Highlights

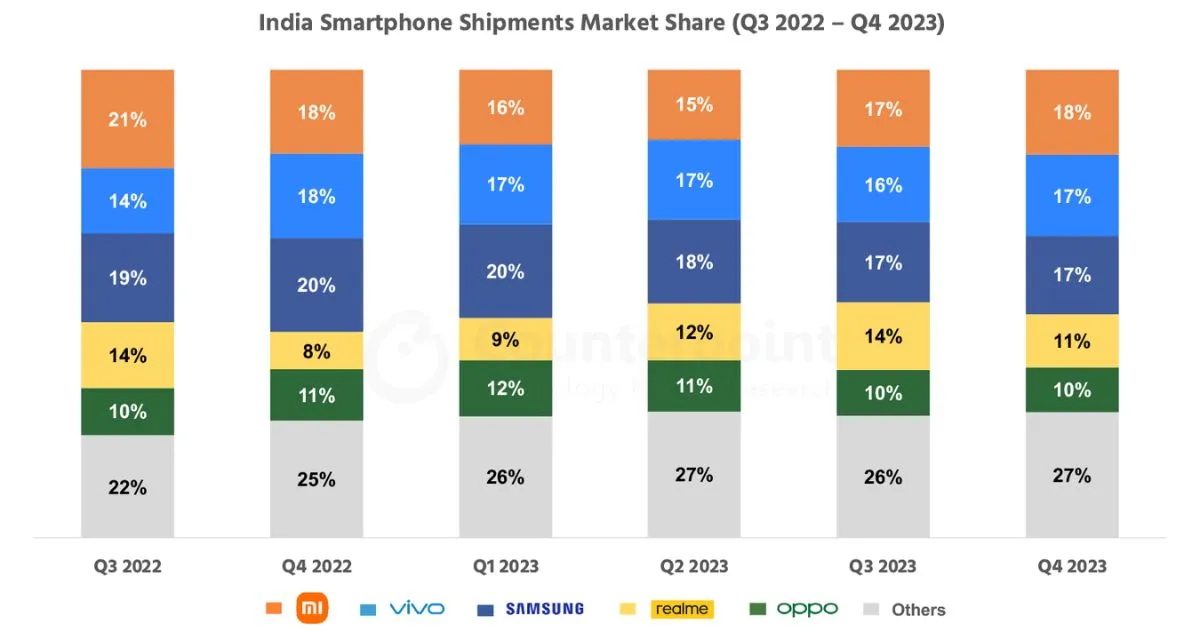

- Samsung clinches the top spot in India’s smartphone market for 2023.

- Xiaomi leads Q4, Vivo secures overall second place in market share.

- Premium smartphones above Rs 30,000 grow by 64% YoY.

- Apple surpasses 10 million shipments, OnePlus sees significant growth.

In 2023, India’s smartphone market experienced a year of steady performance, as reported by Counterpoint Research.

Despite a static growth trajectory throughout the year, a resurgence in the final quarter indicated a positive turnaround, with smartphone shipments surging by 25% compared to the previous year.

Samsung Leads India’s Smartphone Charts

Samsung emerged as the leading brand for the entirety of 2023, capitalizing on the robust sales of its A series, along with strategic marketing initiatives and a focused presence in the premium market sector.

Xiaomi, after a year of competitive performance, regained its lead in the market during the fourth quarter, although it dropped to third place overall for the year.

Vivo secured the second position both in the final quarter and across the entire year, demonstrating consistent market strength.

Counterpoint’s analysis highlights Samsung’s success, attributing it to the appealing offerings of the A series, a strong offline marketing push, and targeted efforts in the higher-end market segments.

Vivo, Xiaomi Make Comeback

Vivo’s achievement in securing a 17% market share was bolstered by the V29 series, which stood out for its design quality in offline sales channels, and the T series, which performed well online.

The shifting dynamics saw Xiaomi making a significant comeback in the fourth quarter, driven by a strategic focus on affordable 5G offerings, expansion into offline markets, and a streamlined product portfolio, as per Shubham Singh, a Research Analyst at Counterpoint.

The trend towards higher-priced smartphones also became more pronounced in 2023, with devices priced above Rs 30,000 witnessing a 64% year-on-year increase.

This growth, facilitated by accessible financing options, led to an interesting consumer behaviour where one in every three smartphones purchased in 2023 was financed.

Apple and OnePlus Grow as well

Apple stood out in the Indian market, surpassing the 10 million shipments milestone and achieving the leading position in terms of revenue for the first time in a calendar year.

This success was fueled by strong consumer demand for both the latest and older iPhone models.

OnePlus also recorded noteworthy growth in 2023, attributed to its strategic offline market expansion and a compelling product lineup in the affordable premium price bracket, ranging from Rs 30,000 to Rs 45,000.

This analysis from Counterpoint Research paints a picture of a dynamically evolving smartphone market in India, marked by competitive strategies, a shift towards premiumization, and significant milestones achieved by leading brands.

FAQs

Who led India’s smartphone market in 2023 according to Counterpoint Research?

Samsung emerged as the leader of India’s smartphone market in 2023, driven by the strong performance of its A series and strategic marketing efforts.

What trend was observed in the pricing of smartphones in India in 2023?

There was a notable shift towards premiumisation, with smartphones priced above Rs 30,000 experiencing a 64% increase in year-on-year growth, partly due to the availability of easy financing schemes.

How did Apple perform in the Indian smartphone market in 2023?

Apple stood out by crossing 10 million shipments and capturing the top revenue position for the first time in a calendar year, thanks to robust demand for its latest and older iPhone models.

What factors contributed to OnePlus’ growth in India in 2023?

OnePlus achieved significant growth by expanding into offline markets and offering an attractive product lineup in the affordable premium segment, priced between Rs 30,000 and Rs 45,000.

What was a significant consumer behaviour trend in India’s smartphone market in 2023?

A remarkable trend was that one out of every three smartphones purchased in 2023 was financed, indicating the growing acceptance of financing options among Indian consumers.

How did Samsung’s revenue and operating profit fare in Q4 of 2023?

Samsung’s revenue dropped by 3.8%, and operating profit decreased by over 34% compared to the same quarter in the previous year, highlighting the financial challenges faced.

What led to the downturn in Samsung’s semiconductor business?

A significant global decline in demand for DRAM chips resulted in the semiconductor division’s shift from profit to a record loss, impacting Samsung’s overall financial health.

Which division of Samsung remained profitable in Q4 of 2023?

The MX and Networks business, encompassing smartphones and other devices, was the profitable division, generating the majority of Q4 operating profit for Samsung.

What is Samsung’s outlook for its smartphone division in 2024?

Samsung projects an increase in demand for premium smartphones, along with a general market recovery, potentially boosting its mobile division’s performance in 2024.

Mobile Display To Focus on Smartphones and IT/Auto; Large Display To Improve Profitability. Details ?

SDC posted KRW 9.66 trillion in consolidated revenue and KRW 2.01 trillion in operating profit for the fourth quarter.

For the mobile display business, the market demand for smartphones increased slightly year-on-year.

Despite facing multiple challenges during the quarter, SDC maintained its performance compared to the previous quarter by ensuring a timely supply for major customers’ new products and focusing on high-end products in its product mix.

For the large display business, although demand remained weak due to unfavorable economic conditions, SDC posted sales growth and reduced losses backed by year-end seasonal TV demand.

In the first quarter of 2024, SDC expects a decline in mobile display business earnings due to intensifying competition among panel manufacturers and muted seasonal demand.

For the large display business, despite challenges posed by weak demand and off-season effects, SDC will continue its efforts to reduce losses by launching new QD-OLED monitors and expanding its customer base.

In 2024, the market demand for smartphones is expected to be sluggish due to the global economic slowdown and prolonged regional conflicts.

Nevertheless, SDC aims to focus on sales growth based on differentiated technology and capabilities in the smartphone market, particularly in the highly competitive high-end segment. It also intends to strengthen its future growth engines in the IT and Auto segments.

Although ongoing macroeconomic uncertainties pose challenges to the large display business, SDC expects TV demand to recover moderately, buoyed by upcoming sporting events.

It will closely monitor market developments and work towards improving profitability by centering QD-OLED monitors in its product mix, enhancing production efficiency and adding capacity without additional investments.

MX Maintains Double-Digit Profitability, Will Become Global Standard for Mobile AI With Galaxy AI. Details?

The MX and Networks Businesses posted KRW 25.04 trillion in consolidated revenue and KRW 2.73 trillion in operating profit for the fourth quarter.

Market demand for smartphones increased slightly quarter-on-quarter, driven by the premium segment, despite continued inflation and geopolitical instability.

The MX Business reported a decline in sales and profit quarter-on-quarter due to lower smartphone sales, including the fading of new-product effects from flagship models launched in the third quarter.

However, tablet shipments, led by new product releases, grew significantly and included healthy sales of premium products. Wearable devices also maintained sales momentum during the peak holiday season.

In the first quarter of 2024, smartphone market demand is expected to decline sequentially due to seasonality, but the premium segment is expected to grow year-on-year.

Accordingly, the MX Business plans to leverage the newly launched Galaxy S24 series — which brings advanced AI capabilities and enhanced product competitiveness — to expand sales of flagship products. The MX Business will also continue to focus on operational efficiency.

In 2024, smartphone market demand is expected to rebound as consumer sentiment stabilizes in anticipation of a global economic recovery, leading to market growth, especially in the premium segment.

Similarly, the tablet market is expected to recover, while the wearables market is forecasted to achieve double-digit value growth for smartwatches and slight value growth for True Wireless Stereo (TWS) devices.

The MX Business aims to lead the AI smartphone market by offering customers a differentiated experience through the integration of Galaxy AI in the S24 series, while also enhancing the user experience and optimizing Galaxy AI for foldable devices. Through these efforts, the MX Business aims to grow its annual flagship shipments at a double-digit rate and solidify its leadership in the foldable category.

In addition, the MX Business will continue to focus on sales of premium devices for tablets. For wearables, it will strive to elevate the Galaxy ecosystem experience, enhance wellness functions in smartwatches and increase the smartphone attach rate by integrating AI technologies.

Through these efforts, the MX Business aims to achieve revenue growth and ensure solid profitability by continuing to optimize resources amid unstable market conditions. Finally, the MX Business will strengthen R&D and investment in future growth areas such as generative AI, digital health and XR.

Visual Display and Digital Appliances To Lead the AI Era.Details?

The Visual Display and Digital Appliances Businesses posted KRW 14.26 trillion in consolidated revenue and KRW 0.05 trillion in operating losses in the fourth quarter.

Overall market demand for TVs increased quarter-on-quarter in the fourth quarter, led by seasonality, but declined year-on-year due to reduced consumption sentiments among advanced markets.

The Visual Display Business expanded its leadership in the premium market by focusing on selling high-value-added products — including Neo QLEDs, OLEDs, and Big TVs above 75″ to preemptively respond to high demand during the peak season, including Black Friday.

However, profitability decreased slightly on a quarter-on-quarter and year-on-year basis due to the stagnant TV market demand and increased costs amid intensified competition.

In the first quarter of 2024, overall TV demand is expected to decrease owing to seasonality, apart from the premium market, including Neo QLEDs, OLEDs, and Big TVs above 75″, where solid demand is projected.

The Visual Display Business will amplify the buzz created by launching new premium models announced at CES and its showcase event First Look and, in order to focus on sales of strategic products and securing profitability, take a more proactive approach to promoting differentiated products and service.

In 2024, replacement demand linked to global sporting events is expected to ease the decline in TV market demand gradually. However, uncertainties surrounding various macro factors are anticipated to continue.

The Visual Display Business aims to innovate its premium and Lifestyle products and diversify its lineup to meet various customer needs. Furthermore, it will lead the AI-screen era by continuing to introduce innovations in hyper-connectivity and customized content and services, powered by its next-generation AI processor and Tizen operating system.

Samsung Electronics Announces Fourth Quarter and FY 2023 Results.Details?

Samsung Electronics today reported financial results for the fourth quarter and the fiscal year 2023.

The Company posted KRW 67.78 trillion in consolidated revenue and KRW 2.82 trillion in operating profit in the quarter ended December 31, 2023. For the full year, it reported KRW 258.94 trillion in annual revenue and KRW 6.57 trillion in operating profit.

Fourth quarter revenue and operating profit increased from the third quarter based on improved performance in Memory due to higher prices, and continued strength in sales of premium display products.

In the first quarter of 2024, the Company will focus on improving profitability by increasing sales of high value-added products. The component businesses aim to meet demand for advanced products and those aimed for generative AI while the Device eXperience (DX) Division will strengthen AI features in smartphones and other consumer products.

The memory market and demand for IT are expected to continue recovering in 2024, though macroeconomic uncertainties remain to be seen. The Company will meet demand for semiconductors for AI applications and expand into AI-enabled consumer product markets. At the same time, the Company will strengthen its leadership in premium products and competitiveness in advanced-node semiconductors.

As ongoing macroeconomic uncertainties are expected to weigh on the business environment in the near-term, the Company expects earnings in the first half of 2024 to show a moderate improvement, with a more significant improvement expected to take place in the second half of the year.

The Company’s capital expenditures in 2023 reached a total of KRW 53.1 trillion, including KRW 48.4 trillion spent in the Device Solutions (DS) Division and KRW 2.4 trillion in Samsung Display Corporation (SDC). In the fourth quarter, the total was KRW 16.4 trillion, with KRW 14.9 trillion allocated to the DS Division and KRW 0.8 trillion to SDC.

Spending on memory was concentrated on building out infrastructure at the facility in Pyeongtaek, Korea and expansion of production capacity of HBM, DDR5 and other advanced nodes. Foundry investments focused on expanding the production capacity of advanced EUV nodes of 5 nanometers (nm) and below, as well as infrastructure at the Company’s factory in Taylor, Texas. Display investments were mainly made in IT OLED products and flexible displays.

Semiconductor Demand To Recover Gradually in 2024 .Details?

The DS Division posted KRW 21.69 trillion in consolidated revenue and KRW 2.18 trillion in operating losses in the fourth quarter of 2023.

For the Memory Business, the overall market showed a recovery compared to the previous quarter, with content-per-box continuing to increase for PC and mobile. Server demand showed signs of recovery as investments in generative AI expanded across the IT industry.

The Memory Business also focused on expanding sales of high value-added products, leading to significantly higher sales of cutting-edge solutions like HBM, DDR5, LPDDR5x and UFS 4.0, among others. As a result, its bit growth exceeded market growth, and inventory depletion of DRAM and NAND accelerated. The DRAM business posted a profit on the back of higher prices.

Looking to the first quarter of 2024, PC and mobile demand recovery is expected to continue, while server and storage demand will show signs of recovery, though market conditions need close monitoring. In terms of industry supply, bit growth of cutting-edge products is anticipated to face constraints across the market while consumer demand for advanced-node products is predicted to stay strong.

The Memory Business will focus on responding to demand for cutting-edge products and intends to improve profitability by actively addressing demand for HBM and generative AI-related server SSDs.

In 2024, the Memory Business expects the market to continue to recover despite various potential obstacles, including interest rate policies and geopolitical issues. For PC and mobile, content-per-box is expected to grow due to the impact from expansion of on-device AI. As far as servers are concerned, server replacements and transitions to new platforms will likely lead to a gradual recovery in demand.

Additionally, the Memory Business plans to focus on profitability based on the competitiveness of cutting-edge nodes.

For DRAM, the aim is to enhance leadership in the high-density DDR5 market and solidify competitiveness in HBM by ramping up the volume of next-generation HBM3E in a timely manner. For NAND, the Memory Business will respond to customer demand for high-density storage by being the first in the industry to enter the mobile QLC market, and by leading the Gen5 SSD market for generative AI applications.

Due in large part to inventory adjustments and the selection of Exynos 2400 for a major customer’s flagship model, the System LSI Business saw its earnings improve in the fourth quarter.

In the first quarter of 2024, sales of new SoCs and high-pixel image sensors are expected to remain strong. However, demand for some SoCs is expected to decline, and earnings are likely to worsen — mainly for mobile display driver IC (DDI) — so overall earnings improvement is predicted to be somewhat limited. However, the introduction of on-device AI provides an opportunity to restore the desire of consumers to replace their smartphones.

Although the smartphone market is expected to rebound in 2024, it is believed that the normalization of chip prices and higher financial costs will erode set makers’ promotional capabilities, limiting demand growth.

The System LSI Business will secure future growth engines by leveraging AI momentum and maximizing SoC, sensor and LSI business competitiveness.

It plans to continuously improve on-device functions like NPU performance improvement and model weight reduction. For image sensors, it will expand sales of high-pixel sensors and DDIs and will achieve growth, even in uncertain environments, as IT devices adopt more OLEDs.

The Foundry Business saw its earnings decline in the fourth quarter due to a delay in global economic recovery.

Despite these challenges, it is actively developing 3nm and 2nm Gate-All-Around (GAA) technology and plans to expand into newly emerging application segments using advanced process technologies. Furthermore, the Foundry Business achieved its highest annual order backlog in 2023.

In the first quarter of the year, it expects the launch of new products including AI smartphones and AI PCs to drive an improvement in demand. However, the ongoing trend of customers reducing inventory may mean that earnings will not significantly recover.

Nevertheless, the Foundry Business is focused on improving yield and optimizing the second-generation 3nm GAA process. It is also securing a 2nm AI accelerator order that includes HBM and advanced packaging.

As demand for smartphones and PCs gradually recovers in 2024, advanced processes are expected to drive an approach to 2022 levels in the foundry market. The Foundry Business will continue stable mass production of the 3nm GAA process, develop the 2nm process and increase orders for fast growing applications such as AI accelerators.

What was Apple’s revenue in Fiscal Q1 2024, and how did it compare to expectations?

Apple reported a revenue of $119.58 billion in Fiscal Q1 2024, surpassing analyst expectations and indicating strong sales across iPhone, Services, and other product lines, despite slight shortfalls in Mac and iPad revenues.

Also Read: Top Smartphones of January 2024 in India Across Price Ranges: From Redmi Note 13 5G to Vivo X100 Pro

Also Read: Samsung Reports Sharp Profit Decline in Q4 2023 Amidst Rising Smartphone Division Success