Highlights

- Google Pay app in the US to sunset by June 4, 2024, transitioning features to Google Wallet.

- Peer-to-peer payment functionality will not be supported post-transition.

- Users must transfer funds to a bank by the deadline to avoid disruption.

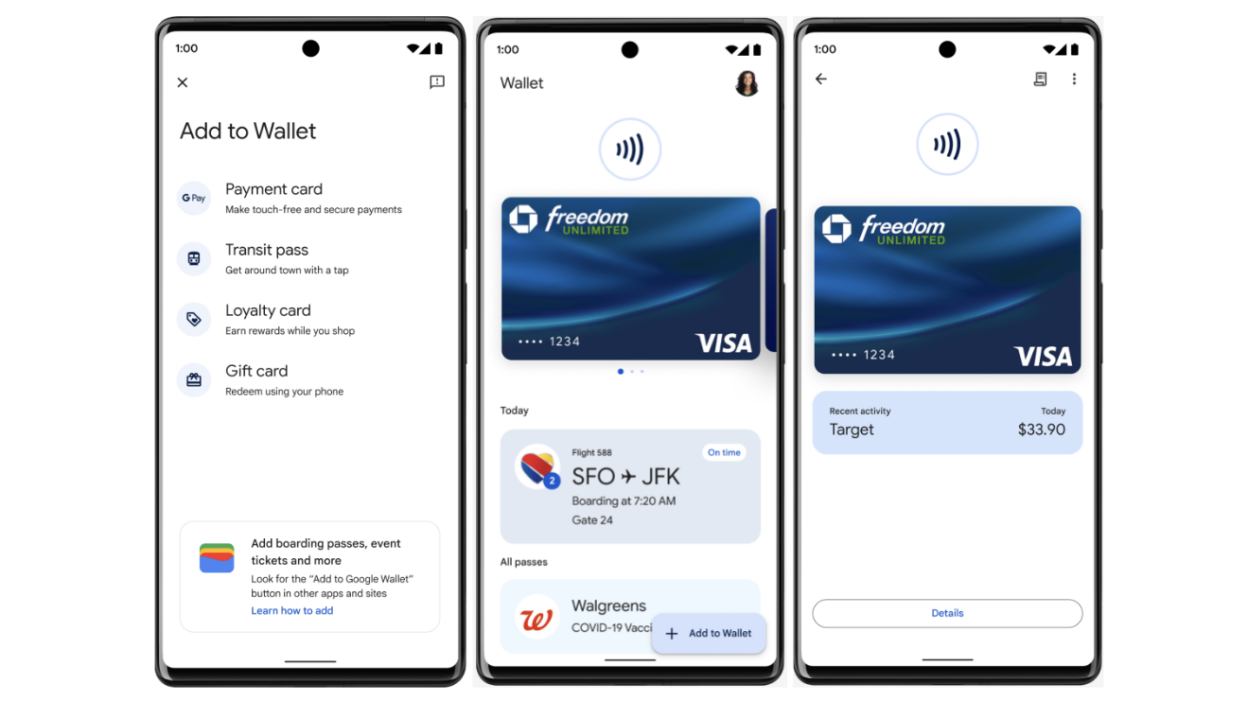

- Google Wallet to become the all-in-one app for mobile payments and digital storage.

The tech giant, known for its penchant for rebranding and reshaping its offerings, is ending the Google Pay app in the United States, as it merges back into the folds of Google Wallet—a name that old-school users might remember as the forerunner in NFC payments.

Simplifying Digital Payments

The Google Pay app will shut down completely by June 4, 2024 and it marks a significant shift in Google’s approach to mobile payments in the US.

The company’s intention is clear: streamline its payment services under one umbrella, making Google Wallet the one-stop-shop for all digital payment needs.

This consolidation aims to eliminate confusion among users and strengthen Google’s position in the competitive mobile payments market.

For users accustomed to Google Pay’s convenience, this transition brings a mixture of continuity and change.

While the most popular features of Google Pay will be available in Google Wallet, the ability to send or request money from peers—a staple functionality of the Pay app—will be conspicuously absent post-deadline.

Google suggests turning to Google Search for discovering deals previously accessible through Pay, signaling a shift in how users will engage with promotional offers.

What Lies Ahead for Users?

The clock is ticking for Google Pay users to transfer any lingering funds to their bank accounts before the June 4 cutoff.

Post-deadline, the app will cease operations, but Google assures that the Pay website will remain active for managing and transferring funds.

This website will also serve as the digital repository for users’ credit and debit cards linked to their Google accounts, ensuring a continuity of service despite the app’s disappearance.

FAQs

What happens to my Google Pay account after the shutdown?

After the Google Pay app shuts down in the US, you will need to use Google Wallet for your mobile payment needs.

Ensure you transfer any funds to your bank account before June 4, 2024, to avoid any inconvenience.

Can I still make peer-to-peer payments with Google Wallet?

Post-transition, Google has not announced any plans to include peer-to-peer payments within Google Wallet.

This functionality will be discontinued with the Google Pay app.

Will I lose my money if I don’t transfer it out of Google Pay before the deadline?

You have until June 4, 2024, to transfer any funds from Google Pay to your bank account. After the app stops working, you can still manage and transfer money via the Google Pay website.

How will I access deals and offers without Google Pay?

Google suggests using Google Search to find deals and offers that were previously available through Google Pay, signaling a shift in how users will discover promotions.

What features will Google Wallet offer after the transition?

Google Wallet will serve as your primary tool for mobile payments, storing credit/debit cards, loyalty cards, passes, tickets, digital car keys, and even government IDs in some jurisdictions.

What the impact of google pay app shutting on users ?

Google Wallet customers will still be able to use tap-to-pay to make contactless purchases at participating merchants.

To guarantee continuous access, customers are recommended to move their credit/debit cards and other payment methods from Google Pay to Google Wallet before the June 4th deadline.

Before the program is discontinued, customers with outstanding balances on Google Pay are also urged to manage and move their money to their bank accounts.

Although funds can still be accessed through the Google Pay website after it closes, users must take action within the allotted time window to prevent any possible inconveniences.

But the removal of the Google Pay app also means that peer-to-peer (P2P) payment services will no longer be available in the US market.

Users who depend on Google Wallet for financial transactions are concerned because Google has not yet disclosed intentions to incorporate P2P capabilities into the app.

The Google Pay app will function normally in nations like Singapore and India where Google Wallet is still not available.

How have users reacted on google pay app shutting ?

Some have welcomed the possibility of a more simplified experience, while others are disappointed that functionality like P2P payments and specific financial management software are gone.

Also Read: Google Pay introduces UPI LITE to help users enjoy the benefits of faster small value transactions

Also Read: Google Pay and NPCI Partner to Take UPI Global, Facilitating Seamless International Transactions