Highlights

- Instagram and Edits introduced Valentine’s‑themed fonts, stickers, chat themes, and Reels effects.

- New additions include animated text, love‑inspired photo frames, “secret phrases” unlocking exclusive visuals, celebratory mention stickers and themed Notes.

- Instagram’s Valentine’s features run from Feb 12–16, while Edits’ video effects will remain available.

Instagram And Edits App Roll Out Valentine’s Day. (Image credit – Instagram)

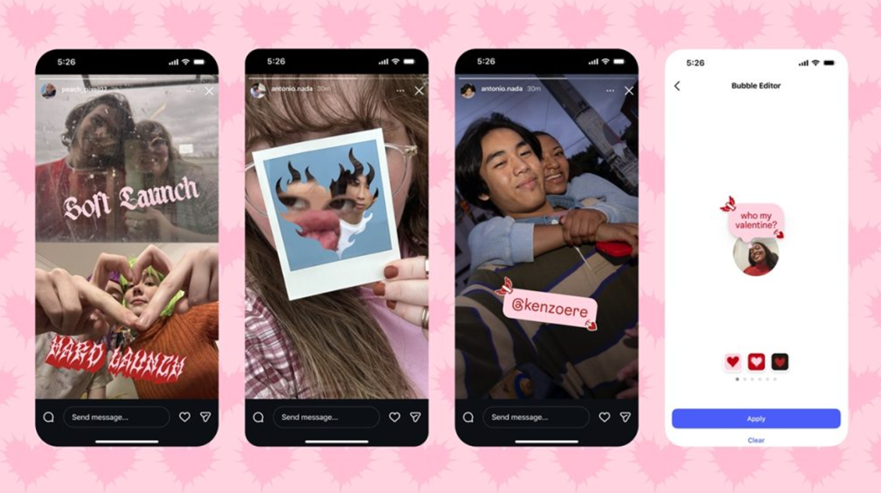

Instagram is celebrating Valentine’s Day with a range of new, limited-time creative tools aimed at helping users express themselves. The platform, along with its companion app Edits, has introduced themed fonts, effects, stickers and chat backgrounds ahead of February 14.

The latest update is designed to make it easier for users to personalise their Stories, Reels and direct messages. Whether they are sharing moments with a partner, highlighting friendships, or simply embracing the Valentine’s vibe, the new additions aim to bring a romantic and fun twist to everyday content.

New Valentine’s Features for Stories and Reels

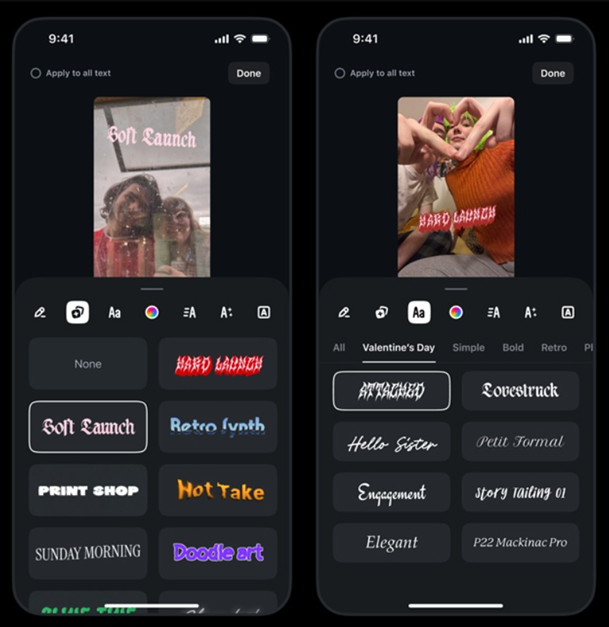

Instagram users can now access Valentine’s-themed fonts and animated text effects for Stories and Reels. These new styles include decorative elements and special animations that give posts a more expressive and festive appearance.

In addition, the platform has rolled out love-inspired photo sticker frames, enabling users to surround selfies and shared memories with heart-themed designs.

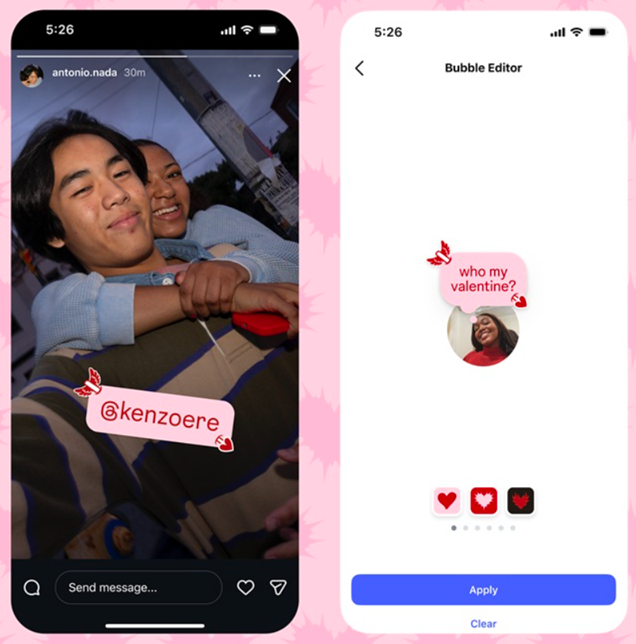

A standout addition is the “secret phrases” feature within Story comments. When users type certain words in the comments section, exclusive themes and animations are unlocked. Instagram has also introduced custom Story mention stickers, offering a more celebratory way to tag a significant other or close friend.

Valentine’s Touch for Notes and DMs

Instagram Notes, short status updates visible in direct messages, are also getting a seasonal refresh. Users can include Valentine’s-themed hint text and uncover hidden phrases that activate themed visuals.

Private conversations haven’t been left out either. A new Valentine’s Day chat theme is now available for direct messages, compatible with both light and dark modes.

Edits App Adds Video Effects

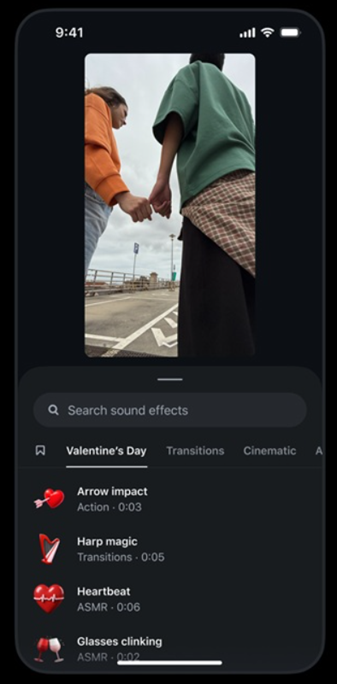

Meanwhile, Edits is focusing on enhancing video creativity. The app now includes Valentine’s Day fonts and pre-designed text presets tailored for Reels. Users can also add themed sound effects such as harp melodies and heartbeat audio to match the romantic mood.

Another notable addition is a new speed control feature that allows creators to accelerate clips up to 100 times. This dramatic speed option opens up possibilities for energetic or playful edits.

Limited-Time Availability

The Valentine’s-themed features on Instagram will be accessible from February 12 through February 16. However, the themed creative tools introduced on Edits will remain available even after the holiday ends.

FAQs

Q1. What Valentine’s Day features has Instagram introduced?

Answer. Instagram rolled out themed fonts, animated text effects, love‑inspired stickers, secret phrases in Story comments, and a new Valentine’s chat theme.

Q2. What updates are available for Instagram Notes and DMs?

Answer. Notes now include Valentine’s hint text with hidden phrases that unlock visuals, while DMs get a seasonal chat theme compatible with light and dark modes.

Q3. What Valentine’s features are added to the Edits app?

Answer. Edits introduced themed fonts, text presets, romantic sound effects (like harp and heartbeat), and a new speed control option for playful or energetic video edits.