Highlights

- RBI’s decision to stop Paytm Payments Bank’s wallet operations after 29 February 2024, has sparked fears of Paytm shutting down.

- There are many alternative payment banks currently functioning in India that you can use instead.

The digital payment landscape in India is currently going through multiple ups and downs.

While our UPI system is internationally appreciated with many countries across the globe working to replicate similar systems, the payment banks are facing compliance issues internally.

The recent RBI action against Paytm Payments Bank has set off a barrage of speculations in the industry with many claims and disclaims surfacing online every day.

Paytm has been instrumental in promoting and expanding India’s digital payment systems to the country’s remotest corners.

However, RBI orders will have ripple effects in the form of user migrations to other platforms.

So, if Paytm payment bank is to shut shop, what are the best alternatives to use instead?

Before we get to that, let’s understand more about why people are planning to switch.

Why Paytm Alternatives Are in Demand?

The Reserve Bank of India (RBI) on January 31 directed Paytm Payments Bank Ltd (PPBL) to stop accepting deposits or top-ups in any customer accounts, wallets, FASTTags, and other instruments after February 29.

This sparked fears about whether Paytm’s QR codes will also be affected.

As per recent media reports, more than 42 per cent of local grocery stores have already switched from Paytm to Mobikwik, Bharatpe, Phonepe and GooglePay, with 20 per cent more planning to do so.

Kirana Club Founder & CEO Anshul Gupta said, “While the ban imposed by the regulatory authority might lead to disruption at Kirana stores, they are not much worried because there are alternate payment options available. Our recent survey also indicates that Kiranas across states have already started using or plan to use other payment apps to ensure smooth business operations.”

Best Alternatives to Paytm Payment Bank

Mobikwik

Mobikwik is a popular digital wallet and payment platform that offers a range of financial services, including digital payments, bill payments, recharges, and money transfers.

Users can link their bank accounts, debit/credit cards, and UPI accounts to the Mobikwik wallet to make seamless transactions.

With its user-friendly interface and wide acceptance across merchants, Mobikwik is a convenient alternative for users seeking digital payment solutions.

Airtel Payments Bank

Airtel Payments Bank is one of the leading alternatives to Paytm Payments Bank.

It offers a range of banking services, including savings accounts, money transfers, and bill payments.

With its widespread network and seamless integration with Airtel’s telecom services, Airtel Payments Bank provides convenient banking solutions to users across India.

PhonePe

PhonePe, owned by Flipkart, is another popular digital payment platform that offers banking services.

Users can open a savings account with PhonePe and enjoy features such as instant money transfers, bill payments, and UPI transactions.

With its user-friendly interface and robust security measures, PhonePe has gained traction among Indian consumers.

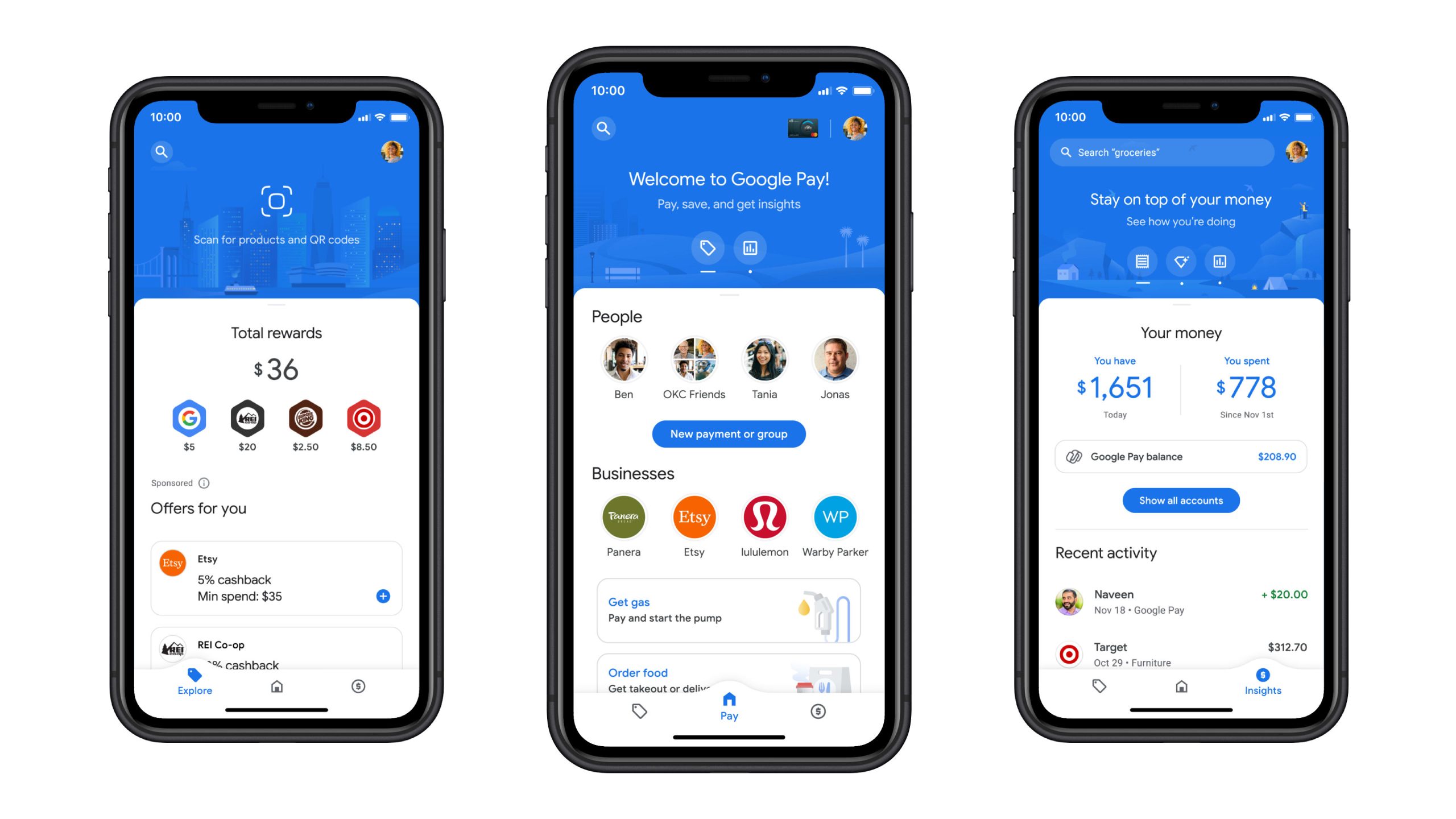

Google Pay

Google Pay is a widely used digital payment platform that also offers banking services through partnerships with various banks.

Users can link their bank accounts to Google Pay and access features such as money transfers, bill payments, and online purchases.

With its seamless integration with Google services and intuitive interface, Google Pay is a convenient alternative to traditional banking.

Amazon Pay

Amazon Pay is another alternative that provides users with a range of banking and payment services.

Users can add funds to their Amazon Pay wallet and use it for online purchases, bill payments, and recharges.

Additionally, Amazon Pay offers cashback rewards and discounts, making it an attractive option for frequent Amazon shoppers.

BharatPe

BharatPe is a fintech company that provides digital payment solutions specifically tailored for merchants and small businesses.

It offers a range of services, including QR code-based payments, instant settlements, loans, and business management tools.

FAQs

Q1. How to transfer waller money from Paytm to other payment banks?

Answer. Follow these simple steps to transfer your money from Paytm to your bank account:

- Open the Paytm app & Tap on ‘Passbook’

- Select ‘Paytm Wallet’

- Select ‘Send Money To Bank’

- Tap ‘Transfer’

- Enter the amount & bank details

- Confirm the transfer

- Once complete, money will be transferred successfully

Q2. Will Paytm QR codes work in future?

Answer. Yes, Paytm QR codes will continue to function as usual, allowing merchants to accept payments beyond February 29, 2024.

Payment devices such as Paytm Soundbox and card machines will also continue to remain operational as always.

Q3. Why did RBI ban Paytm payments?

Answer. The Reserve Bank of India (RBI) on January 31 directed Paytm Payments Bank Ltd (PPBL) to stop accepting deposits or top-ups in any customer accounts, wallets, FASTTags, and other instruments after February 29.

RBI Governor Shaktikanta Das ruled out any review of the central bank’s action against PPBL, saying that its decisions are well thought out.

RBI, he said, is not against any fintech but its prime objective is to protect the interest of customers and depositors.

Q4. Is it advisable for traders to switch to other payment apps from Paytm?

Answer. Yes, Traders’ body CAIT on February 4 issued a cautionary advisory to traders to switch from Paytm to other payment options for business-related transactions following RBI curbs on Paytm wallet and bank operations.

“The Reserve Bank of India has imposed certain restrictions, prompting CAIT to recommend that users take proactive measures to protect their funds and ensure uninterrupted financial transactions. A large number of small traders, vendors, hawkers and women are making payments through Paytm and as such RBI restrictions on Paytm could lead to financial disruption to these people,” the Confederation of All India Traders (CAIT) stated.

Q5. Is Paytm Payments Bank shutting down?

Answer. There is no confirmation about Paytm Payments Bank shutting down.

However, after February 29, 2024, Paytm Payments Bank will not be able to collect deposits, conduct credit transactions, or top up any customer accounts, prepaid cards, wallets, FASTags, NCMC (National Common Mobility Cards), or any other type of customer account.

Also Read: 5 Things to Keep in Mind While Using UPI Apps Paytm, PhonePe or GooglePe

Also Read: Top 10 Paytm UPI Alternative Apps in India for Secure Transactions