Highlights

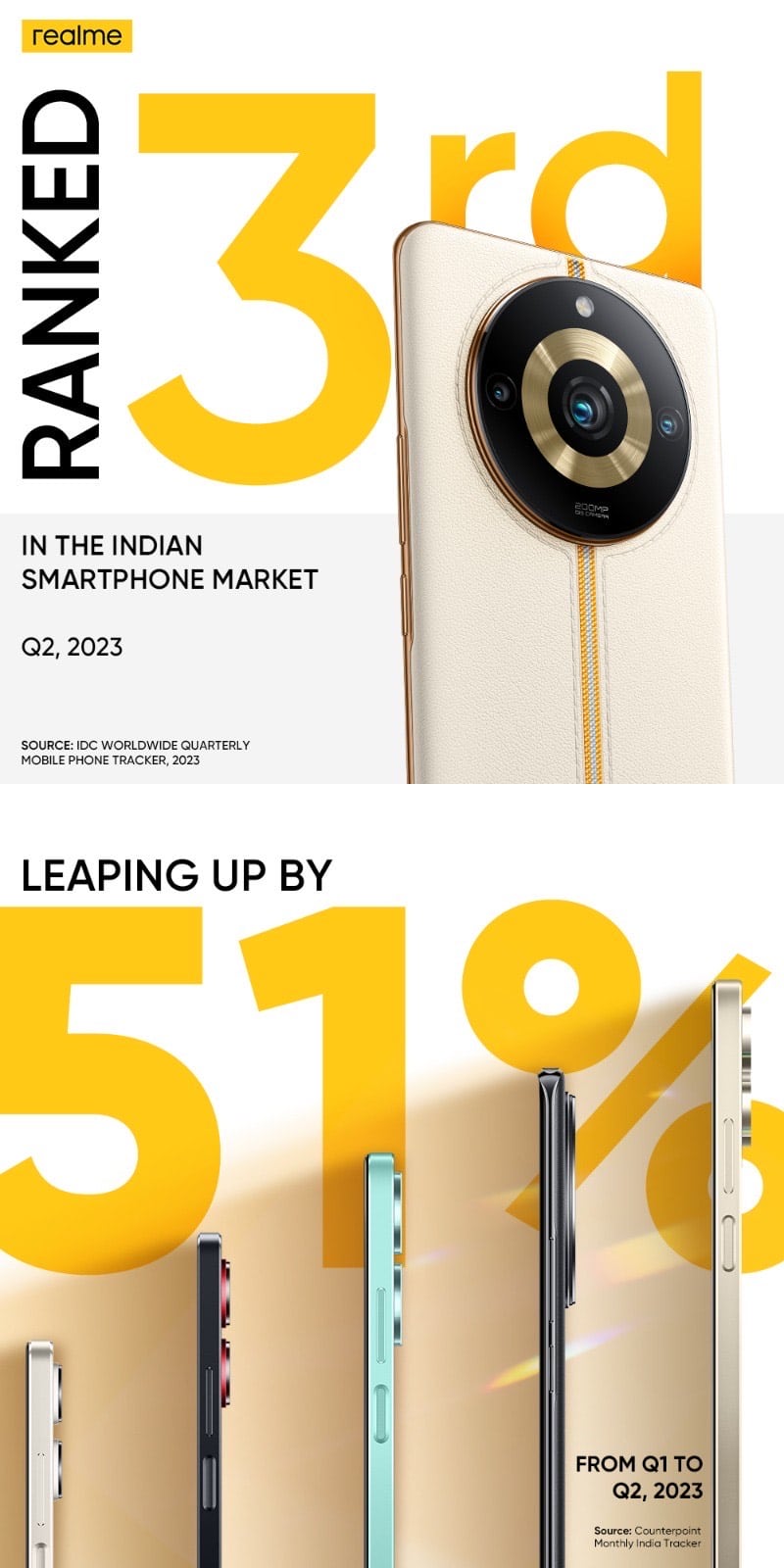

•Realme, has achieved a staggering QoQ growth of 51% in the second quarter of 2023.

•Realme’s position in the Indian smartphone market, is secured for the No. 3 position among the top 10 smartphone brands.

Realme, the Most Reliable Smartphone Service Provider, has achieved a staggering QoQ growth of 51% in the second quarter of 2023, as reported by Counterpoint, a renowned market research firm.

This remarkable growth strengthens realme’s position in the Indian smartphone market, securing the No. 3 position among the top 10 smartphone brands as per IDC’s rankings for Q2 2023.

Despite the overall smartphone market in India witnessing a 3% YoY decline in Q2, realme’s strategic positioning and leap-forward innovations, coupled with the industry’s focus on 5G devices in the INR 10,000-INR 15,000 (~$122-$244) segment, propelled the brand back to its coveted 3rd position in the Indian smartphone market.

realme’s exceptional growth can be attributed to a combination of factors, including the brand’s strategic approach in improving inventory and demand, aggressive sales promotions, and the launch of 5G devices at accessible price points.

This year, realme has achieved numerous milestones across a range of devices, with several emerging as bestsellers in their respective categories.

Notably, the realme C55 sold over 100,000 units in just 5 hours on its first sale day, while the 11 Pro Series set a new record by selling over 200,000 devices across all channels during its initial launch, and achieved 390% of the previous generation during the first sale period offline.

Also, the narzo N53, a best-selling smartphone under the Rs 10,000 segment on Amazon, broke records by selling 100,000 units in an impressive 90 minutes.

For the IOT category, realme pad 2 achieved 122% more than the previous generation during first sale.

These achievements showcase realme’s continued commitment to delivering innovative and high-performing products that resonate with consumers.

Furthermore, realme’s strong offline presence and expansion into the offline channel have played a significant role in enhancing customer engagement and ecosystem development.

The brand’s strategic focus on both online and offline channels has allowed it to cater to diverse consumer preferences and ensure seamless access to its products.

By continuously pushing boundaries and delivering exceptional devices, realme has solidified its position as a prominent player in the Indian smartphone market.

With a compelling product lineup and customer-centric approach, realme is well-poised to continue its upward trajectory and achieve even greater success in the future.

As the company continues to innovate and expand its product portfolio, realme aims to maintain its growth momentum and further strengthen its position as one of the top smartphone brands in India.

With the rapid growth of the Indian smartphone market and the increasing demand for 5G devices, realme is well-positioned to capitalize on these opportunities and deliver unparalleled value to its customers.

As the festive season approaches, Realme is geared up to unveil interesting launches and offers to further entice consumers.

Faqs

1) India Smartphone Market Declines by 10% YoY in 1H23 with 64 million units, Says IDC.Details?

Ans) According to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, India smartphone market shipped 64 million units in 1H23 with a decline of 10% YoY (year-over-year). In 2Q23 the market grew by 10% over the previous quarter but declined by 3% YoY with 34 million units. The vendors and channels focused on clearing the inventory by offering discounts, special schemes, and price drops before the start of the festive season in the second half of the year.

After several quarters of growth, the ASP (average selling price) declined by 8% QoQ but grew by 13% YoY, reaching US$241 in 2Q23. The share of the sub-US$200 segment declined to 65% from 70% a year ago, a dip of 11% YoY. The mid-range segment (US$200<US$400) remained flat with a 22% share, while the mid-to-high-end segment (US$400<US600) with a 5% share, grew by 34% YoY in 2Q23. The premium segment (US$600+) grew the highest, up 75% YoY reaching 9% share.

“Consumers are opting for premium offerings, driven by easy and affordable financing options. IDC expects this growth momentum to continue in the upcoming months in 2023,” said Upasana Joshi, Research Manager, Client Devices, IDC India.

17 million 5G smartphones shipped with an ASP of US$366 in 2Q23, down 3% YoY. Samsung, vivo and OnePlus were the leaders in the 5G segment with a combined share of 54%. Apple’s iPhone 13 and OnePlus’ Nord CE3 Lite were the highest shipped 5G models in 2Q23.

Overall shipments to the online channel dropped by 15% YoY, while the offline channel grew by 11%, reaching a 54% share. Relatively lower shipment for the online-heavy players such as Xiaomi and realme intensified this drop.

Apple, with the highest ASP of US$929, registered a massive 61% YoY growth. OnePlus too registered a healthy growth of 61%, although its ASP dropped by 14% YoY to US$346. POCO with its very affordable C series models registered the highest growth amongst the top ten brands. vivo (excluding iQOO) emerged as the market leader as it drove its growth for its V series models, closely followed by Samsung which focused on the growth of its higher-end portfolio as well.

“In the upcoming festive season, the brands will try to spur consumer demand with affordable 5G launches, pre-booking offers, and loyalty/upgrade programs clubbed with festive discounts. The market requires strong double-digit growth in the next few months to see annual growth in 2023, which looks unlikely as of now,” says Navkendar Singh, AVP – Devices Research, IDC.