Highlights

- India’s smartphone market grows by 1%, shipping 146 million units in 2023.

- ASP reaches record $255, marking the third year of double-digit growth.

- Online channel share drops to 49%, while offline sales grow by 8%.

- 5G smartphones gain a 55% market share, with nearly a million foldable phones shipped.

In a year marked by cautious optimism, India’s smartphone market witnessed a modest year-over-year growth of 1%, shipping a total of 146 million units in 2023.

This figure comes amidst an unprecedented average selling price (ASP) surge, according to the International Data Corporation’s (IDC) Worldwide Quarterly Mobile Phone Tracker.

“The road to recovery for smartphones in 2024 looks strained and elongated, as worries around income, inflationary stress, price increases, and inventories remain. 2023 was all about affordable 5G devices, timely price corrections, and offline channel expansion by brands, whereas 2024 and beyond requires greater efforts, especially at entry-level price points, to fuel organic growth,” said Navkendar Singh, AVP, Client Devices Research, IDC India. “IDC estimates a flat to low single digit annual growth in 2024, primarily led by upgraders in ($200<$400) segment, backed by financing schemes, extended warranties and upgrade programs.”

“Most brands chose to reduce prices and offer additional channel margins in the last quarter to manage the inventory levels from post festive cyclic dip. This will give a lukewarm start to 2024 with cautious stocking by the channels,” said Upasana Joshi, Research Manager, Client Devices, IDC India.

“IDC estimates a flat to low single digit annual growth in 2024, primarily led by upgraders in (US$200<US$400) segment, backed by financing schemes, extended warranties and upgrade programs,” ends Singh.

A Year of Contrasts

The journey through 2023 was a tale of two halves for the Indian smartphone market.

The initial months saw a 10% decline in shipments, a slump offset by an 11% growth in the latter half of the year.

Remarkably, the final quarter alone boasted a 26% growth, with 37 million units shipped, thanks to a flurry of new model launches that exceeded expectations.

Pricing Dynamics

A significant highlight of the year was the ASP reaching a new high of US$255, marking a 14% increase from the previous year.

This escalation, driven by the growing prominence of premium-segment smartphones and a surge in 5G adoption, represents the third consecutive year of double-digit ASP growth, posing challenges to market recovery.

Online vs Offline: The Channel Shift

The distribution channels saw a notable shift in 2023. Online sales dipped by 6%, reducing its market share to 49%, while offline channels experienced an 8% growth, buoyed by enhanced retail presence and strategic expansion into smaller towns and cities.

Segment-Wise Performance

The entry-level segment (<US$100) saw a 12% growth, with Xiaomi leading the charge. However, the mass budget segment (US$100-US$200) witnessed a decline, dropping to 44% market share.

The entry-premium (US$200-US$400) segment held steady, while the mid-premium (US$400-US$600) and premium (US$600-US$800) segments enjoyed growth, led by flagship models from OnePlus, Samsung, and Apple.

5G and Foldables: The New Frontier

5G smartphones carved out a 55% share of the market, with 79 million units shipped in 2023.

The mass budget segment of 5G smartphones saw significant growth, while the entry-premium segment remained dominant.

Foldable phones also made their mark, with nearly a million units shipped, spearheaded by Samsung despite increased competition.

The Chipset Battle

In the chipset arena, MediaTek claimed a 50% share, marking a 6% growth, whereas Qualcomm experienced a decline.

Unisoc has not been mentioned in the list but you would imagine it will also occupy a significant market share given the flurry of budget phones that are packing the SoC.

Key Highlights for 2023

– Shipments to online channels dropped by 6% and its share dropped to 49% in 2023, down from 53% in 2022. Offline channel shipments grew by 8% YoY as vendors strengthened their retail presence with lucrative premium offerings as well as an expansion into smaller towns and cities.

Price segment details

- The entry level (sub-US$100) segment grew by 12% YoY to 20% share, up from 18% a year ago. While Xiaomi continued to lead, POCO (2nd) and Samsung (3rd) emerged in the top brand list.

- Shipments to the mass budget (US$100<US$200) segment declined, with its share dropping to 44% from 51%, declining by 12% YoY. vivo, Realme and Samsung together accounted for 53% of shipments.

- The entry-premium (US$200<US$400) segment remained flat, with 21% share. vivo and OnePlus had significant share, making up almost 40% of overall shipments in this price segment.

- The mid-premium segment (US$400<US$600) reached a share of 5%, growing by 27% YoY. OnePlus continued to lead with 35% share, followed by Samsung and vivo.

The premium segment (US$600<US$800) reached 3% share, growing by 23%, led by the iPhone 13, Galaxy S23/S23 FE and OnePlus 11. While Apple’s share declined, Samsung’s share more than doubled in this segment. - The super-premium segment (US$800+) registered the highest growth of 86%, with its share up from 4% to 7%. The iPhone14/13/14 Plus together accounted for 54% of shipments, followed by the Galaxy S23+/S23/S22+/S23 Ultra with 22% share. Overall, Apple led the segment with a share of 68%, followed by Samsung at 30%.

- 79 million 5G smartphones shipped in 2023, with a plethora of launches in the mass budget segment. 5G ASPs dropped to US$374, a decline of 5% YoY in 2023. Within 5G shipments, the mass budget (US$100<US200) segment share increased to 35% from 22% a year ago, while the entry-premium (US$200<US$400) segment continued to dominate with 38% share, albeit down from 49% in 2022. Apple’s iPhone 13 & 14, Samsung’s Galaxy A14, vivo’s T2x and Xiaomi’s Redmi12 were the highest shipped 5G models in 2023.

- Almost a million shipments of foldable phones shipped, with ASPs declining by 4% at US$1,236. Samsung led the foldable phone market, although its share dropped to 73% in 2023 as other players such as Motorola, Tecno, OnePlus and OPPO have entered India’s foldable market.

- The share of MediaTek-based smartphones increased to 50%, growing by 6% YoY. vivo’s T2x, Xiaomi’s Redmi A2, and Realme’s C55 were the highest shipped MediaTek-based models. Qualcomm’s share dropped to 25%, a shipment decline of 6% YoY.

Brand performance - Apple had a stellar year, finishing at 9 million units, despite having the highest ASP of US$940. This was led by previous generation iPhone models and its push for local manufacturing. Its iPhone 13/14 were amongst the Top 5 shipped models annually.

As a brand, Samsung remained in the leadership position, with a record high ASP of US$338, although with a 5% shipment decline YoY. Its Galaxy A14 was the highest shipped device of 2023. - vivo (excluding iQOO) climbed to the second slot as shipments and ASPs both grew by 8% and 9% respectively. It was the only brand to register growth amongst the top five brands.

Realme, despite facing challenges in the beginning of the year, maintained its third position, led by affordable launches. - After declining for four consecutive years, 61 million feature phones shipped, growing by 8% YoY. While Samsung exited the feature phone segment, Transsion continued to lead, followed by Lava. The entry of Reliance Jio’s new 4G feature phone fueled growth in 2H23.

FAQs

What was the growth rate of India’s smartphone market in 2023?

India’s smartphone market experienced a nominal growth of 1% year-over-year, with a total of 146 million units shipped in 2023.

How did the average selling price (ASP) change in 2023?

The ASP of smartphones in India hit a record high of $255 in 2023, reflecting a 14% increase from the previous year and marking the third consecutive year of double-digit growth.

What trends were observed in online vs. offline sales channels in 2023?

In 2023, online sales of smartphones in India declined by 6%, reducing its market share to 49%. Conversely, offline channel shipments grew by 8%, as vendors expanded their retail presence.

How did 5G smartphones perform in the Indian market in 2023?

5G smartphones accounted for a 55% share of the Indian market in 2023, with 79 million units shipped. This segment saw significant growth, particularly in the mass budget category.

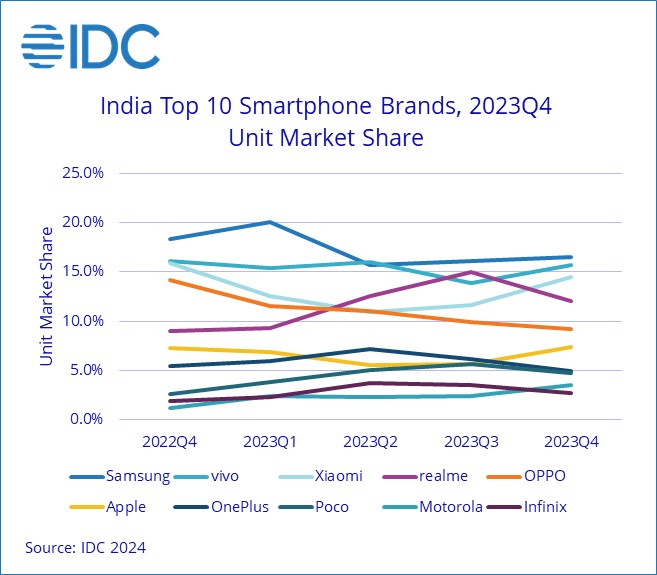

What has been Market share of smartphone brands in 2023 ?

The smartphone brand with the highest unit market share is Samsung which currently holds a share of 17 percent.

While this number is a decline from 2022, it still managed to outpace the likes of Vivo, Realme, and Xiaomi which also operate in similar price segments as Samsung.

Vivo witnessed an increase in its market share from 14.1 percent in 2022 to 15.2 percent in 2023 resulting in a positive 8.2 percent year-over-year change.

Realme and Xiaomi take up the third and fourth spot respectively in the smartphone market share with both on a decline in terms of year-over-year change.

Coming in fifth place is OPPO which had a total market share of 10.3 percent in 2023, which again is a decline from 2022.

Perceived as premium brands by the general public, Apple and OnePlus saw a growth of 38.6 percent and 48.7 percent respectively on a year-over-year basis and took up the sixth and seventh positions in the phone market share.

Brands such as POCO, Infinix, and Tecno which tend to offer impressive specifications on their smartphones at aggressive prices are the ones that exhibited the most growth in terms of market share.

What are the Key trends in the smartphone space in 2023 ?

A total of 79 million 5G smartphones were shipped for the budget segment alone in 2023. However, the average selling price of a 5G smartphone decreased to $374 (approx. Rs 31,000) towards the end of last year.

Some of the most shipped 5G smartphones in 2023 include Apple iPhone 13, iPhone 14, Samsung Galaxy A14 5G, Vivo T2x, and Redmi 12 5G.

Close to about 1 million foldable smartphones were shipped in 2023 which also saw Samsung losing some market share in the foldable space to new entrants like Motorola, Tecno, OnePlus, and OPPO.

MediaTek-powered smartphones witnessed a year-on-year increase of six percent taking up the total share in the smartphone market to 50 percent. Vivo T2x, Redmi A2, and Realme C55 were the highest-shipped MediaTek-based models in 2023. On the other hand, Qualcomm’s share declined to 25 percent.

What are the Key insights of Indian smartphone market in 2023 across price segments ?

Entry-level $100 (approx Rs 8,300) – The smartphone market under Rs 8,300 in India saw an increase of 12 percent year-over-year and now contributes 20 percent share in the market. Xiaomi led this segment closely followed by POCO and Samsung.

Mass budget $100 to $200 (approx Rs 8,300 to Rs 16,600) – This particular smartphone price segment declined from 51 percent to 44 percent market share towards the end of 2023. Major contributors to this segment include Vivo, Realme, and Samsung.

Entry-premium $200 to $400 (approx. Rs 16,600 to Rs 33,000) – The entry-premium smartphone category didn’t witness any significant growth or losses and remained at 21 percent market share. Vivo and OnePlus were the winners in the segment.

Mid-premium $400 to $600 (approx. Rs 33,000 to Rs 50,000) – Coming to the mid-premium smartphone segment, with an impressive year-on-year growth of 27 percent, this category had a total share of 5 percent in the smartphone space. OnePlus largely maintained the lead with a 35 percent share with Vivo and Samsung being right behind.

Premium $600 to $800 (approx. Rs 50,000 to Rs 66,000) – Next up is the premium segment in which handsets like Apple iPhone 13, Samsung Galaxy S23/S23 FE, and OnePlus 11 remained consumer favourites. This segment’s contribution to the total smartphone market share increased to 3 percent where Samsung doubled its numbers while Apple saw a decline in its market share.

Super-premium $800 (Rs 66,000) and above – The ultra-premium smartphone space was spearheaded by the likes of Apple and Samsung. This segment recorded the highest growth of 86 percent with its share increasing from four percent to seven percent.

How did the Indian smartphone market perform in the third quarter of 2023?

The Indian smartphone market demonstrated consistent year-on-year growth during the third quarter of 2023, with a total of 44 million units shipped. Samsung maintained its position as the market leader despite a slight dip in market share compared to the previous year.

What trends were observed in the 5G smartphone segment in India?

The 5G segment within the Indian smartphone market experienced robust growth, with 5G device shipments reaching a 58% share of the total market. This growth was facilitated by the launch of budget-friendly 5G models and various discounting strategies.

Which smartphone brands are leading in India’s premium market segment?

In India’s premium smartphone segment, significant growth was led by high-end models such as the Apple iPhone 13 and the Samsung Galaxy S23 series. The segment itself grew by 52%, indicating a healthy consumer interest in premium devices.

Has there been a change in the average selling price (ASP) of smartphones in India?

Yes, there has been an increase in the ASP of smartphones in the Indian market, with a rise to approximately Rs 21,000 (US$253). This represents a 12% year-on-year growth and a 5% increase from the previous quarter.

What makes the mid-range smartphone segment so popular in India?

The mid-range smartphone segment, typically priced between Rs 20,000 and Rs 30,000, has gained immense popularity in India due to its balance of high-end features and affordability.

Phones like the iQOO Neo 7 and Vivo V27 offer advanced capabilities, such as high-quality displays and powerful cameras, without the steep price tag of flagship models.

Which smartphones are currently leading in this price range?

In 2023, smartphones like the iQOO Neo 7, Vivo V27, Motorola Edge 40, and POCO F5 are among the top contenders in the mid-range market.

These phones have attracted consumers with their impressive specifications, such as AMOLED displays, high refresh rates, and substantial battery life.

What are the key features consumers look for in mid-range smartphones?

Consumers in the mid-range smartphone market typically seek features that were once exclusive to high-end models.

This includes AMOLED displays with high refresh rates, large battery capacities with fast charging, high-resolution multi-camera setups, and powerful processors for smooth performance.

How has the mid-range smartphone market evolved in 2023?

The mid-range smartphone market in 2023 has seen significant advancements, with manufacturers focusing on delivering premium features at more accessible price points.

This includes better screen technology, enhanced camera capabilities, and more efficient processors, catering to the growing demand for high-quality yet affordable smartphones.

Also Read: Top 10 Most Popular Smartphones Between Rs 20,000 – Rs 30,000 Dominating the Indian Market in 2023

Also Read: Indian Smartphone Market in Q3 Powered by 5G Growth, Samsung Leading the Charge