HIGHLIGHTS

* PhonePe can be used to pay self-assessment and advance tax.

* PhonePe supports UPI and credit cards for income tax payments.

* The new PhonePe tax payment feature is available for both individuals and businesses.

* Enables users to pay self-assessment and advance tax directly from the PhonePe app.

* Users can pay using UPI or credit cards.

PhonePe, today announced the launch of the ‘Income Tax Payment’ feature on its app. The feature allows taxpayers, both individuals and businesses to pay self-assessment and advance tax directly from within the PhonePe app.

This eliminates the need to log in to the tax portal, creating a seamless and efficient experience for taxpayers.

PhonePe has partnered with PayMate, a leading digital B2B payments and service provider to enable this feature. Users can choose to pay their taxes using their credit card or UPI.

With credit card payments, users also get a 45-day interest-free period and earn reward points on their tax payments, depending on their bank.

Once the payment has been made, taxpayers will receive a Unique Transaction Reference (UTR) number as an acknowledgement within one working day.

The challan for the tax payment will be available within two working days.

PhonePe is one of the biggest payment apps in India with support for UPI, recharges, bill payments, insurance, and more.

The company has now announced a new feature aimed at the country’s taxpaying citizens.

It has added native support for income tax payments with the goal of providing a seamless and efficient payment experience. Here is what you need to know.

Commenting on the announcement, Niharika Saigal, Head of Bill Payments and Recharge Business at PhonePe said, “At PhonePe, we are committed to continuously enhancing our offerings to meet the evolving needs of our users. We are thrilled to announce the launch of our latest feature, the convenience of paying income taxes on the PhonePe app itself.

Paying taxes can often be a complex and time-consuming task, and PhonePe is now offering its users a hassle-free and secure way to fulfill their tax obligations. We believe that this will transform the way our users pay taxes as we have now made the process both simple and easy.”

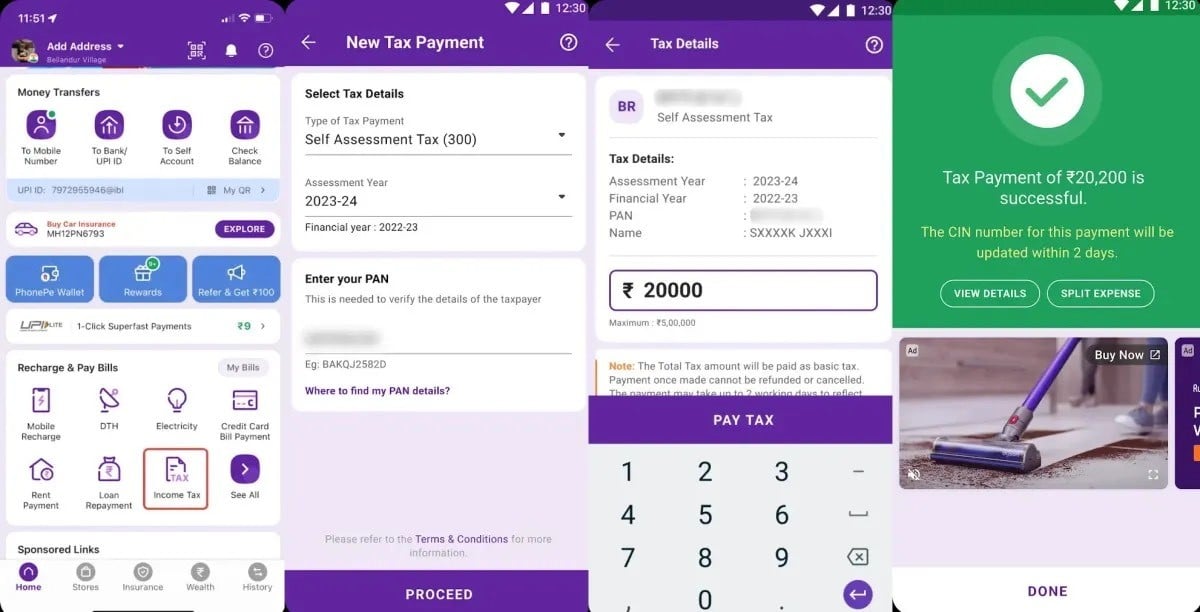

Here’s how users can pay their taxes in just 3 simple steps on the PhonePe app

- Step 1: Open the PhonePe app homepage and tap on the ‘Income tax’ icon.

- Step 2: Select the Type of Tax you would like to pay, the assessment year, and PAN Card details.

- Step 3: Enter the total tax amount and pay using the preferred mode of payment.

- Step 4: Post successful payment, the amount will be credited to the tax portal within 2 working days.

PhonePe says users will receive a Unique Transaction Reference (UTR) number within one day of the successful tax payment. It will take up to two working days for the tax payment challan number to arrive.

It is important to note that the new PhonePe feature is only meant for income tax payments. You cannot file income tax returns (ITR) through PhonePe which you can do through the Income Tax Department website.

The last date for filing your ITR for the financial year 2022-2023 is July 31, 2023.

Faqs

1) What is PhonePe Income Tax Payment Feature?

Ans) PhonePe has introduced a new income tax payment feature within its app on Android and iOS. It gives taxpayers one more method using which they can pay income tax in a timely manner and with improved user experience.

The app’s new feature is powered by PayMate, a leading digital B2B payments and service provider, and is available for both individuals and businesses. It can be used to pay self-assessment and advance tax with just a few taps. There is support for UPI and credit cards for income tax payments. PhonePe says credit card users will get a 45-day interest-free period and earn reward points on payments depending on their bank.

2) How to Pay Income Tax Using PhonePe?

Ans) 1. Launch the PhonePe app and look for the Income Tax option under Recharge & Pay Bills section.

2. Choose your tax payment type, Self-assessment or Advance Tax, and assessment year.

3. Enter your 10-digit PAN card number for verification.

4. Enter your tax amount and proceed to the payment page.

5. Choose your preferred mode of payment: UPI or credit card.

6. Wait for the payment successful message on the app.