HIGHLIGHTS

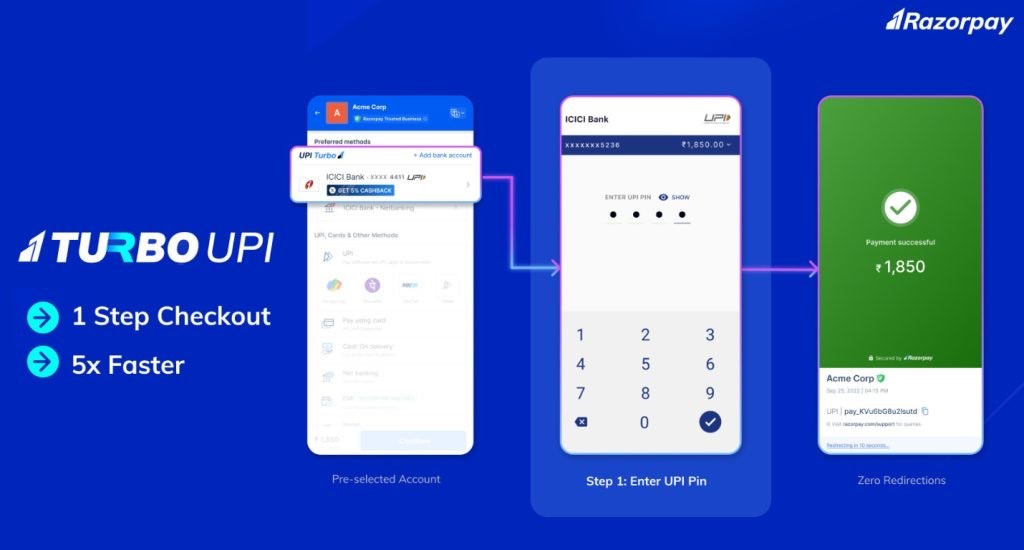

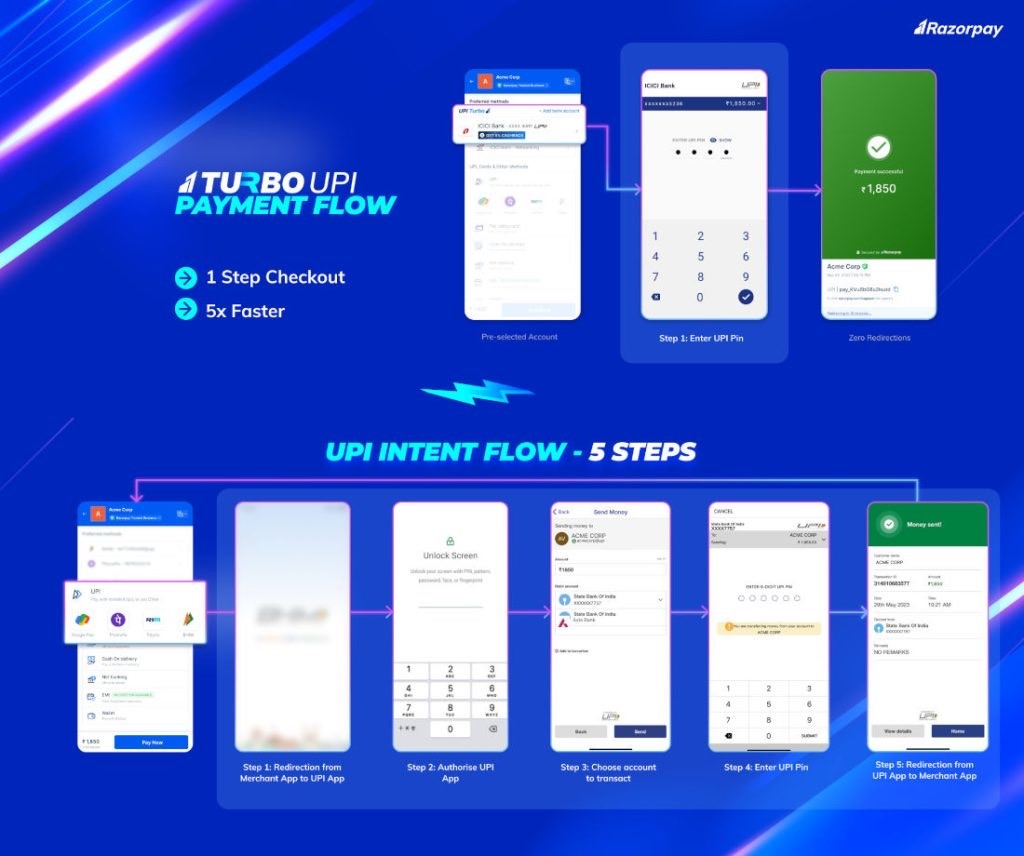

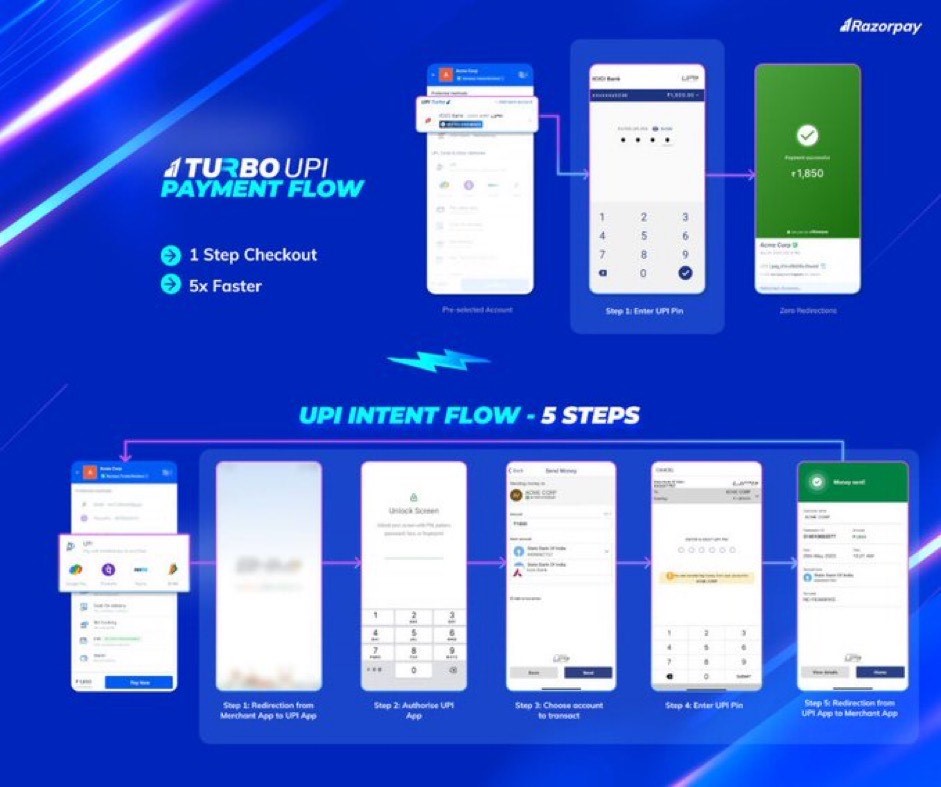

* Razorpay will now let users make UPI payments with just one step.

* This new feature is called Turbo UPI and it will soon be available with select brands.

* It essentially cuts the process from five steps to just one step.

* Turbo UPI allows direct UPI payments without getting redirected to a third-party UPI app during checkout.

* It is a 1-step payment experience for online customers as compared to a 5-step process on regular UPI.

* Razorpay collaborated with NPCI and Axis Bank for Turbo UPI.

Razorpay has launched a new and faster UPI system called ‘Turbo UPI’ which is said to offer a 1-step payment experience, five times faster than normal UPI, as claimed by the company.

The finance platform partnered with the National Payments Corporation of India (NPCI) and Axis Bank for the launch of Turbo UPI. This new payment system will essentially make it easier and faster for consumers to make UPI payments to online merchants.

Razorpay has launched Turbo UPI as its one-step solution for a faster and more streamlined UPI payments experience. It teamed up with the National Payments Corporation of India (NPCI) and Axis Bank.

It is being touted as India’s fastest payment solution with a 5X faster payment experience than regular UPI. It is primarily aimed at online businesses but will also benefit customers making payments.

Commenting on the launch, Shashank Kumar, Co-founder & MD at Razorpay, said:

With India’s consumers swiftly adopting UPI as a digital mode for its transaction needs, it is crucial for businesses to have access to a hassle-free, seamless payment experience like never before.

Therefore, we wanted to build a solution that not only made the end-users’ UPI payment experience fast & frictionless but will also help businesses with a significant increase in success rate by 10% for UPI transactions, empowering businesses with higher revenue potential in the evolving digital landscape. So, as opposed to the 5-step process of UPI flow, our one-step solution reduces the scope of non-technical errors that can lead to drop-offs and provide a major boost to UPI transactions.

This new offering is in tandem with Razorpay’s commitment to taking on the challenges of payments head-on that businesses face in their day-to-day operations. By providing a simplified and seamless payments experience, we believe we are enabling businesses to grow and thrive in a rapidly evolving digital landscape.

This continuous innovation in the digital payments industry is a testament to the fact that the industry is headed towards a glorious future, especially with India’s UPI success story becoming a global benchmark today.

What is Turbo UPI?

In the official announcement, Razorpay has described Turbo UPI as a 1-step payment experience. This is because it eliminates the need for redirection to a third-party UPI app during the checkout process. It allows customers to make UPI payments directly by entering their UPI PIN.

Turbo UPI is primarily meant for merchants who will need to integrate the service into the payment gateway.

It is said to boost the payment success rate by 10%. Merchants will get access to granular insights into the end-users drop-off pattern and full control over the customer’s payment experience.

Some of its early adopters are Tata Starquik, Ixigo, FNP (Ferns N Petals), Trainman, and Dhan among others. A specific timeline has not been shared but customers of these businesses will be able to use the service “soon”.

Turbo UPI vs Regular UPI: What is the difference?

It is a relatively lengthy process when it comes to making payments via regular UPI on websites. The first step is to either choose the preferred third-party UPI app or enter your UPI address.

The payment gateway then redirects you to the selected app where you have to use your face/fingerprint lock to access the app. The next step is to cross-check the business name and requested payment and then you enter your UPI PIN to complete the payment.

Afterwards, you are redirected to the merchant’s payment gateway to show the final payment status.

In comparison, Razorpay says Turbo UPI will fasten the whole payment experience by eliminating app redirection steps. All you need to do is to select Turbo UPI on the gateway, enter your UPI PIN, and voila, payment would be done.

It should be noted that Razorpay is not the only one with a 1-step payment experience. Last week, Paytm launched UPI SDK with the same purpose where customers can make direct UPI payments without any third-party UPI app redirects.

It is powered by the same technology stack as Paytm Payments Bank. This SDK will also get support for UPI Lite and UPI on RuPay Credit Card in the future.

Razorpay Turbo UPI

Razorpay Turbo UPI will let users make payments to online merchants directly and remove the process of redirecting to a third-party UPI app. This quick process is said to help increase the success rate of UPI payments by 10 percent.

In addition to this, Turbo UPI gives merchants control over the payment experience by showing them insights of the end-users drop-off pattern.

Razorpay has collaborated with popular brands to enable Turbo UPI on their platforms. Some of the first merchants for Turbo UPI include Tata Starquik, Ixigo, FNP (Ferns N Petals), Trainman, and Dhan.

So merchants will have to enable Turbo UPI to get the quick payment system.

How Razorpay Turbo UPI works

* At present, UPI payments have a long process where you have to first choose the payment method, then enter your UPI ID.

* You will then be redirected to your UPI payment app or website and enter your UPI PIN to complete the payment.

* With Turbo UPI, the whole five-step process will be shortened to just one.

* All you’ll have to do is select the Turbo UPI payment option from the list of payment modes, enter your UPI PIN and the payment will be completed.

* The initial process will require you to link your bank account to your UPI account so you can easily complete the payment when you use the feature.

Razorpay Turbo UPI is similar to Paytm UPI SDK that launched just last week. This feature too lets users make UPI payments directly without getting redirected to another page during checkout.

Similar to Razorpay Turbo UPI, Paytm UPI SDK also lets you complete the payment by simply entering the UPI PIN from the merchant’s app itself.

Faqs on Razorpay Turbo UPI

1) Razorpay launches ‘Turbo UPI’ payment service.Details?

Ans) Razorpay has announced the launch of ‘Turbo UPI’ that allows customers of online merchants to make UPI payments directly without getting redirected to a third-party UPI app during checkout. According to the company, the new feature streamlines the payment process and helps businesses in successful completion of UPI payments.

Turbo UPI also offers insights into the end-users’ drop-off pattern and enables merchants to control the entire payment experience of their customers, end-to-end. For end-users, this means a 1-step UPI payment experience, as opposed to 5 steps.

About the launch of Turbo UPI, Shashank Kumar, Co-founder and Managing Director of Razorpay, said, “With India’s consumers swiftly adopting UPI as a digital mode for its transaction needs, it is crucial for businesses to have access to a hassle-free, seamless payment experience like never before. Therefore, we wanted to build a solution that not only made the end-users’ UPI payment experience fast and frictionless but will also help businesses with a significant increase in success rate by 10 per cent for UPI transactions.”

“This new offering is in tandem with Razorpay’s commitment to take on the challenges of payments head-on that businesses face in their day-to-day operations. By providing a simplified and seamless payments experience, we believe we are enabling businesses to grow and thrive in a rapidly evolving digital landscape,” he added.

2) Razorpay unveils India’s fastest one-step payments solution Turbo UPI. Details?

Ans) Razorpay has launched ‘Turbo UPI’ which the fintech unicorn says is India’s fastest one-step UPI (unified payments interface) payment solution. This new product allows customers of online merchants to make UPI payments directly without getting redirected to a third-party UPI app during checkout.

Razorpay Turbo UPI aims to deliver a 5X faster payment experience. It streamlines the payment process and eliminates any redirection to external apps. This helps businesses achieve a significant increase in the success rate of UPI payments by 10 per cent.

This solution was developed in partnership with NPCI and Axis Bank.

“With India’s consumers swiftly adopting UPI as a digital mode for its transaction needs, it is crucial for businesses to have access to a hassle-free, seamless payment experience like never before,” said Shashank Kumar, co-founder and managing director at Razorpay. “So, as opposed to the 5-step process of UPI flow, our one-step solution reduces the scope of non-technical errors that can lead to drop-offs and provide a major boost to UPI transactions.”

Turbo UPI also offers granular insights into the end-users drop-off pattern and enables merchants to control the entire payment experience of their customers, end-to-end. For end-users, this means a simple 1-step UPI payment experience instead of 5 steps. Customers of popular apps including Tata Starquik, Ixigo, FNP (Ferns N Petals), Trainman, and Dhan among others will soon be able to get the benefits of this innovation.

Providing a frictionless customer experience has been a top priority for us. As a business, it is of utmost importance to provide customers best and most seamless payment experience, and ‘Turbo UPI’ has taken that up a notch,” said K. Radhakrishnan, Co-founder, Tata Starquik. “We are confident that this streamlined, frictionless, and time-saving payment solution will not only enhance our customers’ experience but also minimize drop-offs during the UPI payment journey.”

UPI has become the common and preferred mode of payment for end users. It is projected to reach 1 billion transactions per day and capture a 90 per cent share of retail digital payments by 2026-27, according to a recent industry report. However, businesses are actively seeking solutions to address issues such as reliance on third-party UPI apps, and a lack of visibility into their customer drop-offs during the payment process. Razorpay said Turbo UPI will help solve these challenges.

Razorpay has been powering innovations on UPI since 2017. These range from launching payment acceptance for UPI in 2017 to introducing the UPI Autopay feature to enabling CC on UPI.

3) Razorpay Joins Paytm, Launches ‘Turbo UPI’ For One-Step Payment To Online Merchants.Details?

Ans) Days after the launch of UPI SDK by Paytm, fintech unicorn Razorpay on Tuesday (May 30) announced the launch of ‘Turbo UPI’, a one-step payment solution for the UPI network.

Razorpay said the service would allow users to make payments without being redirected to a third-party app during checkout. The fintech startup launched the service in partnership with the National Payments Corporation of India (NPCI) and Axis Bank.

It must be noted that last week, Paytm launched its UPI SDK (Software Development Kit) to allow customers to make UPI payments from within the app of online merchants without redirecting them to the Paytm app

In a statement, Razorpay claimed that Turbo UPI would deliver a faster payment experience by eliminating redirection to other payment apps. The fintech unicorn further claimed that businesses could see up to a 10% increase in the success rate of UPI payments on their platforms.

“Turbo UPI also offers granular insights into the end-users drop-off pattern and enables merchants to control the entire payment experience of their customers, end-to-end,” the statement said.

Explaining the rationale behind the new service, Razorpay said that while UPI is set to dominate as the preferred digital payment method, businesses are looking to reduce reliance on third-party apps and address the lack of visibility into their customer drop-offs during the payment process.

Turbo UPI has been integrated with apps and platforms like grocery delivery platform Tata StarQuik, online travel aggregators ixigo and Trainman, gifts and flowers platform Ferns N Petals, and stock trading platform Dhan, among others.

Commenting on the launch, Shashank Kumar, cofounder and MD at Razorpay, said, “We wanted to build a solution that not only made the end-users’ UPI payment experience fast & frictionless but will also help businesses with a significant increase in success rate by 10% for UPI transactions, empowering businesses with higher revenue potential in the evolving digital landscape,”

Kumar added that a one-step solution reduces the scope of non-technical errors that can lead to drop-offs and boost UPI transactions.

4) Razorpay Turbo UPI: How It Works?

Ans) It was stated that customers of online merchants would be able to use this to make UPI payments directly without being forwarded to another UPI application at the time of the transaction, helping businesses increase the success rate of payments by over 10 percent. For the end users, the newly introduced Razorpay Turbo UPI gets a 1-step UPI solution which is 5X faster than the regular 5-step process.

5) How Is RazorPay Turbo UPI Faster?

Ans) The process is simplified for the users by only requiring them to complete one step; otherwise, they would be unable to switch from the merchant’s application to another UPI application, slowing down the process. The user only needs to enter the UPI Pin to authorise the transaction without exiting the application as the pre-selected UPI account will be used.

6) Which Companies Will Use This Feature?

Ans) As per Razorpay’s statement, the companies like Tata Starquik, Ixigo, FNP (Ferns N Petals), Trainman, and Dhan will be using the Turbo UPI as per the company.

7) Razorpay launches ‘Turbo UPI’: How is it different from regular UPI.Details?

Ans) Indian fintech startup, Razorpay has launched a new product called Turbo UPI. For this product, Razorpay has partnered with Axis Bank and the National Payments Council of India (NPCI). Turbo UPI claims to make UPI payments faster and reduce potential payment failures. The company will also allow merchants to integrate Turbo UPI at the payment gateway. This will eliminate the need for customers to go to third-party UPI payment apps and they can pay directly from their UPI-linked bank accounts within the merchant app. Razorpay also claims that this product will also help businesses to achieve nearly a 10% increase in the success rate of UPI payments. Turbo UPI also promises a 2-step UPI payment experience for end-users. This also claims to make the payment experience 5X faster.

Early adopters of Turbo UPI

Turbo UPI is still in the pilot stage. However, some popular apps including Tata StarQuik, Ixigo, FNP (Ferns N Petals), Trainman and Dhan are among the multiple companies that are soon going to enable this product on their platforms.

Importance of platform-specific UPI payment solutions

Using third-party apps like Google Pay or PhonePe can make the payment process inconvenient due to the additional steps involved. At times, customers can also miss payments if messages or notifications for the payment prompt get delayed.

This is why major digital merchants prefer to build their own UPI payment solutions. For example, Amazon has Amazon Pay UPI, while Zomato recently launched Zomato UPI. Reports suggest that Walmart-owned Flipkart is also planning to start its own UPI payments solution.

8) Razorpay partners with Axis Bank, NPCI to launch Turbo UPI. Details?

Ans) Fintech unicorn Razorpay on May 30 launched Turbo UPI in partnership with Axis Bank and the National Payments Council of India (NPCI). Turbo UPI aims to make UPI payments faster and reduce potential payment failures.

Merchants can integrate Turbo UPI at the payment gateway, which eliminates the need for customers to go to third-party UPI payment apps. This will allow customers to pay directly from their UPI-linked bank accounts within the merchant app. The additional step of switching apps is estimated to cause almost 5-10 percent of payment failures.

Last week, Paytm, which also has a payment gateway solution, launched a similar product called “UPI SDK”. Paytm’s product supports UPI payments through UPI Lite, as well as Rupay Credit Cards linked to the UPI account. SDK stands for software development kit, or a software plug-in that a merchant can integrate with their payment gateway.

“This is a one-click process and the payment is completed much faster. Here no PSPs (payment service providers) are required, the merchant app will itself become a UPI App. The merchant will install a Razorpay Plug-in and the customer can directly link their bank accounts to the merchant app,” said Shashank Kumar, cofounder and Managing Director of Razorpay.

The additional steps involved in using a third-party app like Google Pay or PhonePe can make the payment process cumbersome. Sometimes, messages or notifications for the payment prompt may be delayed, which could result in customers missing the payments. This is one of the reasons why some large digital merchants prefer to build their own UPI payment solutions. For example, Amazon has Amazon Pay UPI, while Zomato recently launched Zomato UPI. Flipkart also has plans to start its own UPI payments solution.