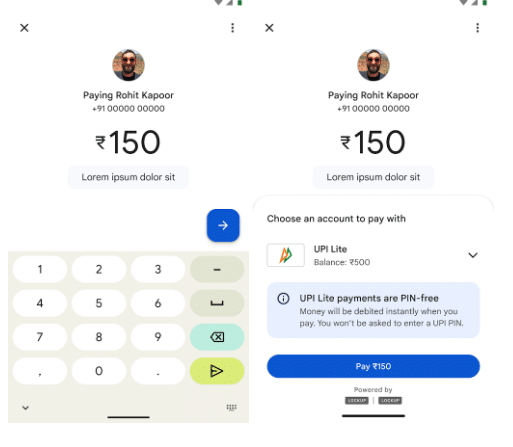

Google Pay on Thursday rolled out UPI LITE on its platform to enable users to make fast and one-click UPI transactions without needing to enter the UPI PIN.

The LITE account is linked to the user’s bank account but does not rely real-time on the issuing bank’s core banking system, the company said in a statement.

The UPI LITE account can be loaded with up to Rs 2,000 twice a day and allows users to do instant UPI transactions up to Rs 200.

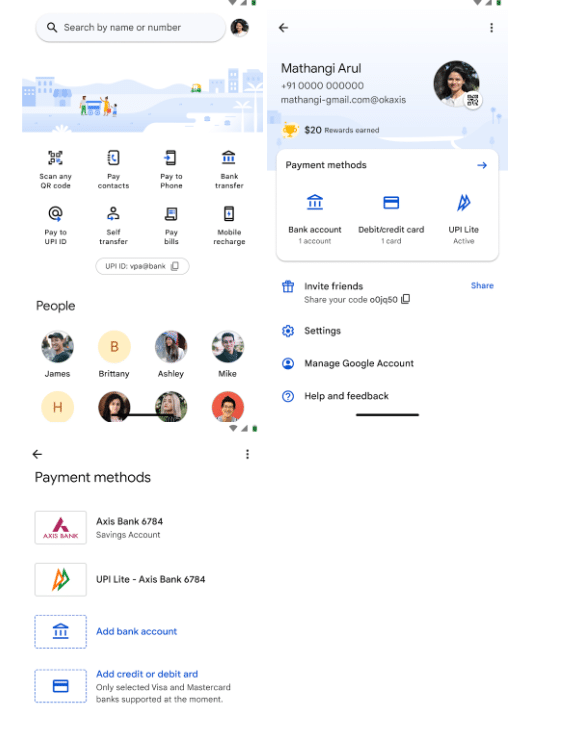

Google Pay app users can go to their profile page and tap on activate UPI LITE.

On completion of the linking process, users will be able to add funds up to Rs 2,000 to their UPI LITE account, with the maximum per day limit being Rs 4,000.

“Subject to UPI Lite balance and for transaction values less than equal to Rs 200, the UPI LITE account will be selected by default,” the company said.

To complete the transaction, users need to tap on “Pay PIN-Free”.

The UPI LITE feature was launched by the Reserve bank of India in September 2022 to ease the UPI transaction process and is enabled by National Payments Corporation of India (NPCI).

Fifteen banks support UPI LITE to date, with more banks to follow in upcoming months.

With an aim to make digital payments simple, fast and reliable, Google Pay has rolled out UPI LITE on its platform.

UPI LITE enables users to make fast and one-click UPI transactions without needing to enter the UPI PIN.

Behind the scenes, the LITE account is linked to the user’s bank account but does not rely realtime on the issuing bank’s core banking system.

Due to this technical innovation by the ecosystem, UPI LITE promises higher success rates even during peak transaction hours.

The UPI LITE account can be loaded with up to INR 2000 twice a day and allows users to do instant UPI transactions up to INR 200.

Using UPI Lite, also results in a less cluttered bank passbook with fewer transaction details.

Speaking about the roll-out, Ambarish Kenghe, VP Product Management from Google, said, “At Google Pay, we feel privileged to partner with the Indian government along with NPCI and RBI, in growing the reach and usefulness of UPI. Unique offerings and use cases are core to driving further adoption of digital payments in the country and with the introduction of UPI LITE on the platform, we aim to simplify small-value transactions by helping users access a convenient, compact and superfast payments experience.”

How to activate this feature on Google Pay

* Google Pay app users can go to their profile page and tap on activate UPI LITE.

* On completion of the linking process, users will be able to add funds up to INR 2000 to their UPI LITE account, with the maximum per day limit being INR 4000.

* Subject to UPI Lite balance and for transaction values less than equal to INR 200, the UPI LITE account will be selected by default.

* To complete the transaction, users need to tap on “Pay PIN-Free”

The UPI LITE feature was launched by the Reserve bank of India in September 2022 to ease the UPI transaction process and is enabled by National Payments Corporation of India (NPCI). As of now 15 banks support UPI LITE with more banks to follow in upcoming months.

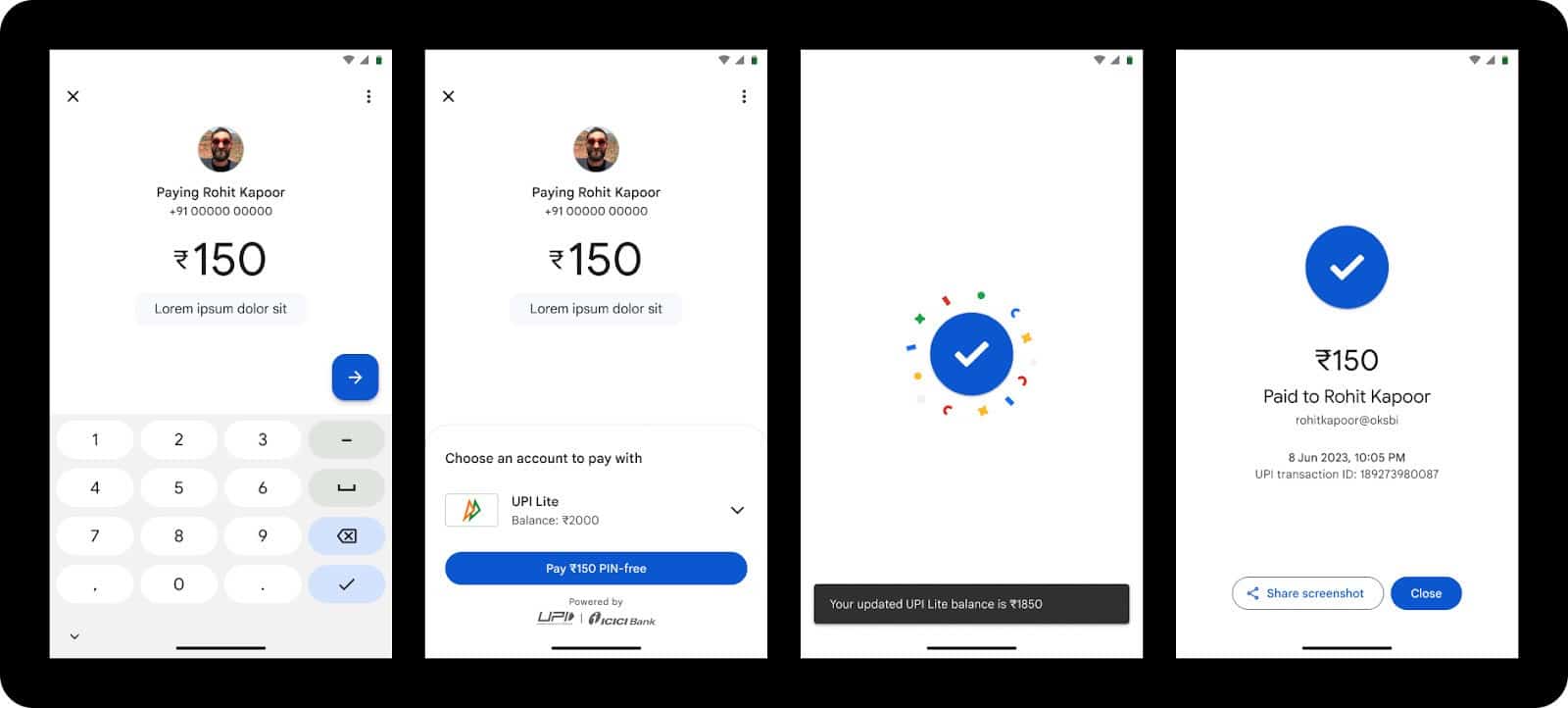

Pay with UPI Lite on Google Pay

UPI Lite is an on-device wallet with the following key features:

* Make payments of up to ₹200 INR without the use of a UPI PIN on the Google Pay app.

* No fees.

* No KYC required.

* Maximum balance is ₹2,000 INR and you can spend up to a total of ₹4,000 INR within 24 hours.

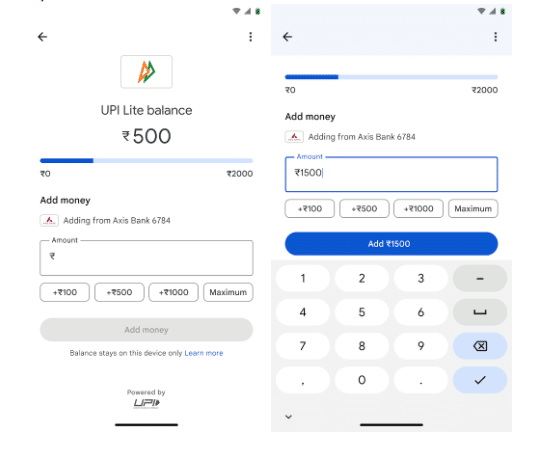

To get started, set up your UPI Lite balance:

1. Choose an eligible bank account that supports UPI Lite to add money from. Find the list of banks that support UPI Lite below.

2. Add up to ₹2,000 INR to your UPI Lite balance.

When you set up your UPI Lite balance, UPI Lite will be the default payment method option for payments of ₹200 INR or less.

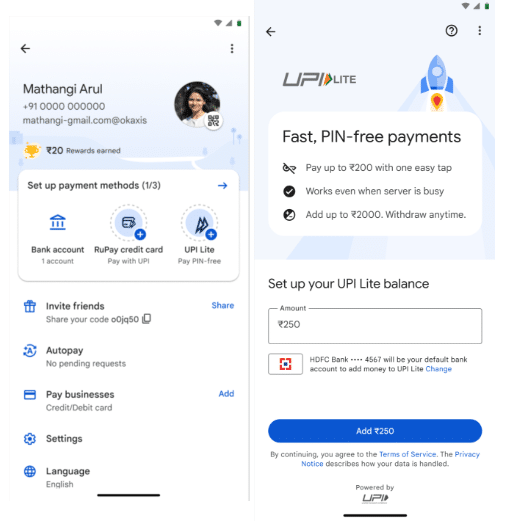

Set up UPI Lite

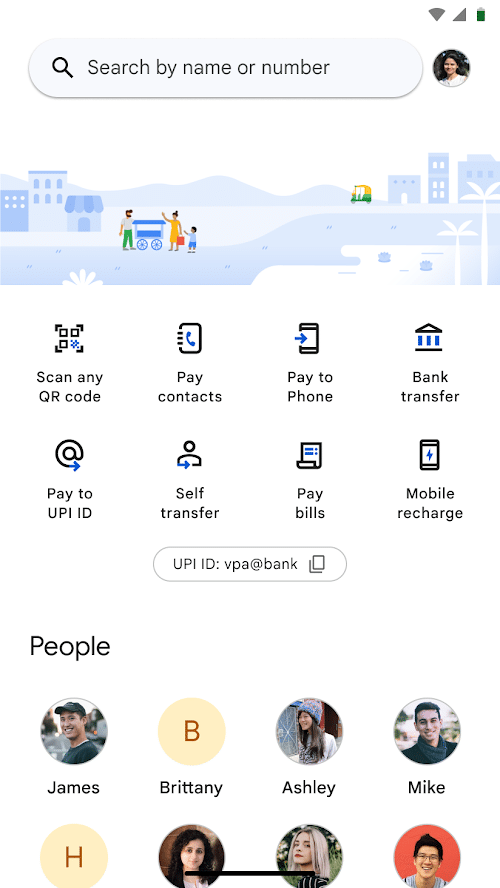

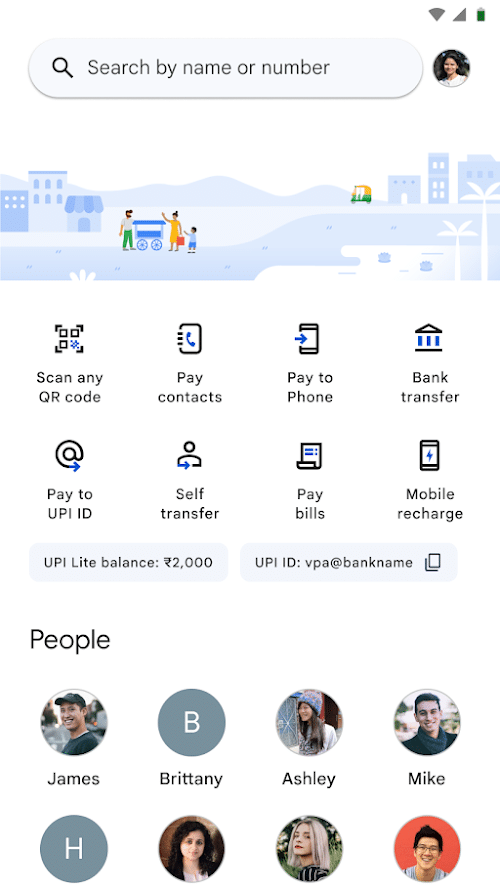

1. Open the Google Pay app

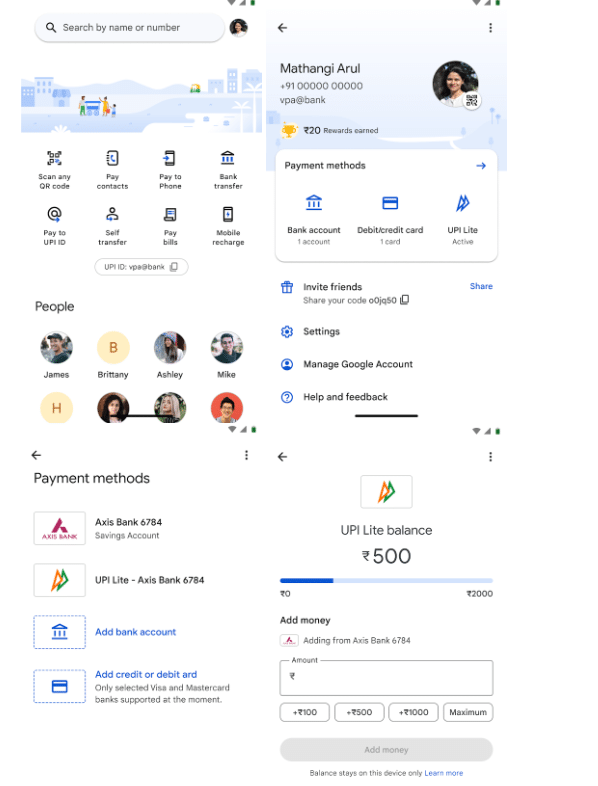

2. At the top right, tap your Profile picture.

3. Tap Pay PIN-free UPI Lite.

4. Enter the amount you want to add.

* You can load up to ₹2,000 INR.

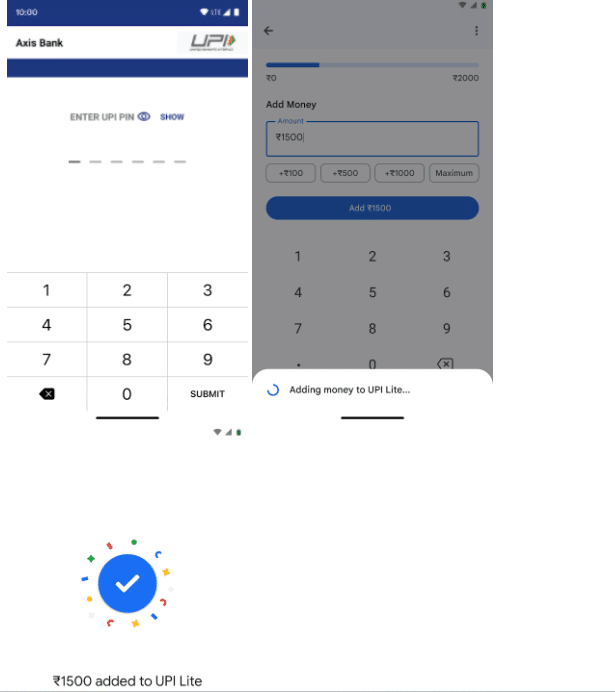

5. Enter your UPI PIN.

Tip: You can only create one UPI Lite account on Google Pay.

Make a payment with UPI Lite

You can make payments of up to ₹200 INR each with UPI Lite.

To pay:

1. Open the Google Pay app

2. Scan the merchant QR code or enter a phone number.

3. Enter the amount to pay.

4. Pay with your UPI Lite account.

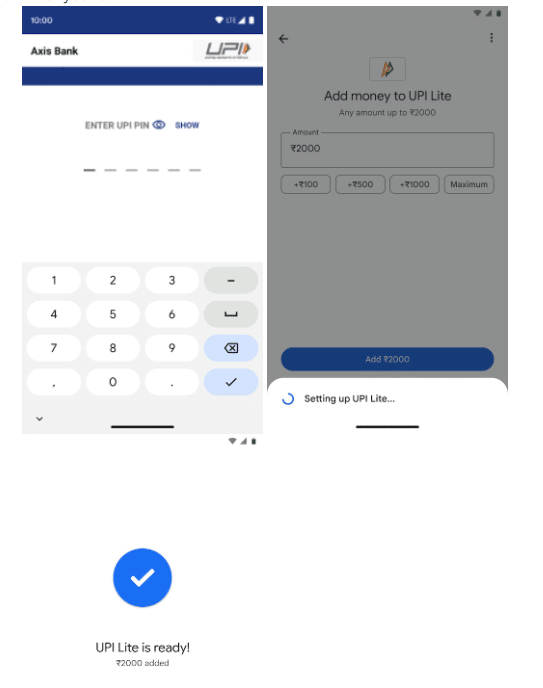

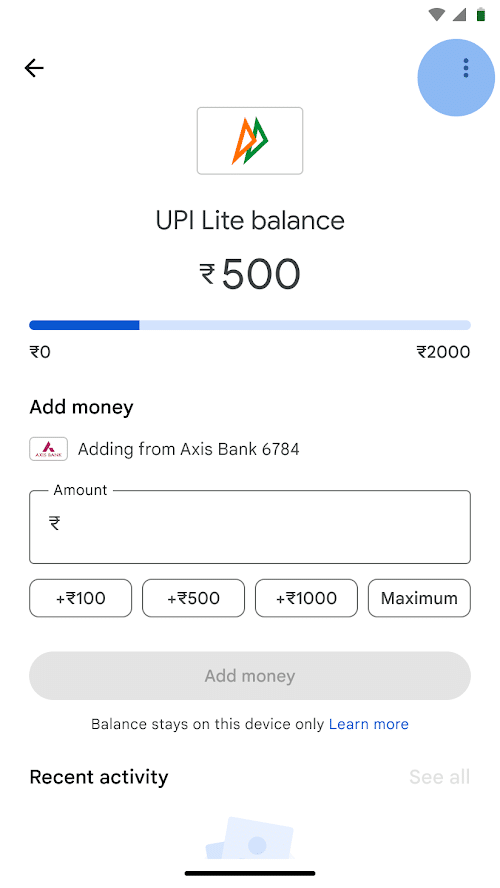

Add money to your UPI Lite Balance

You can add up to ₹2,000 INR to your UPI Lite balance.

1. Open the Google Pay app.

2. At the top right, tap your Profile picture and select your UPI Lite account.

3. Add an amount of up to ₹2,000 INR.

Tip: UPI Lite can have a maximum balance of ₹2,000 INR.

4. To load the amount, enter your UPI PIN.

Check UPI Lite balance

The UPI lite balance will be visible on the home screen.

You can also check your UPI Lite balance by:

1. Open the Google Pay app

2. At the top right, tap your Profile picture.

3. Under ‘Payment methods’, select your UPI Lite account.

4. You can find your UPI Lite balance above the ‘Add money’ section.

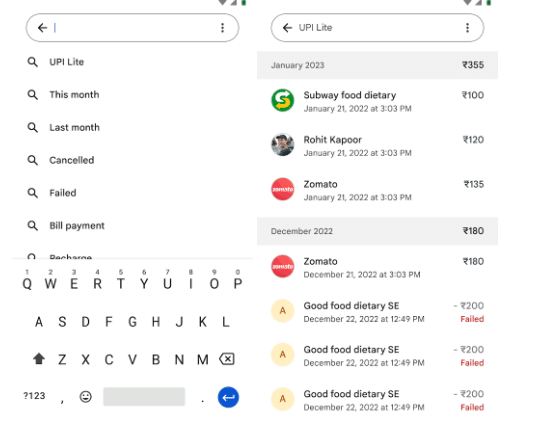

Check Transaction History

You can find your UPI Lite transactions on Google Pay in the transaction history section.

1. Open the Google Pay app

2. At the bottom of the screen, tap Show transaction history.

3. On the search bar, select UPI Lite.

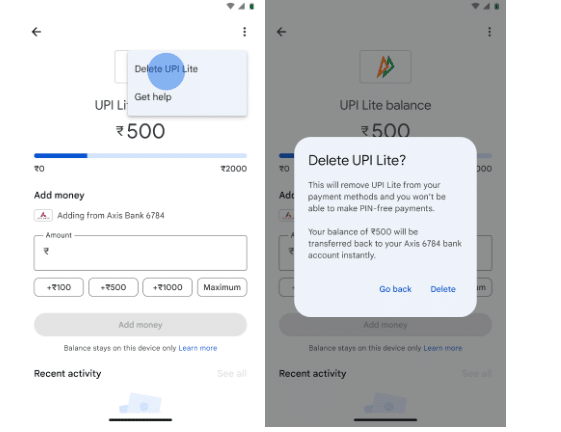

Delete your UPI Lite Account

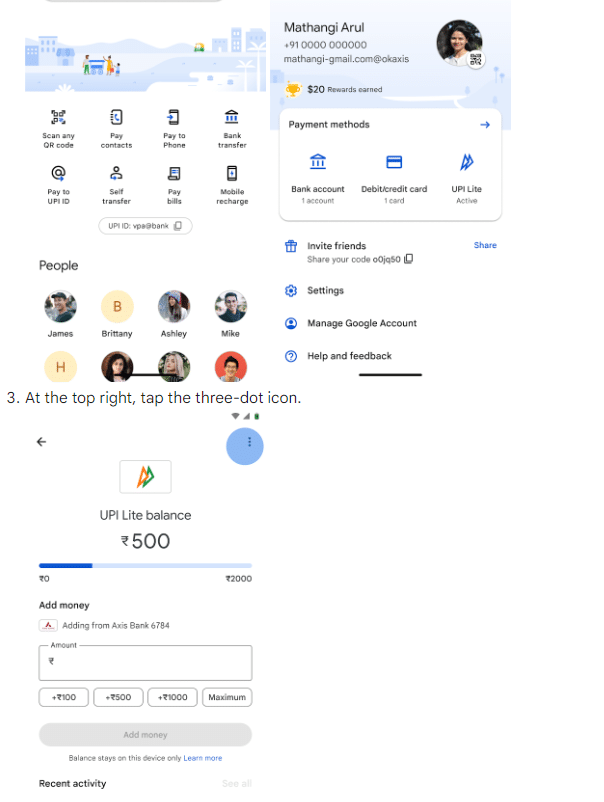

1. Open the Google Pay app

2. At the top right, tap your Profile picture and select your UPI Lite account.

3. At the top right, tap the three-dot icon.

4. Tap Delete UPI Lite.

5. To confirm, tap Delete.

Tip: When you deregister your account, the money is credited back to your bank account.

Faqs

1) How to use UPI Lite and send money without PIN on Gpay, Paytm and PhonePe?

Ans) The Reserve Bank of India (RBI) introduced a new payment system called UPI Lite in September 2022. It is a simplified version of the original UPI payment system, which allows users to initiate small-value transactions every day without facing payment failure issues in case of problems in bank processing and more.

UPI Lite is a simplified version of UPI that is designed for low-value transactions. Unlike regular UPI transactions, which have a daily limit of Rs 1 lakh, UPI Lite transactions are limited to Rs 200 per transaction. To use UPI Lite, users must first add money to their UPI Lite account through their linked bank account. Once the account is set up, users can add up to Rs 2,000 to their UPI Lite account twice a day, for a total daily limit of Rs 4,000.

UPI Lite is a good option for people who want to make small, frequent payments. It is also a convenient and flexible payment method, as Lite users have the option to close their account at any time or transfer funds from their Lite account to their bank account with a single click, and without incurring any fees.

Let’s take a look at how to set up UPI Lite on popular payment gateways including Google Pay, PhonePe and Paytm.

2) How to use UPI Lite on GPay?

Ans) * Open the Google Pay app.

* Tap on your profile picture at the top right corner.

* Tap on Pay Pin Free UPI Lite.

* Follow the on-screen instructions to add money to your UPI Lite balance. You can add up to ?2,000 INR.

* To add money, choose an eligible bank account that supports UPI Lite.

* Add money

* Once you have added money to your UPI Lite balance, you can make payments of up to Rs 200 INR without entering your UPI PIN.

* To make a payment, simply select the UPI Lite option when you are prompted to enter your UPI PIN. Your payment will be deducted from your UPI Lite balance.

3) How to use UPI Lite on PhonePe?

Ans) * Open the PhonePe app.

* Tap UPI Lite on your PhonePe app home screen. You can also, tap your profile picture and tap UPI Lite under the Payment Methods section.

* Tap on UPI Lite.

* Follow the on-screen instructions to add money to your UPI Lite balance. You can add up to Rs 2,000 INR.

* Once you have added money to your UPI Lite balance, you can make payments of up to Rs200 INR without entering your UPI PIN.

4) How to use UPI Lite on Paytm

Ans) * Open the Paytm app

* On the Home page find and click on ‘Introducing UPI Lite’.

* Select a linked bank account that is supported by Paytm UPI Lite.

* Add money to UPI lite.

* Once the money has been added you can pay to the recipient by scanning QR code or to a mobile number linked with UPI ID.

5) How is UPI Lite different from UPI payments?

Ans) With UPI Lite, you can make payments of up to ₹200 INR without the use of a UPI PIN on the Google Pay app. Money is deducted from your UPI Lite balance.

6) What are the benefits of UPI Lite?

Ans) * Make payments without a UPI PIN: You don’t need a UPI PIN when you make a UPI Lite payment of ₹200 INR or less.

* Cleaner bank statements: You can find all your UPI Lite transactions on Google Pay instead of your bank statements. Only your initial load, top up and unload transactions show up on your bank statement.

* No KYC: You don’t need to have an additional KYC to set up a UPI Lite account.

* Pay anywhere: Scan and pay at shops or pay people on Google Pay with UPI Lite for amounts up to ₹200.

Tip: You can’t use UPI Lite for some payments like:

* Payment collect requests

* Autopay

* UPI International payments

7) Which banks support UPI Lite payments?

Ans) List of banks:

* AU Small Finance Bank

* Axis

* Bank of India

* ICICI

* Indian

* Kotak

* SBI

* South Indian Bank

* Union

8) What’s the maximum value of payments I can make?

Ans) * You can pay up to ₹200 INR per transaction and have multiple transactions up to a total of ₹4,000 INR within 24 hours.

* Your balance can hold up to ₹2,000 INR.

9) Does my balance remain if my device or mobile number changes?

Ans) No, your balance won’t be available if you change your device or mobile number.

To claim your balance, use the same device and mobile number (used when you registered to UPI Lite) to deregister the UPI Lite account. Deregistration transfers your balance back to the bank account that you used to add the money to the UPI Lite account. If you can’t access the same device or mobile number, contact your bank’s customer support team.