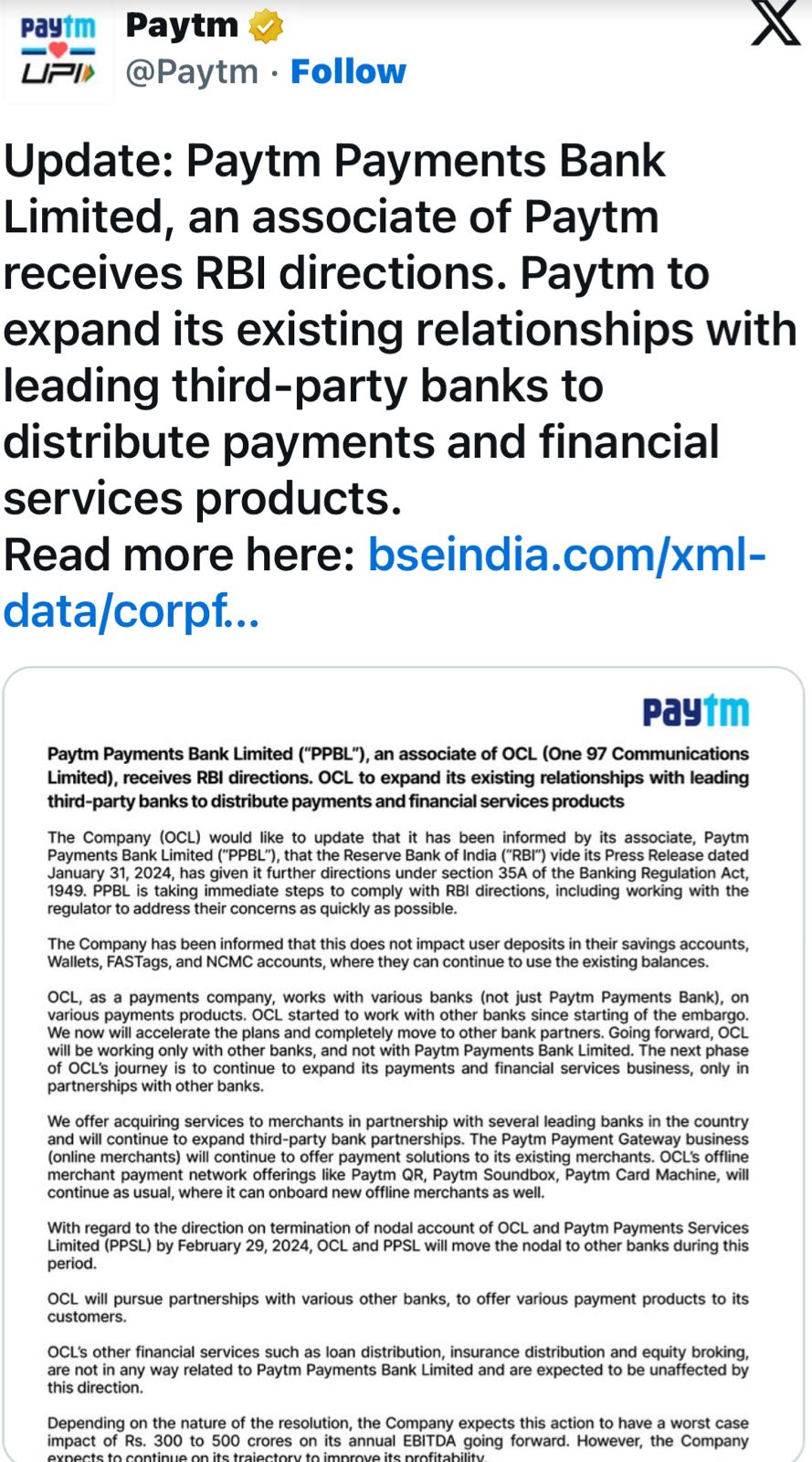

Paytm’s Response to RBI’s Actions

In response to the RBI’s directive, PPBL said “PPBL is taking immediate steps to comply with RBI directions, including working with the RBI to address their concerns as quickly as possible.”

Furthermore, One97 Communications Limited (OCL), Paytm’s parent company, also announced a strategic shift in its operations. The company said in its press release “OCL, as a payments company, works with various banks (not just Paytm Payments Bank), on various payments products. OCL started to work with other banks since starting of the embargo.

We now will accelerate the plans and completely move to other bank partners. Going forward, OCL will be working only with other banks, and not with Paytm Payments Bank Limited. The next phase of OCL’s journey is to continue to expand its payments and financial services business, only in partnerships with other banks.”

Implications for Paytm Users

How are Paytm users going to be affected by this?

Well from February 29 onwards, as mentioned, new user onboarding on Paytm Payments Bank will be halted and existing users will face limitations in using their Paytm wallets, Fastags, and Mobility Cards.

As a matter of fact, Paytm Fastag users are being told to purchase a new tag from other issuers and deactivate the existing one.

Apart from that National Common Mobility Cards (NCMC), which are typically used for transactions in metro systems, and wallets designated for specific purposes like food and fuel will also face the axe.

While users can continue to utilise the existing balance in these instruments, the directive restricts the infusion of new funds after February 29.

However, it’s important to note that Paytm’s existing payment solutions and offline services will remain operational, including their Payment Gateway business and offline merchant payment network.

Paytm UPI Users: The Way Forward?

The biggest question will undoubtedly be around UPI.

Paytm is one of the largest, if not the largest, platforms for UPI transactions.

Will UPI stop working for Paytm users?

The situation remains somewhat ambiguous.

The RBI’s directive primarily targets the banking operations of Paytm, suggesting that digital payments through Paytm connected to external bank accounts might still be feasible.

However, given that UPI is also powered by Paytm Payments Bank, there’s a degree of uncertainty about its functionality post-February 29.

In simpler terms, if your UPI ID is linked to a different bank like ICICI, HDFC, Axis, etc, you should not face any problem.

Only users with UPI linked to Paytm Payments Back will need to switch to another bank before the deadline.

Concerns Regarding Mutual Fund Investments Via Paytm

For users who have invested in mutual funds via Paytm or have ongoing Systematic Investment Plans (SIPs), there is a concern about the potential impact of RBI’s restrictions.

It’s crucial to understand that mutual fund investments and SIPs, being part of OCL’s financial services, are not directly linked to Paytm Payments Bank.

Your investments are handled via a separate company called Paytm Money, which is regulated by SEBI and not RBI.

As such, these services are expected to remain unaffected by the recent RBI action.

Nevertheless, investors are advised to stay informed about any further updates from Paytm regarding their investment services.

FAQs

What are the RBI’s restrictions on Paytm Payments Bank?

The RBI has prohibited Paytm Payments Bank from onboarding new customers, accepting fresh deposits, and conducting debit or credit transactions through wallets, FASTags, and NCMC cards.

How will Paytm’s operations change in response to RBI’s directive?

Paytm’s parent company, One97 Communications, announced a strategic shift to work with various banks other than Paytm Payments Bank. This move aims to comply with RBI’s directives while continuing its payment and financial services.

What is the impact on Paytm Fastag and NCMC card users?

Users of Paytm Fastag are advised to purchase a new tag from other issuers as the existing tags will be deactivated. NCMC card users can use the existing balance but cannot infuse new funds after February 29.

Will Paytm UPI services be affected by the RBI’s restrictions?

The impact on Paytm UPI services is not entirely clear. UPI transactions linked to external bank accounts might still be operational, but those linked to Paytm Payments Bank might face disruptions.

Are mutual fund investments and SIPs via Paytm affected by these restrictions?

Mutual fund investments and SIPs via Paytm, managed by Paytm Money regulated by SEBI, are not expected to be affected by the RBI’s action on Paytm Payments Bank.

Also Read: Digital Rupee Pilot to be launched by RBI for Retail Use on December 1

Also Read: The Best Android Apps of 2023