Highlights

- iPhones claimed 7 of the top 10 spots in global bestsellers of 2023.

- iPhone 14 named the year’s biggest selling smartphone.

- Apple surpasses Samsung in Europe with a 33% market share in Q4 2023.

- iPhone 15 Pro Max emerges as the bestselling smartphone in Q4 2023.

If reports are to be believed Apple has not only dominated the list of 2023’s top-selling phones but also dethroned Samsung as the leading smartphone brand in Europe during the last quarter of the year.

Data from research firms Counterpoint and Canalys reveal a tale of two giants, with Apple seizing significant milestones that show its growing influence and appeal across global markets.

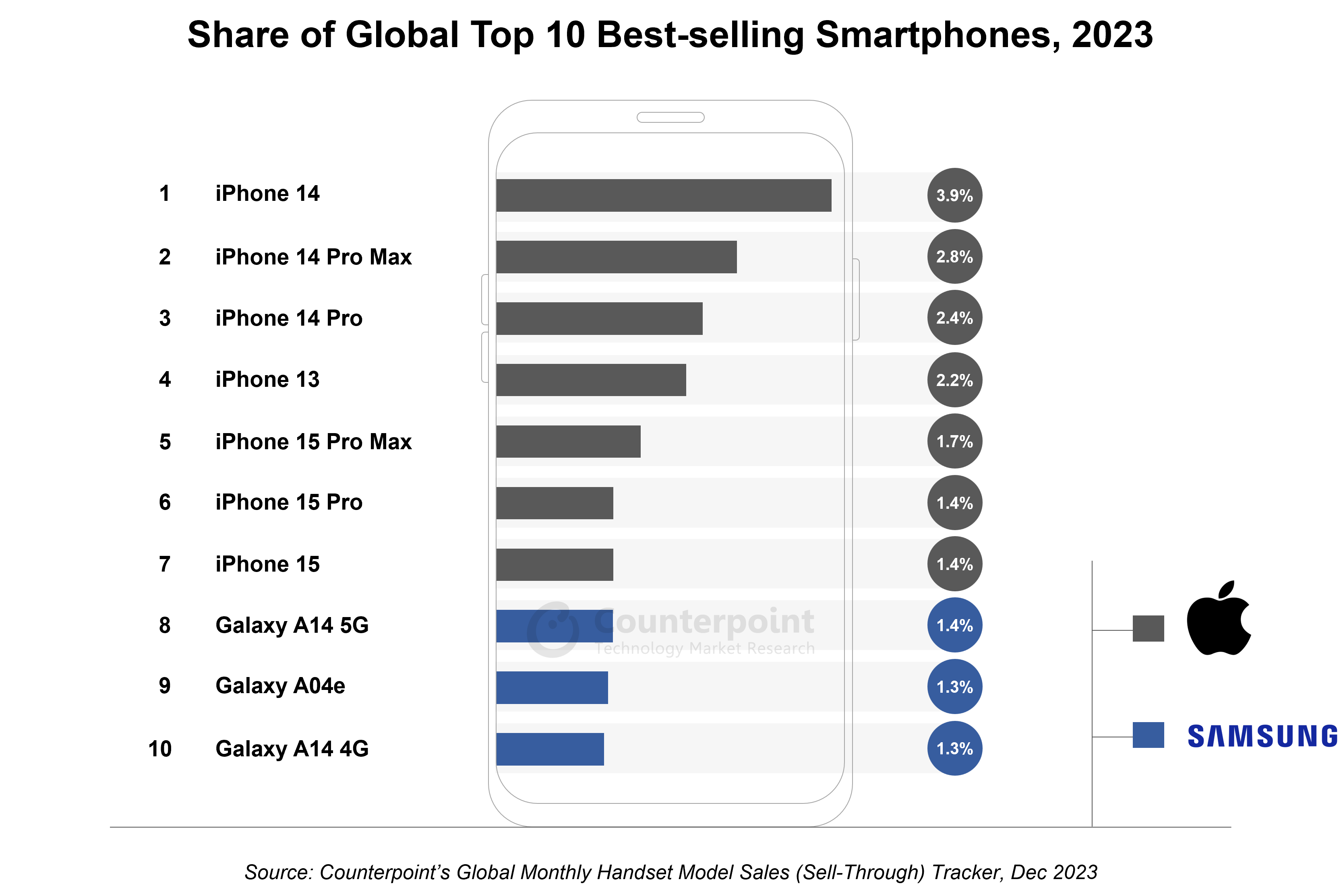

“Apple, for the first time, captured the top seven positions in the global list of bestselling smartphones in 2023,” Counterpoint said, citing data from its Global Monthly Handset Model Sales Tracker.

“Samsung secured the remaining three places in the list, marking an increase of one spot from the 2022 list.”

We believe the share of the top 10 smartphones will increase in 2023 as brands focus on clearing inventory and optimizing their launches,” said Counterpoint analysts Harshit Rastogi and Karn Chauhan.

“We also expect brands to continue making their portfolios leaner in 2023 to minimize cannibalization. The number of active smartphone models in the global market has already fallen from over 4,200 in 2021 to around 3,600 in 2022.”

Apple’s Unrivaled Market Presence

According to Counterpoint’s latest findings, Apple’s dominance in the smartphone arena has reached new heights, with iPhones claiming seven spots in the list of the top 10 bestselling handsets of 2023.

This achievement marks a first in Counterpoint’s historical data tracking, highlighting Apple’s unparalleled market appeal and strategic product placements.

Leading the pack was the iPhone 14, which alone accounted for 3.9% of all smartphone sales last year, followed closely by its siblings, the iPhone 14 Pro Max and iPhone 14 Pro, with the older iPhone 13 not far behind.

Interestingly, the iPhone 15 series, despite their late entry in the year, made a significant impact, with the iPhone 15 Pro Max becoming the bestseller in the fourth quarter.

However, the budget-friendly iPhone SE 2, a previous contender, did not make the cut this time, indicating a shift in consumer preference towards more premium offerings.

Samsung managed to secure its place with the Galaxy A14 5G leading its charge in the eighth spot, showcasing the brand’s strength in offering value through its mid-range segment.

Despite this, the combined market share of the top 10 handsets reached an all-time high of 20%, a clear indicator of the increasing concentration of power within the hands of a few leading brands.

Apple’s European Conquest

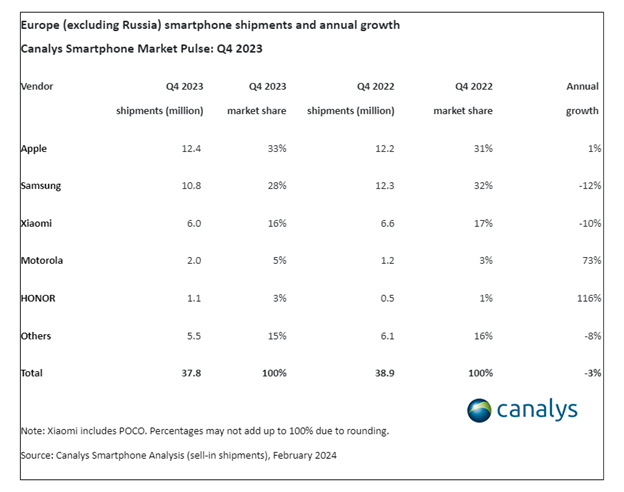

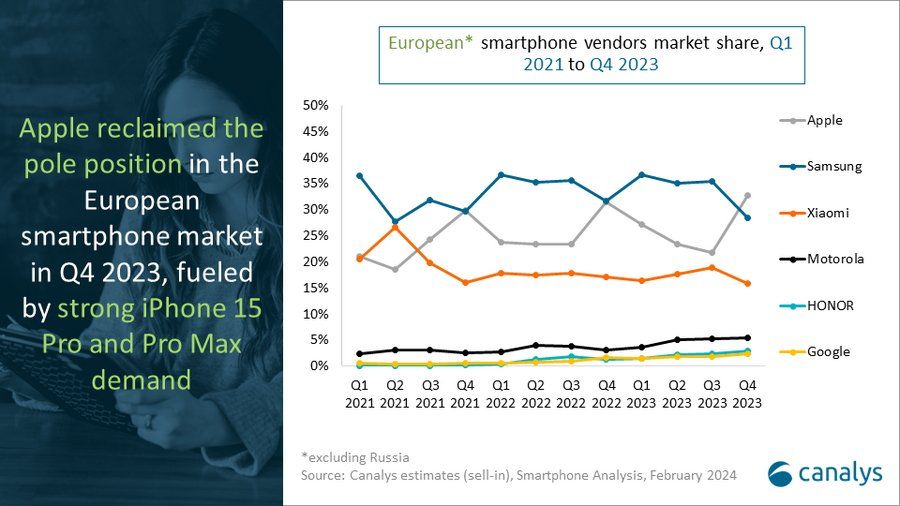

In another significant development, Apple toppled Samsung to become the top smartphone vendor in Europe in Q4 2023.

As per Canalys, with 12.4 million iPhones shipped, compared to Samsung’s 10.8 million, Apple not only increased its shipments by 1% but also expanded its market share to 33%.

Meanwhile, Samsung faced a 12% drop in shipments, reflecting a broader trend of shifting consumer loyalties and the impact of Apple’s aggressive marketing and product innovation strategies.

The overall European smartphone market witnessed a 3% decline in shipments, with Samsung experiencing a sharper fall than the market average.

This shift underscores Apple’s resilience and adaptability in a competitive market landscape.

Xiaomi, Motorola, and Honor also made notable strides, with Honor, in particular, achieving a remarkable 116% increase in shipments, highlighting the dynamic nature of the market competition.

FAQs

Which iPhone model was the top seller in 2023?

The iPhone 14 emerged as the biggest seller, accounting for 3.9% of all smartphone sales last year, showcasing Apple’s strong market presence.

How did Apple iPhones perform in the European market in Q4 2023?

Apple surpassed Samsung to become the leading smartphone brand in Europe in the last quarter of 2023, with a market share of 33%.

What was the market share of the top 10 best-selling phones in 2023?

The combined market share of the top 10 best-selling smartphones reached a record 20% in 2023, indicating a high concentration of sales among the leading models.

Did any Samsung phones make it to the top 10 bestsellers of 2023?

Yes, Samsung’s Galaxy A14 5G was the first non-Apple phone on the list, securing the eighth spot, highlighting the demand for affordable 5G options.

What contributed to Apple’s success over Samsung in Europe?

Apple’s success in Europe was attributed to increased iPhone shipments, innovative product offerings, and a 1% increase in shipments, while Samsung saw a 12% decrease.

Which smartphones are on the list of the most selling ?

For 2023, the iPhone 14 was the number-one-selling phone, with the US and China alone making up half of its sales.

What’s interesting is that the current base model — the iPhone 13 — accounted for 19% of total iPhone sales for the year. That’s down from the 28% that the iPhone 13 logged in 2022 when it was the best-selling phone.

The biggest reason for that, Counterpoint Research says, is that the iPhone 14 was fairly similar to the iPhone 13, leading people to adopt Pro models instead in order to gain new features.

iPhone 14

iPhone 14 Pro Max

iPhone 14 Pro

iPhone 13

iPhone 15 Pro Max

iPhone 15 Pro

iPhone 15

Galaxy A14 5G

Galaxy A04e

Galaxy a14 4G

The 14 Pro Max and then the 14 Pro claimed the second and third spots, bolstered by customers who were looking for a new phone, but wanting enough of a difference from the previous generation.

2021’s iPhone 13 still held strong in the number spot overall, which research shows is largely due to carrier promotions in Japan and value-focused shoppers in India.

The 15 Pro Max, 15 Pro, and 15 sit in the 5 through 7 spots, respectively, despite being available for less than a quarter of the year.

It’s not until spot number eight that another manufacturer arrives, with the Galaxy A14 finally appearing on the list, followed by the Galaxy A04e in ninth place and the Galaxy a14 4G in 10th. It’s worth noting that these too are value-oriented phones, especially popular in emerging markets such as Brazil, India, Mexico, and Indonesia.

While these top 10 phones dominate the market, they account for only 20% of total sales, showing there’s a lot of room for other players.

Aside from Apple and Samsung, though, no other manufacturer made the list, which has been the case since 2021.

Apple Captures Top 7 Spots in Global List of Top 10 Best-selling Smartphones. Details?

The combined market share of the top 10 smartphones in 2023 reached the highest ever at 20%, up from 19% in 2022.

Apple’s iPhone 14 was the best-selling smartphone of 2023 and the iPhone 15 Pro Max was the best-selling smartphone of Q4 2023.

Apple and Samsung were the only brands in the top-10 list.

Apple, for the first time, captured the top seven positions in the global list of best-selling smartphones in 2023, according to Counterpoint Research’s Global Monthly Handset Model Sales Tracker. Samsung secured the remaining three places in the list, marking an increase of one spot from the 2022 list.

There have been no other brands on the list since 2021. The combined market share of the top 10 smartphones reached the highest ever at 20% in 2023, up from 19% in 2022.

Apple’s iPhone 14 was the best-selling smartphone of 2023, with the US and China making up half of its sales. Further, the model contributed 19% of the total iPhone sales for 2023, down from the 2022 bestseller iPhone 13’s 28% share.

Limited differentiation between the iPhone 13 and iPhone 14 led to lower adoption of the base variant and increased sales of the iPhone Pro variants, which offer substantial upgrades like Dynamic Island, a more advanced chipset and a higher display refresh rate.

The iPhone 15 series took the top three spots on the global bestseller list for Q4 2023, with the iPhone 15 Pro Max becoming the best-selling smartphone.

Apple’s total sales remained flat in 2023 even as major competitors declined. This stability was partly due to a significant boost from emerging markets like India and the Middle East and Africa (MEA).

In 2023, India became the fifth smartphone market to exceed 10 million iPhone unit sales in a single year, highlighting the market’s growing importance for Apple. These factors contributed to the iPhone 15 series sales matching the performance of the iPhone 14 series in 2022.

Apple’s iPhone 13, the oldest model on the list, maintained its fourth position with double-digit YoY volume growth in Japan and India. Carrier promotions in Japan drove sales of older iPhones over the newer generation, while in India, the iPhone 13’s value proposition made it a popular choice.

Samsung’s budget A series captured three spots in the top-10 list due to its strong value proposition and presence across various geographies and customer categories. The Samsung Galaxy A14 5G secured eighth place driven by high sales in the US and India.

Notably, it was the best-selling smartphone in India for 2023. The only LTE-capable smartphones in the list, the Samsung Galaxy A04e and A14 4G secured the remaining two places thanks to their affordability driving sales in emerging markets like Brazil, India, Mexico and Indonesia.

Apple overtook Samsung smartphones in Europe for first time in almost two years. Details?

Canalys’ latest research reveals that smartphone shipments into Europe (excluding Russia) fell 3% year-on-year to 37.8 million units in Q4 2023. Apple returned to the lead position of the ranking table after seven quarters behind Samsung, growing 1% year-on-year to 12.4 million units.

Samsung took the second spot, declining 12% to 10.8 million units, offset by stable S-series and mid-range A-series shipments.

High-end smartphones took a record share of the European market in Q4 2023. Almost 40% of smartphone shipments were priced at US$800 or higher,” said Runar Bjørhovde, Analyst at Canalys.

“The dominance of the high-end was mainly fuelled by strong iPhone 15 Pro demand alongside consistent Galaxy S-series volumes and a growing Google Pixel.

Also Read: Apple Claims Top Spot as World’s Largest Smartphone Manufacturer, Omdia Reports

Also Read: Apple Leads in AI Startup Acquisitions in 2023, Surpassing All Other Tech Giants: Statista

Also Read: Apple iPhone 14 Pro Max Clinches Top Spot in Global Smartphone Sales for 2023: Canalys Reports