Highlights

- The iPhone 16 lineup captured the top four global spots in Q3 2025 with the standard iPhone 16 leading at 4% share.

- Samsung filled positions 5–9 exclusively with Galaxy A-series models, driven by its “Awesome Intelligence” AI features.

- No flagship Galaxy S device made the list, highlighting a shift toward affordability.

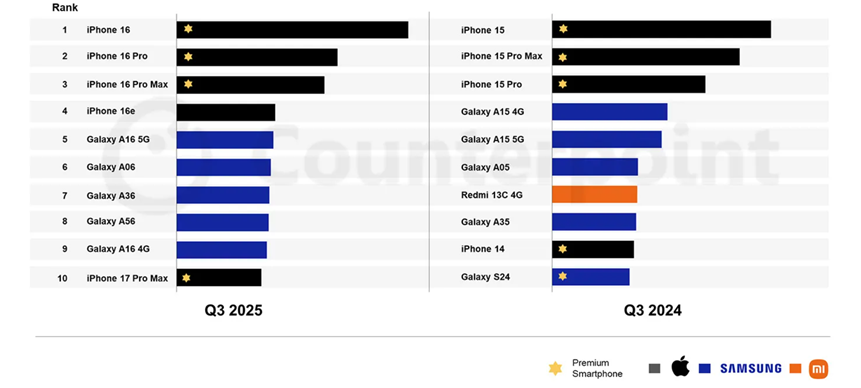

Apple and Samsung once again filled all 10 slots on Counterpoint Research’s list of the best-selling smartphones for the third quarter of 2025. However, the split between the two brands tells a very different story this year. While both companies secured five positions each, Apple swept the top four places with its premium iPhone 16 lineup. This was in sharp contrast to Samsung, which did not place a single flagship device in the top tier.

Top Q3 2025 Smartphones

The research highlights that the standard iPhone 16 remained the best-selling smartphone globally in Q3 2025, commanding a 4% volume share. This marks the model’s third straight quarter at No. 1. Even more notably, the entire top four was dominated by the iPhone 16 family including the iPhone 16, iPhone 16 Pro, iPhone 16 Pro Max, and iPhone 16e. This was despite the series typically seeing a slowdown as consumers await newer releases.

Another standout was the iPhone 17 Pro Max, which secured the 10th position even though it hit the market near the end of the quarter. Its late entry and immediate traction signal extremely strong demand for Apple’s newest, most premium offering.

Samsung’s performance skewed heavily toward its affordable lineup. The company occupied fifth to ninth place with its Galaxy A-series models, led by the Galaxy A16 5G, followed by the Galaxy A06, Galaxy A36, Galaxy A56, and Galaxy A16 4G. Unlike previous years when the base Galaxy S24 made the Q3 2024 leaderboard, Samsung had no premium smartphone appear in the 2025 list.

Counterpoint Research suggests that Samsung’s push to add AI-powered features to its midrange portfolio through its “Awesome Intelligence” initiative could be fueling these sales.

According to the report, “The mid-price segment’s presence in the top-10 best-selling smartphones is expected to remain strong, driven by the growing integration of GenAI features.” It adds that these upgrades boost competitiveness, improve user value, and help narrow the experience gap with flagship models.

The absence of the Galaxy S25 from the rankings may reflect early seasonal weakness as customers anticipate the Galaxy S26 series. Still, it marks a significant gap for Samsung, as none of its top-performing models this quarter carried a wholesale price above $600.

The report also noted an important milestone that 5G smartphones dominated the top five spots for the first time, underscoring what Counterpoint calls “a key consumer preference across regions” during Q3 2025.

Overall, Apple’s premium strength and Samsung’s midrange momentum defined the quarter, painting a clear picture of current global consumer buying trends.

FAQs

Q1. Which smartphones dominated global sales in Q3 2025?

Answer. Apple’s iPhone 16 lineup took the top four spots, with the standard iPhone 16 leading at 4% share.

Q2. How did Samsung perform compared to Apple?

Answer. Samsung relied entirely on its midrange Galaxy A-series (A16 5G, A06, A36, A56, A16 4G), filling positions 5–9, while no flagship Galaxy S device made the list.

Q3. What key consumer trend was highlighted in the smartphones global sales in Q3 2025 report?

Answer. For the first time, 5G smartphones dominated the top five positions, showing strong global preference for advanced connectivity.