Highlights

* The government has given great relief to the common people.

* GST on electronic items has been reduced significantly.

* Now the price of mobile phones, TV, fridge can be reduced.

The Government of India has reduced GST on home appliances and mobile phones. The GST introduction completes the sixth-year anniversary today, July 1, 2023.

The tax came into effect on July 1, 2017, through the implementation of the One Hundred and First Amendments of the Constitution of India by the Indian Government. The GST replaced existing multiple taxes levied by the central and state governments.

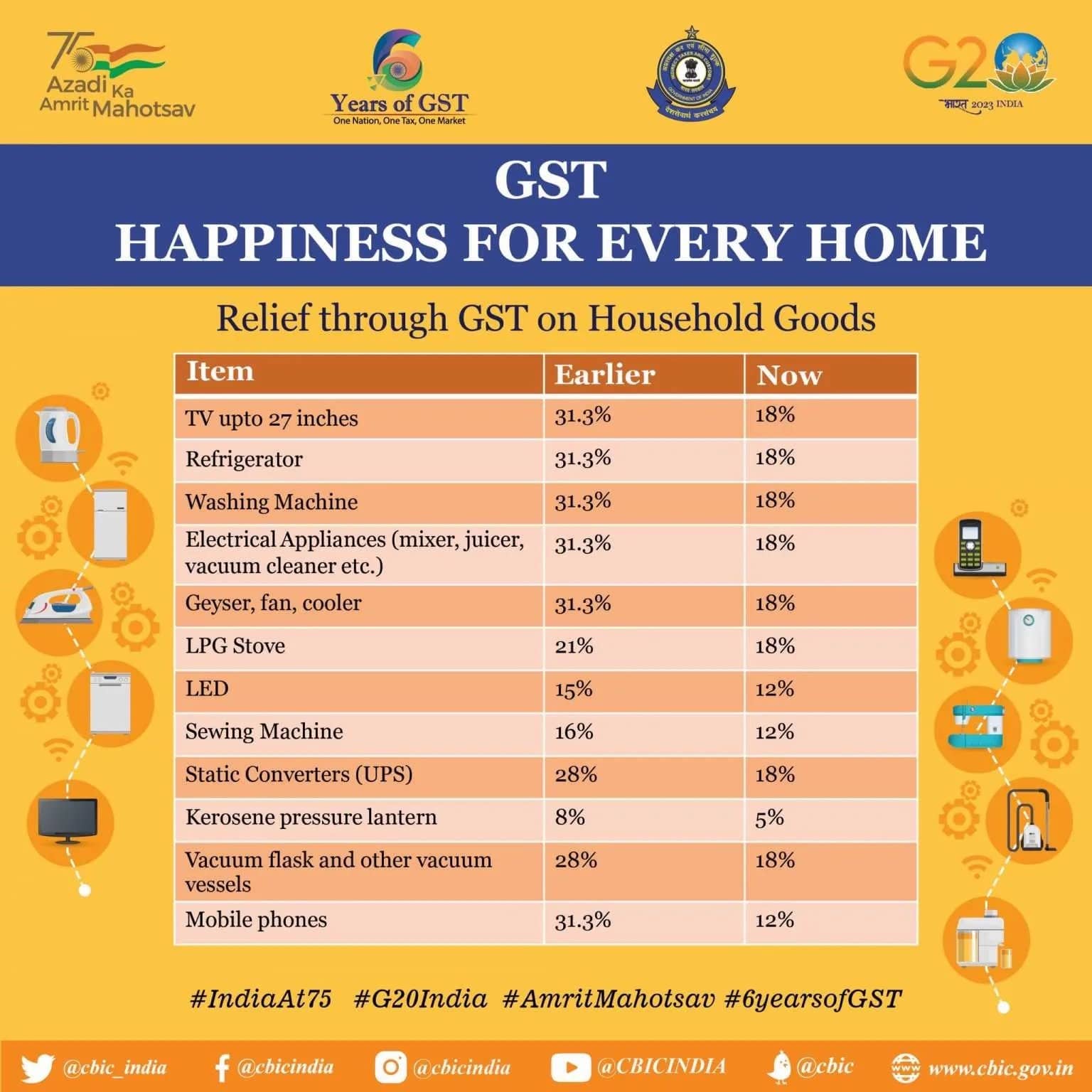

The GST for TV up to 27 inches was reduced from 31.3% to 18%, GST for Refrigerators reduced from 31.3% to 18%, GST for Washing Machine reduced from 31.3% to 18%, GST for electrical appliances like Mixer, Juicer, Vacuum cleaner, etc.

Reduced from 31.3% to 18%, GST for Geyser, Fan, Cooler reduced from 31.3% to 18%, GST for LPG stove reduced from 21% to 18%, GST for LED reduced from 15% to 12%, GST for Sewing machine reduced from 16% to 12%, GST for Static converters (UPS) reduced from 28% to 18%, GST for Kerosene pressure lantern reduced from 8% to 5%, GST for Vacuum flask and other vacuum vessels reduced from 28% to 18% and GST for Mobile phones reduced from 31.3% to 18%.

GST is the Goods and Services Tax in other words. GST is a successor to VAT used in India for the supply of goods and services. GST is a digitalized form of VAT where you can also track goods and services.

Both VAT and GST have the same taxation slabs. It is a comprehensive, multistage, destination-based tax.

It is comprehensive because it has subsumed almost all the indirect taxes except a few state taxes.

GST is imposed at every step in the production process but is meant to be refunded to all parties in the various stages of production other than the final consumer and as a destination-based tax, it is collected from the point of consumption and not a point of origin like previous taxes.

The Ministry of Finance celebrated six years of the Goods and Services Tax (GST) in India.

The official social media handles of the Ministry of Finance shared an image highlighting the benefits of GST compared to the previous regime, where there were multiple taxes involved, which resulted in a higher cumulative value.

The screenshot highlights the difference in tax value before and after GST was introduced.

One of the pointers that highlight the benefits of GST is a lower tax on mobile phones.

The timing of the post led to confusion among several users online, including some prominent, individual social media influencers, who celebrated the reduction of GST on mobile phones.

The image also shows the GST on TVs, home appliances, etc.

But is that really the case though? Well, sorry to burst the bubble, but no. The GST on mobile phones has not been reduced in India. At the time of the implementation of GST, the government set a 12 per cent tax on mobile phones.

Later, after the 39th GST council meeting, the Government of India increased GST on mobile phones and set it to 18 per cent effective from April 1, 2020.

Since then, smartphone companies have been paying up to 18 per cent GST on mobile handsets, which were transferred and taken from the consumer’s pocket.

During Budget 2023, the government reduced GST on mobile phones and brought it down to 12 per cent. However, consumers are yet to see the benefits of the same as the price of components, logistics, etc.

Have remained unaffected due to external factors, such as supply chain disruptions, the ongoing Russia-Ukraine war and the fluctuating value of the Indian rupee against the US dollar.

This has led to consumers paying more directly or indirectly. If the prices of phones remained the same, they did not provide the same value in terms of hardware and features.

Alternatively, phones that featured upgraded hardware over the outgoing model attracted significantly higher prices.

Overall, the GST on mobile phones remains the same at 12 per cent and has not changed.

However, several users seem to have been mistaken by the latest post, which compared the taxes during the pre and post-GST eras.

The GST on various household appliances and mobile phones has been reduced.

📱 For mobile phones, it’s down from 31.3% to 12% 🖥️ For LEDs, it’s been decreased from 15% to 12% 📺 For TVs up to 27″, it’s now 18%, down from 31.3% ❄️ FOR REFRIGERATORS, IT’S ALSO REDUCED FROM 31.3% to 18%.

Faqs

1) Will TV’s be cheaper to buy?

Ans) The government has slashed GST from 31.3 percent to 18 percent on TVs with a screen size of 27 inches or less. However, most consumers will not get the benefit of this as most of the smart TVs have a screen size of 32 inches or more, and they still have a GST of 31.3 percent.

So, if you want a smaller TV, you can save some money. But if you want a bigger TV, you will have to pay the same GST as before.

2) Will Mobile phones be cheaper?

Ans) The government has lowered GST on mobile phones, making them cheaper for customers.

Earlier, a consumer needs to pay 31.3 percent GST while buying a mobile phone.

This has now been reduced to 12 percent, which will allow mobile phone companies to cut the price of their phones.

3) Will Home appliances be cheaper?

Ans) Home appliances like refrigerators and washing machines, as well as fans, coolers, geysers, etc., will also be cheaper.

The GST on these home appliances has been slashed from 31.3 percent to 18 percent, which means a price reduction of up to 12 percent.

Other household appliances such as mixers, juicers, vacuum cleaners, LEDs, vacuum flasks and vacuum utensils have also got a GST cut.

The GST on mixers, juicers, etc. has gone down from 31.3 percent to 18 percent while the GST on LEDs has gone down from 15 percent to 12 percent.

4) What is the Government GST collection for May ?

Ans) Meanwhile, the government GST collection in the month of May 2023 was Rs 1,57,090 crore, which was 12% higher than the GST collection in the same month last year. The GST collection for May 2023 included 28,411 crore collected towards CGST, Rs 35,828 crore towards SGST, and Rs 81,363 crore towards IGST (including Rs 41,772 crore collected on import of goods).

The state-wise break-up of GST collections in May 2023 showed that Maharashtra posted the highest GST collection in absolute terms at Rs 23,536 crore. Other states like Karnataka, Gujarat, Tamil Nadu, Haryana and Uttar Pradesh also showed high GST collections. The GST collections for May 2023 were attributed to the improved economic activity and the increased compliance by taxpayer.

Also Read: Aadhaar-PAN Link: How to Check Status of Aadhaar link with PAN card, How to Link, Deadline, and More