Highlights

- Huawei considers IPO in alignment with China’s technological goals.

- Operating profit margin decline presents financial challenges for Huawei.

- Potential valuation contrasts from $128 billion to $1.3 trillion.

- IPO decision reflects strategic adaptation to geopolitical and market dynamics.

Huawei has long maintained its stance against becoming a publicly traded company.

Ren Zhengfei, the company’s CEO, has emphasized Huawei’s commitment to societal ideals over financial gains.

Recent developments have suggested that an initial public offering (IPO) may be on the cards if it aligns with China’s national interests.

Huawei’s Role in China

President Xi Jinping’s vision for China as a “great modern socialist country” heavily relies on technological innovation and self-sufficiency.

Huawei, with its advanced products despite US sanctions, stands as a testament to this ambition.

The company’s Mate 60 Pro smartphone, launched in September, is a prime example.

Laden with Chinese-made components and an advanced semiconductor from Shanghai’s SMIC, the device marks Huawei’s resilience and capability in innovation, despite brewing problems with US-based tech giants.

Financial Strain and Market Valuation

Huawei has faced financial challenges since 2019 due to U.S. restrictions which forbids any US-based company from working with Huawei.

The company’s operating profit margin has seen a decline, dropping from over 10% in 2018 to less than 7% in 2022.

The annual net profit in the same year dipped to $5.1 billion.

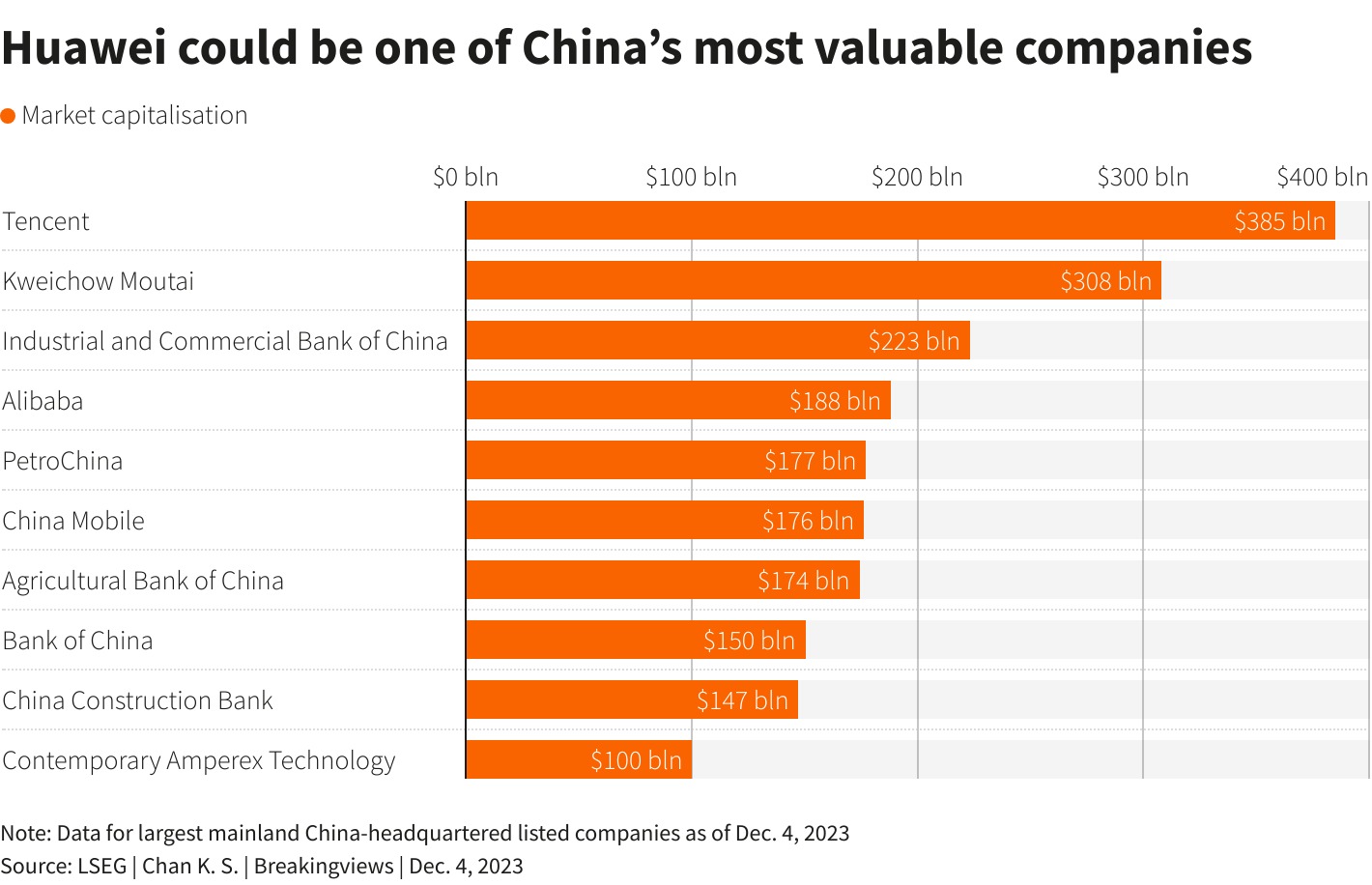

If valued at the same 25 times trailing earnings multiple as Apple, Huawei’s market valuation would stand at around $128 billion.

This valuation, however, contrasts sharply with the assertion made in 2019 by Ni Guangnan, a former chief technology officer at Lenovo.

Guangnan had estimated Huawei’s worth at a staggering $1.3 trillion, surpassing Apple’s valuation at the time.

Comparative Market Analysis

However, Apple, a key player and competitor in the market, has since reached a market capitalization of $3 trillion.

This makes Huawei’s potential valuation all the more speculative.

Even so, the company’s listing on China’s three stock exchanges is bound to shoot up Huawei’s valuation to an astronomical level as the company is so entrenched in the Chinese ecosystem.

Time will tell how well Huawei’s IPO plays out and if it can become the world’s biggest company in terms of market cap.

FAQs

What factors are influencing Huawei’s potential decision to go public?

Huawei’s consideration of an IPO is influenced by its commitment to support China’s technological self-sufficiency and innovation goals.

This move could also be a strategic response to financial pressures and the need for additional capital amidst US restrictions.

How has Huawei’s financial performance been impacted in recent years?

Huawei has experienced a decrease in operating profit margin, dropping to less than 7% in 2022 from over 10% in 2018.

This decline, alongside a reduced annual net profit of $5.1 billion, highlights the financial challenges it faces due to US restrictions.

What are the varying estimations of Huawei’s market valuation?

Based on 2022 earnings and applying Apple’s trailing earnings multiple, Huawei could be valued at $128 billion.

However, a former Lenovo CTO estimated Huawei’s worth at $1.3 trillion in 2019, suggesting a significantly higher valuation.

How does Huawei’s potential IPO compare with global tech giants like Apple?

While Apple’s market capitalization stands at $3 trillion, Huawei’s speculated valuation ranges dramatically.

This comparison underscores the volatile nature of the tech market and the impact of geopolitical factors on company valuations.

How did Huawei’s sales compare to Apple’s during the Singles’ Day period?

Huawei experienced a significant sales increase of 66% year-on-year during the Singles’ Day period, surpassing the performance of Apple’s iPhone 15, which saw a 4% decline.

This surge was primarily driven by the popularity of Huawei’s Mate 60 series.

What was Xiaomi’s performance during the Singles’ Day sales?

Xiaomi also showcased a strong sales performance, with a 28% increase during the Singles’ Day shopping period.

This growth contributed to the overall rise in China’s smartphone market sales and highlighted Xiaomi’s growing market presence alongside Huawei.

How does the pricing of Huawei and Xiaomi smartphones compare to Apple’s iPhone 15?

Huawei’s Mate 60 series starts at a price of 5,499 Yuan, and Xiaomi’s 14 lineup begins at 3,999 Yuan.

In comparison, the starting price of Apple’s iPhone 15 series is slightly higher at 5,999 Yuan, making Huawei and Xiaomi’s offerings more competitively priced.

How did the iPhone 15 Pro Max perform in the Chinese smartphone market?

In October, the iPhone 15 Pro Max unexpectedly led China’s smartphone market, securing a 5% market share.

This is particularly notable given the market’s usual preference for local brands like Huawei.

What was the market share of Huawei Mate 60 Pro in China?

The Huawei Mate 60 Pro, a strong contender with its Kirin 9000s 5G SoC, narrowly missed the top spot and secured the second position in the Chinese smartphone market, showcasing Huawei’s continued influence.

Which other Apple models ranked in the top five in China?

Alongside the iPhone 15 Pro Max, Apple’s iPhone 15 Pro and iPhone 15 also made it to the top five best-selling smartphones in China, holding 4% and 3% market shares, respectively.

Also Read: iPhone 15 Pro Max Leads in China’s Smartphone Market, Surpassing Huawei Mate 60 Pro

Also Read: Huawei and Xiaomi Overtake Apple in Singles Day Sales