HIGHLIGHTS

* Google Pay will now let users activate UPI ID without a debit card.

* A user must have the same mobile number linked to the bank account and Aadhar.

* The new feature is available for more than 25 banks.

* Google Pay has rolled out support for the Aadhaar-based UPI onboarding method.

* This service is currently available to some banks at the moment.

* The company claims that in this process, Google Pay does not keep the Aadhaar number.

Google Pay has announced the release of Aadhar-based authentication for UPI activation via the National Payments Corporation of India (NPCI). It is aimed at giving users more ways to activate their UPI IDs.

The support was originally released by NPCI last year but Google Pay is receiving it now. It is already one of the leading UPI apps in the country and is now hoping to reach even more users with the new feature.

If you are struggling to set your Unified Payments Interface (UPI) PIN without a debit card, there’s a new alternative. Mobile payment service Google Pay now lets people sign up for UPI through the National Payments Corporation of India (NPCI) using their Aadhaar numbers.

The company said that with the Aadhaar-based UPI onboarding method, people who use Google Pay wouldn’t need a debit card to set up their UPI PIN. This service is currently available to customers of banks who accept it. More banks are likely to follow suit soon.

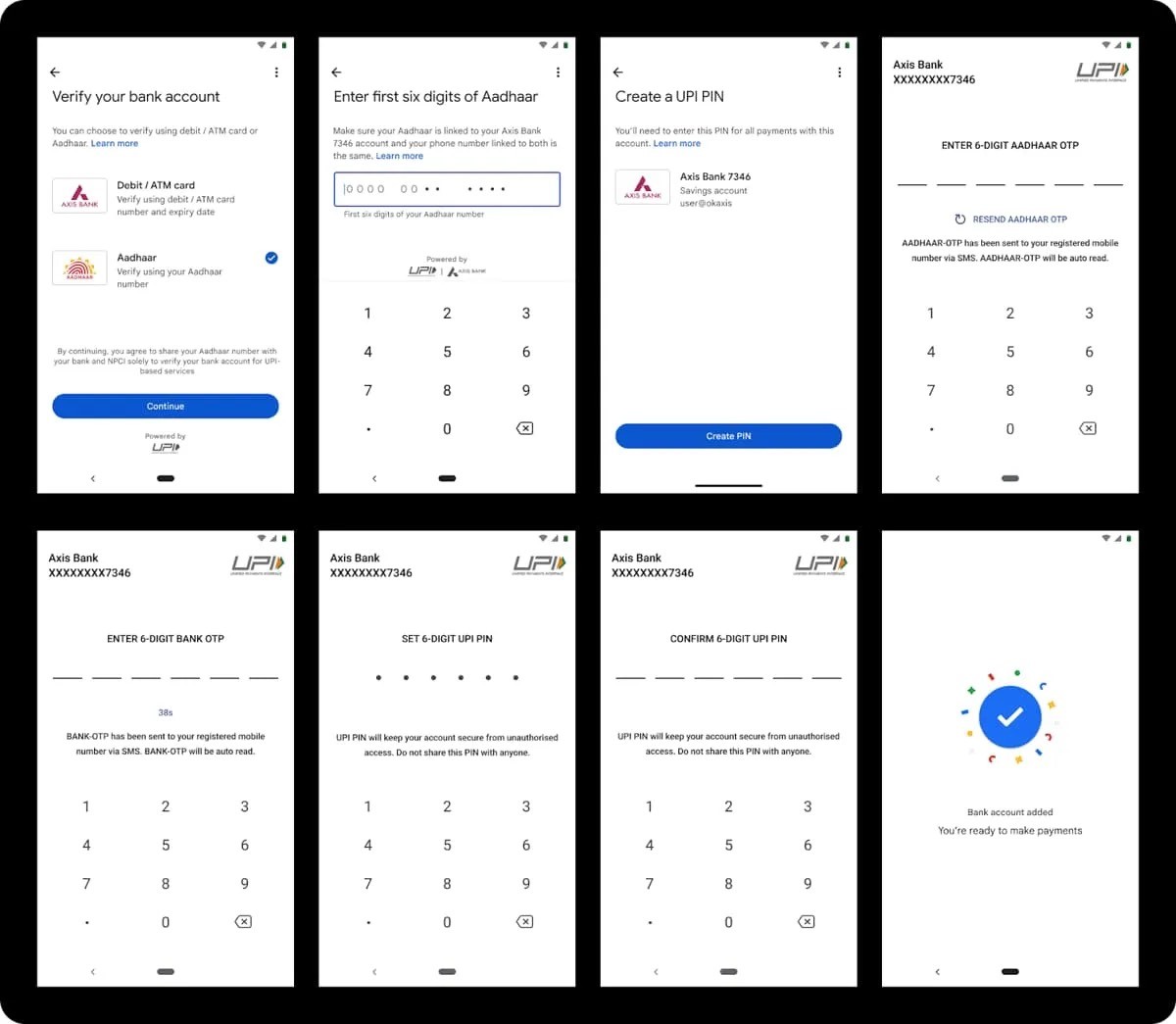

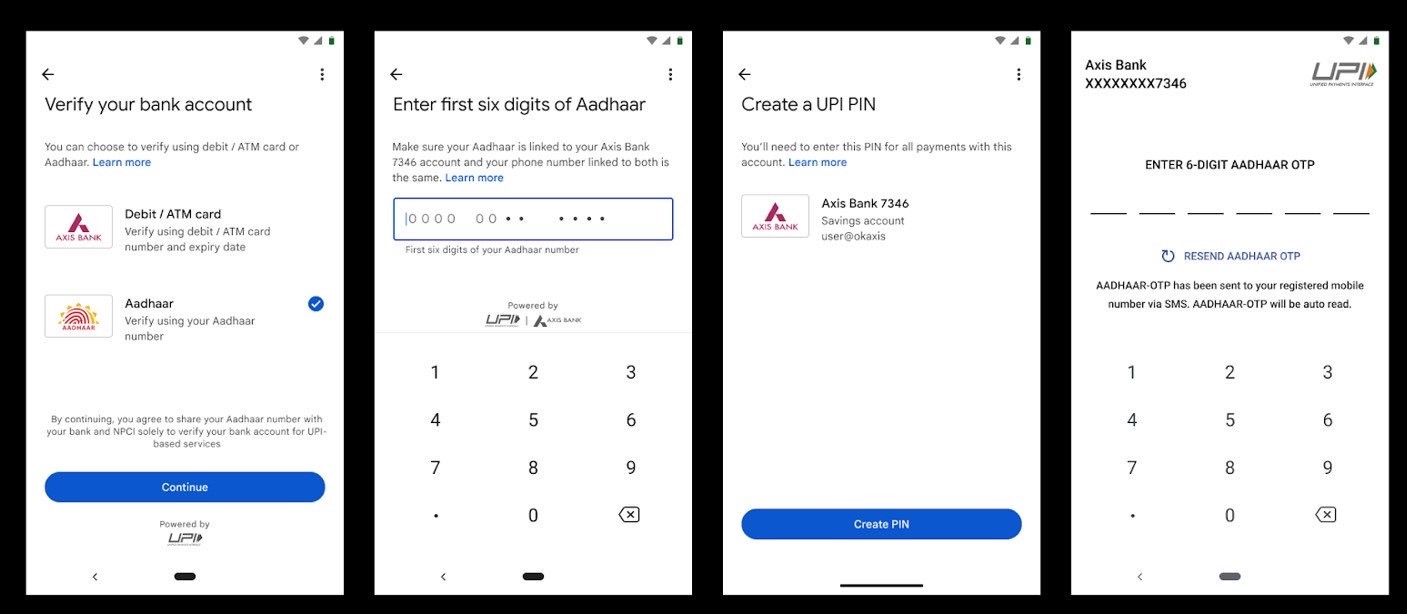

How to Activate Google Pay UPI ID Using Aadhar?

The process of using Aadhar-based UPI activation on Google Pay is pretty simple and straightforward. However, there are a couple of things that need to be fulfilled before a user can proceed.

The first thing to ensure is that the same mobile number must be linked to Aadhar and the concerned bank account. The second thing is that the bank account must also be linked to Aadhar.

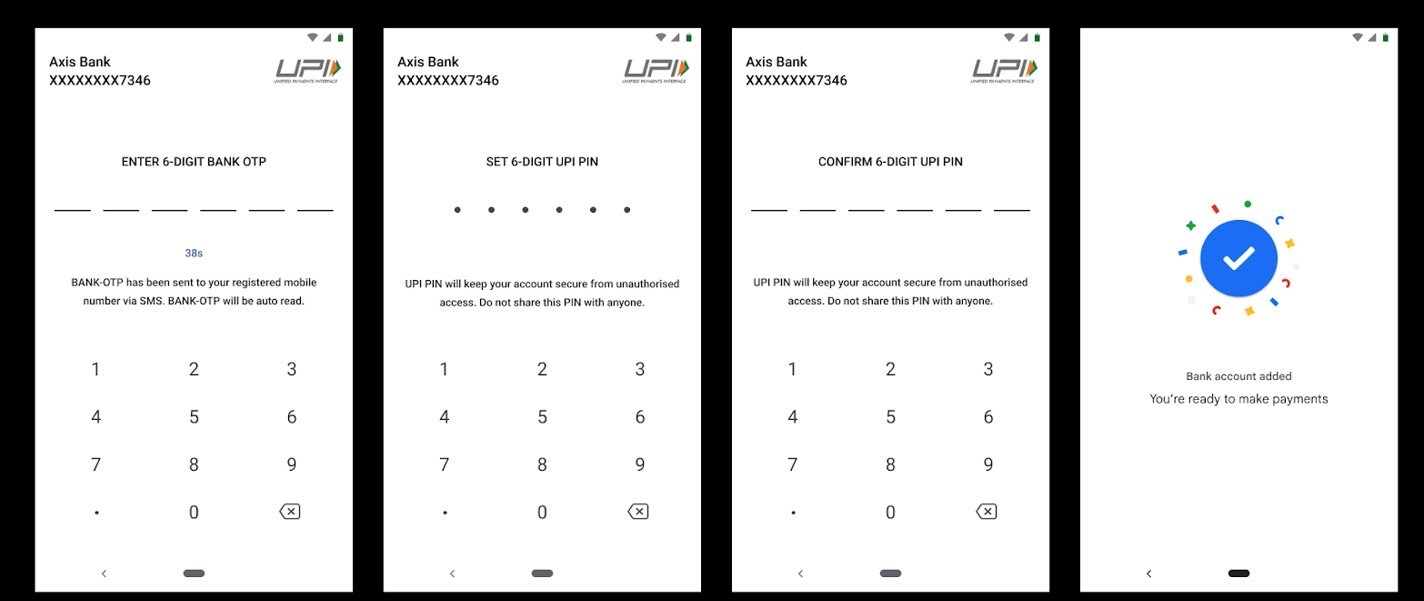

If you fulfil the aforementioned criteria, you can proceed with the following steps:

1. Launch the Google Pay application on your smartphone.

2. Choose Aadhar as the option for verifying your bank account.

3. Enter the first six digits of your Aadhar number.

4. Tap the Create PIN option to receive a 6-digit Aadhar OTP.

5. Enter OTP to authenticate yourself and your bank will handle this part.

6. Once authenticated successfully, choose a 6-digit UPI PIN for all your future transactions.

Google says it does not store your Aadhar number during the process. When a user enters the first six digits of Aadhar, it is shared with UIDAI via NPCI for validation purposes. This is done to ensure user privacy and the safety of the user’s Aadhar number.

Prior to this new feature, a user could not activate UPI ID unless they had a debit card. This is the reason many users across India who have a bank account but do not have a debit card could not use UPI. UIDAI’s data shows 99.9% of the adult population in India have an Aadhar number and they use it at least once a month.

Aadhar-based Authentication for UPI Activation Supported Banks

Aadhar-based authentication for UPI activation is currently available for select banks. You can check out the list below:

* Kerala Gramin Bank

* Punjab National Bank

* Karnataka Bank

* South Indian Bank

* Canara Bank

* Dhanlaxmi Bank

* CSB Bank

* IndusInd Bank

* Karnataka Gramin Bank

* Karur Vysya Bank

* Tamilnad Mercantile Bank

* Central Bank Of India

* Equitas Small

* AU Small Finance Bank

* The Rajasthan State Co-Operative Bank

* Punjab and Sind Bank

* Chaitanya Godavari Grameena Bank

* UCO Bank

* The Cosmos Co-Operative Bank

* Paytm Payments Bank

* Federal Bank

* Jio Payments Bank

Faqs

1) How to do Setting of UPI PIN without a debit card?

Ans) If a user wants to use UPI through Aadhaar, they must make sure that:

* Their bank and UIDAI share the same phone number.

* Aadhaar is linked to their bank account.

After that, Google Pay users will be able to choose between using a debit card or their Aadhaar number to sign up for UPI. And, if they choose Aadhaar:

* Users must enter the first six digits of their Aadhaar number in order to start the process.

* They will have to enter the OTPs they got from UIDAI and their bank to finish the identification step.

* Then, their bank will finish the process, and they will be able to set their UPI PIN.

* Then, customers will be able to use the Google Pay app to buy things or see how much money they have.

* After a user enters the first six digits of an Aadhaar number, the number is sent to UIDAI for approval through NPCI.

* According to the company, this process keeps the user’s Aadhaar number safe. Google Pay does not keep the Aadhaar number. Instead, it helps the Aadhaar number get to the NPCI so that it can be validated.

2) Google Pay gets Aadhaar-based authentication support for UPI: How to use it

Ans) Google has announced that its mobile payment service Google Pay now supports Aadhaar-based authentication for UPI activation. Users can now register for UPI using Aadhaar via National Payments Corporation of India (NPCI) and will be able to set their UPI PIN without a debit card.

This feature is now available to bank account holders of select banks and the company said that more banks are expected to follow very soon. As UPI becomes accessible to more users, the new functionality is expected to help many more users set up UPI IDs and enable them to make digital payments.

How to use Aadhaar for UPI activation

Users who want to onboard UPI via Aadhaar are required to have:

* Their phone number registered with UIDAI and bank are the same, and

* Their bank account is Aadhaar linked.

Once they have done this, they can follow the steps below for onboarding:

* On Google Pay, users have the option to select between Debit card or Aadhaar based UPI onboarding.

* When they select Aadhaar, then users will need to enter the first six digits of their Aadhaar number to initiate the process.

* In order to complete the authentication step, users will enter OTPs received from UIDAI and their bank.

* Subsequently, their respective bank will complete the process and they can set their UPI PIN.

* Customers will then be able to use Google Pay app to make transactions or check balance.

Once a user enters the first six digits of an Aadhaar number, it is sent to UIDAI via NPCI for validation to ensure the safety of users’ Aadhaar number.

“The Aadhaar-based onboarding facility on UPI is provided to make it available to a greater number of users and further financial inclusion,” Google said.

As per the data by Unique Identification Authority of India (UIDAI), over 99.9% of the adult population in India have an Aadhaar number and use it at least once a month.

“We are thrilled to announce UPI activation using Aadhaar-based OTP authentication on Google Pay, bringing simplicity and convenience to our users,” said Sharath Bulusu, director of product management from Google.

Aligned with the Government’s vision to drive financial inclusion, this feature will further strengthen our efforts to drive deeper penetration for digital payments in India,” Bulusu added.

The company also said that Google Pay does not store the Aadhaar number and acts as a facilitator in sharing the Aadhaar number with the NPCI for validation.

3) Google Pay now supports Aadhaar-based UPI activation

Ans) Google has partnered with the National Payments Corporation of India (NPCI) to enable Aadhaar-based authentication for UPI activation to further ease the user onboarding process on Google Pay. According to Unique Identification Authority of India (UIDAI), 99.99% of adults in India have a unique Aadhaar number, and this new initiative is said to further boost the adoption of digital payments in the country.

To use this feature, one needs to have their Aadhaar card updated with the phone number that is linked to their bank account. Google confirms that it does not store Aadhaar numbers and they only acts as a facilitator in sharing the Aadhaar number with the NPCI for validation.

Besides Google Pay, other prominent UPI payment platforms also support Aadhaar based onboard.

How to set up Google Pay using Aadhaar

Setting up Google Pay by using Aadhaar is similar to the previous onboarding process, which involved users entering their debit card numbers.

Users can now download and install Google Pay and click on Aadhaar-based UPI onboarding and enter the last six digits of their Aadhaar number. In the next step, a user has to authenticate the process by entering the six-digit OTP received on their phone number and then entering the six-digit bank OTP.

The last step involves the creation of a new UPI code, which completes the Google Pay onboarding process using Aadhaar. The same procedure also works while when users want to activate Google Pay on a new smartphone.

List of banks that support Aadhaar-based UPI onboarding

Kerala Gramin Bank

Punjab National Bank

Karnataka Bank

South Indian Bank

Canara Bank

Dhanlaxmi Bank Ltd

CSB Bank Ltd

INDUSIND BANK

Karnataka Gramin Bank

Karur Vysya Bank

Tamilnad Mercantile Bank

Central Bank Of India

EQUITAS SMALL

AU small Finance Bank

The Rajasthan State Co-Operative Bank Ltd

Punjab and Sind Bank

Chaitanya Godavari Grameena Bank

UCO Bank

The Cosmos Co-Operative Bank Ltd

Paytm Payments Bank

Federal Bank

Jio Payments Bank

4) Google Pay enables Aadhaar-based authentication for UPI activation .Details?

Ans) Google launched Aadhaar-based authentication for UPI transactions that will allow users to set up their UPI pin without a debit card. Support for UPI using Aadhaar will work via National Payments Corporation (NPCI).

Users looking to onboard UPI via Aadhaar will need to ensure their phone numbers registered with UIDAI and their bank are the same, and their bank account is linked with Aadhaar.

How to set up Google Pay using Aadhaar

Google Pay users will now have the option to select between a Debit card or Aadhaar-based UPI while onboarding. In order to use Aadhaar-based onboarding, users will need to enter the first six digits of their Aadhaar number to initiate the process.

To complete the authentication, users will have to enter the OTPs received from UIDAI and their bank, after which the bank will complete the process and users can set their UPI pin.

Post set up, users will be able to use Google Pay to make transactions and check their account balance. Google will not store Aadhaar number and merely acts as a facilitator in sharing the Aadhaar number with the NPCI for validation, the company shared in a press release.

“Aligned with the Government’s vision to drive financial inclusion, this feature will further strengthen our efforts to drive deeper penetration for digital payments in India. Over the years, we are very heartened by the ready adoption digital payments have witnessed in the country, and this feature will help boost the UPI ecosystem even further”, Sharath Bulusu, Director of Product Management from Google said.

According to UIDAI over 99.9% of the adult population in India have an Aadhaar number and use it at least once a month.

Also Read: How to Download Aadhaar, PAN card on Your WhatsApp