Highlights

- 2% drop in overall smartphone shipments in India for 2023.

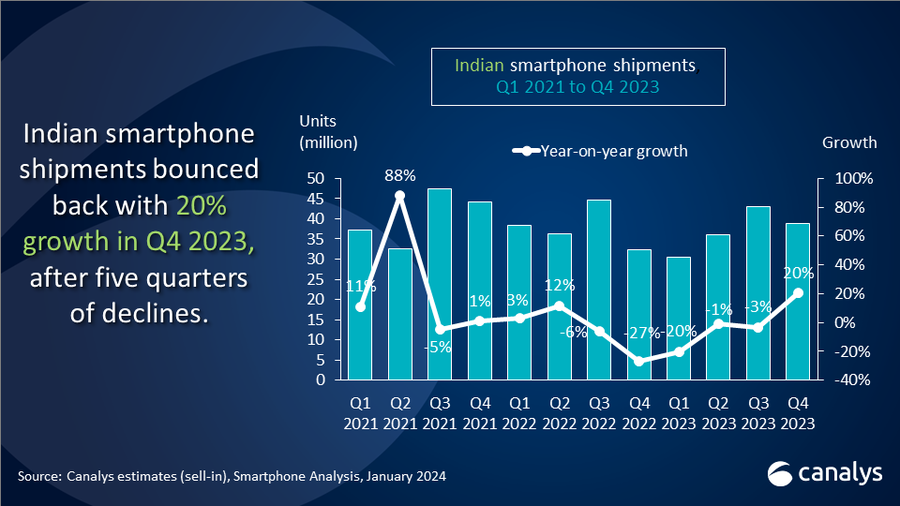

- Strong recovery in Q4 with a 20% year-on-year increase.

- Total shipments reached 148.6 million units in 2023.

- Festive season demand drives market resilience.

In 2023, India’s smartphone market demonstrated remarkable resilience despite a slight overall downturn.

According to a Canalys report, the market experienced a 2% drop in shipments, with a total of 148.6 million units.

Yet, in a significant turnaround, the final quarter of the year saw a 20% year-on-year growth, resulting in 38.9 million units shipped.

This recovery was primarily fueled by strong consumer demand during the festive season, highlighting the market’s robustness in challenging times.

“In 2023, growing investment in mainline retail space proved beneficial not only for vendors but also allowed the overall market to stabilize,” said Sanyam Chaurasia, Senior Analyst at Canalys. Brands such as Xiaomi and realme saw their highest offline shipment share in Q4.

Xiaomi democratized its portfolio, contributing equally to offline and online channels, making its highest offline channel contribution quarter. Its Redmi 12 5G and recently launched Redmi 13C series contributed to its offline share, each surpassing a million shipments.

Similarly, realme also shipped devices with equal channel contribution, with the Narzo series driven by ecommerce, while the remaining portfolio continued to dominate offline channels. To further enhance their positions in the premium space, brands should continually focus on bolstering the confidence of their channel partners.

“The premium segment witnessed robust growth, thanks to easy financing options, incentive schemes for retailers and rising disposable income,” said Chaurasia.

“With the celebration of Diwali in November 2023, Apple got the opportunity to push the latest iPhone 15 series during the festive sales, contributing more than 50% to its shipments in Q4. Additionally, discounts on the previous-generation iPhone 14 and iPhone 13 models during online sales resulted in Apple’s record shipments, allowing it to capture 7% market share in India.

Similarly, Samsung had set aggressive retail targets for its premium Galaxy S23 series to drive premium segment growth. Along with this, Samsung’s latest Galaxy S23 FE launch in Q4 drove shipments, thanks to compelling banking deals.”

“Vendors are entering 2024’s ‘Election Year’ with improved indicators for the consumer market with manageable inflation, a steady interest rate and clear visibility of a stable government to come into power,” said Chaurasia.

“Canalys expects the Indian smartphone market to grow by mid-single digits in 2024, driven by affordable 5G and the pandemic period replacement cycle. But the biggest challenge for vendors this year will be to manage the rising bill of materials costs.”

Key Insights into India’s 2023 Smartphone Market

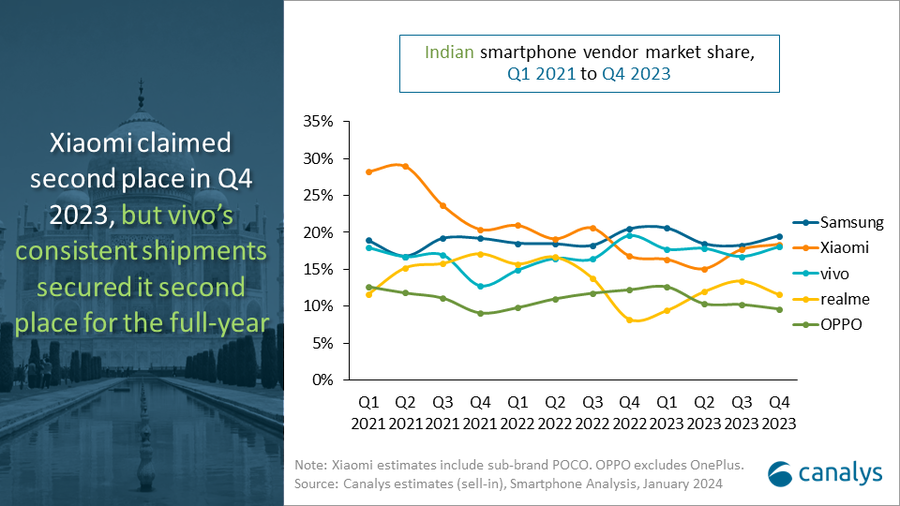

- Samsung’s Dominance: In Q4, Samsung led the market, claiming a 20% share with 7.6 million units shipped. This success was mirrored throughout the year, with Samsung maintaining its position at the top, despite a slight dip in market share.

- Xiaomi’s Performance: Following closely was Xiaomi, shipping 7.2 million units in the fourth quarter. Over the year, Xiaomi also saw a decline in its market share.

- Other Key Players: Vivo, Realme, and OPPO rounded out the top five brands, with Vivo displaying modest growth and Realme and OPPO witnessing shipment decreases.

Trends and Consumer Behaviour

As per the report, the festive season played a pivotal role in stabilizing the market, countering challenges such as inflation and inventory issues.

Notably, the premium segment of the market saw significant expansion.

Brands like Apple and Samsung capitalized on this trend by introducing new models and offering attractive financing options.

Channel Strategies and 5G Adoption

- Offline Expansion: Xiaomi and Realme were successful in extending their offline presence, balancing their distribution channels effectively. This strategy led to an increase in offline shipments, contributing substantially to their total sales.

- 5G’s Influence: The growing affordability of 5G smartphones has been a major driver of market growth, with consumers showing a keen interest in upgraded technology.

The Outlook for 2024

Looking ahead, Canalys anticipates that the Indian smartphone market will continue its growth trajectory in 2024.

This optimism is based on factors like the availability of reasonably priced 5G models and a replacement cycle spurred by the pandemic.

However, manufacturers will need to navigate the challenge of rising material costs.

FAQs

What was the overall performance of India’s smartphone market in 2023?

In 2023, India’s smartphone market saw a minor decline of 2% in overall shipments, totaling 148.6 million units. Despite this slight decrease, the market remained resilient.

How did the smartphone market in India fare in the last quarter of 2023?

The final quarter of 2023 marked a notable recovery for India’s smartphone market, with a 20% increase in shipments compared to the same period in the previous year, indicating strong market dynamics.

What factors contributed to the resilience of the smartphone market in India?

The resilience in India’s smartphone market was largely attributed to the heightened consumer demand during the festive season, which played a crucial role in driving sales and market recovery.

Was the decline in India’s smartphone market significant?

The 2% drop in India’s smartphone market in 2023 represents a minor decline, especially considering the strong recovery observed in the last quarter of the year.

Who led the Indian smartphone market in Q3 2023?

Samsung led the market with an 18% share and 7.9 million units shipped.

How did Xiaomi perform in this quarter?

Xiaomi climbed to second place by shipping 7.6 million units, largely due to its affordable 5G models.

What trends were observed in the premium smartphone segment?

The premium segment grew robustly, driven by Samsung’s Galaxy S23 series and older-generation iPhones offered at attractive deals.

Which brands faced a decline in Q3 2023?

Realme and Oppo experienced declines compared to the same timeframe in 2022.

How did the Indian smartphone market perform in the third quarter of 2023?

The Indian smartphone market demonstrated consistent year-on-year growth during the third quarter of 2023, with a total of 44 million units shipped. Samsung maintained its position as the market leader despite a slight dip in market share compared to the previous year.

What trends were observed in the 5G smartphone segment in India?

The 5G segment within the Indian smartphone market experienced robust growth, with 5G device shipments reaching a 58% share of the total market. This growth was facilitated by the launch of budget-friendly 5G models and various discounting strategies.

Which smartphone brands are leading in India’s premium market segment?

In India’s premium smartphone segment, significant growth was led by high-end models such as the Apple iPhone 13 and the Samsung Galaxy S23 series. The segment itself grew by 52%, indicating a healthy consumer interest in premium devices.

Has there been a change in the average selling price (ASP) of smartphones in India?

Yes, there has been an increase in the ASP of smartphones in the Indian market, with a rise to approximately Rs 21,000 (US$253). This represents a 12% year-on-year growth and a 5% increase from the previous quarter.

Also Read: Indian Smartphone Market in Q3 Powered by 5G Growth, Samsung Leading the Charge

Also Read: Samsung Retains Crown in India’s Smartphone Market for Q3 2023: Canalys

Also Read: Smartphone Market Plummets at Global Level; 9% Fall for 3rd Straight Quarter