Highlights

- Smartphone shipments in India grew 5% YoY, while market value jumped 18% YoY, driven by premiumisation and festive demand, marking a record quarter.

- Apple entered India’s top five brands by shipment volume, led the premium segment with 28% value share, and made India its third-largest iPhone market.

- Worldwide smartphone revenue rose 5% YoY to $112B, with Apple, Samsung, and Xiaomi leading. Apple’s iPhone 17 series outperformed its predecessor across regions.

Caption – Global and Indian Smartphone market trends revealed by Counterpoint Research. (Image credit – Apple)

India’s smartphone market saw a 5% year-on-year (YoY) growth in shipments and an impressive 18% YoY increase in value during Q3 2025 (July–September). This marks its highest-ever quarterly value, according to Counterpoint Research’s Monthly India Smartphone Tracker.

Meanwhile, Apple climbed into India’s top five smartphone brands by shipment volume, fueled by strong sales of its iPhone 16 and iPhone 15 series alongside festive season deals. With this milestone, India has now become the third-largest iPhone market globally.

Senior Analyst Prachir Singh from Counterpoint noted that the premium smartphone segment led the market’s growth with a 29% YoY rise in shipments as consumers increasingly gravitated toward high-end devices. This premiumisation trend pushed the overall market value up by 18% YoY and boosted the average selling price (ASP) by 13% YoY, both all-time highs for a single quarter.

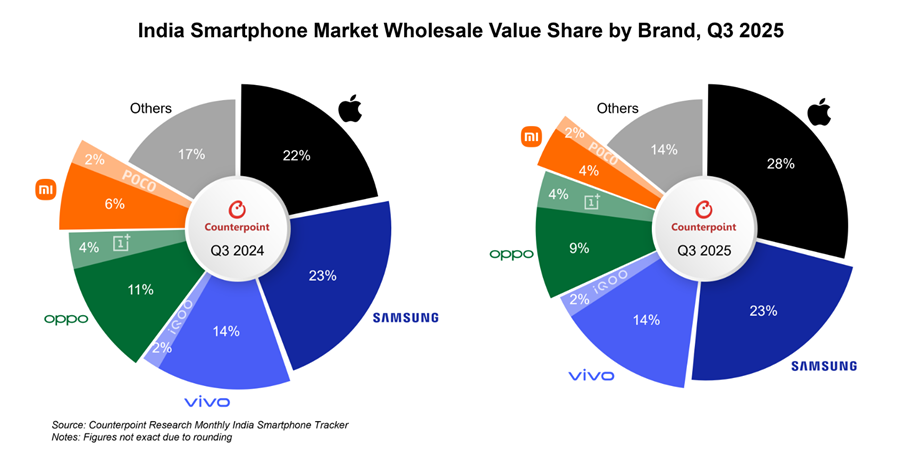

Senior Analyst Prachir Singh said, “The premium segment was the fastest-growing segment with 29% YoY shipment growth, as more consumers moved toward higher-value devices. This premium push lifted the overall market’s value by 18% YoY, reaching the highest-ever value in a single quarter, with the average selling price (ASP) growing by 13% YoY. Apple led the charge with a 28% value share, driven by strong demand for its iPhone 16 and 15 series, while the iPhone 17 series has witnessed strong momentum in India at launch, with demand outpacing that of its predecessor. Samsung followed closely with 23% value share, driven by its premium Galaxy S series, AI-led mid-tier A series, and offers on its high-end A-series models. The latest Galaxy Z Fold series also saw record sales, strengthening Samsung’s leadership in the foldable smartphone segment.”

India Smartphone Market Q3 2025 Highlights

Apple dominated the premium category with a 28% revenue share, entering the top five by shipment volume for the first time. Samsung followed with a 23% value share, driven by its flagship Galaxy S series and AI-powered Galaxy A series in the mid-tier range.

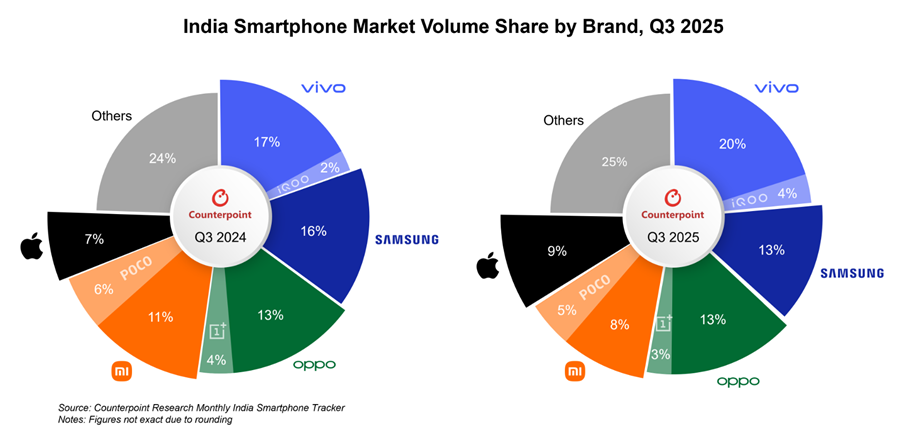

Vivo (excluding iQOO) ranked third in revenue share at 14% and maintained its lead in shipment volume with a 20% share, supported by its robust offline presence and the continued success of its T series smartphones.

OPPO saw its revenue share drop from 11% in Q3 2024 to 9% in Q3 2025, but managed to secure a 13% volume share, closely challenging Samsung with a volume-driven approach.

Other notable performers included iQOO, which became the fastest-growing brand of the quarter with 54% YoY volume growth, while Motorola posted a 53% YoY shipment increase. Lava emerged as the fastest-growing brand in the sub-₹10,000 price segment, recording a massive 135% YoY shipment growth.

In terms of chipsets, MediaTek-powered smartphones led with a 46% shipment share, followed by Qualcomm at 29%. On the distribution front, online sales reached 45% of total shipments during the festive season, while offline channels maintained dominance with 55%.

Global Smartphone Market Trends

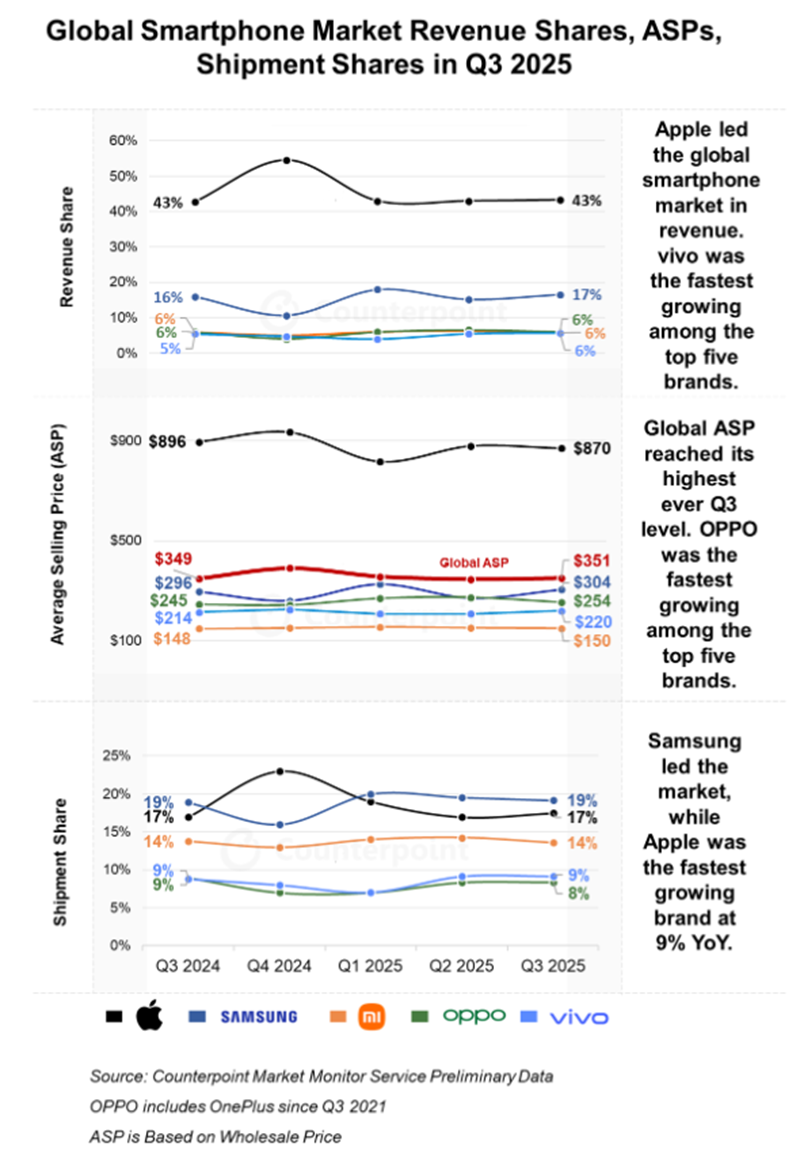

Globally, the smartphone industry’s revenue climbed 5% YoY in Q3 2025 to reach $112 billion, marking the highest-ever level for a September quarter, according to Counterpoint’s Market Monitor. Shipments also grew 4% YoY, reaching 320 million units.

Commenting on Apple’s performance, Research Director Jeff Fieldhack said, “Apple witnessed its best-ever Q3 in terms of revenue (6% YoY growth) despite a slight decline in ASP as shipment growth (9% YoY) offset the ASP impact due to broader product mix. The iPhone 17 series is performing better than the iPhone 16 series, with the base version doing well across regions due to a very strong value proposition. The iPhone 16e has further added width to the portfolio. This positive momentum is supported by strong growth in emerging markets, a trend we expect to continue.”

Samsung led globally with a 19% shipment share, posting 9% revenue growth and 3% ASP growth, largely driven by the strong performance of the Galaxy S25 series and Z Fold7/Flip7 foldables.

Xiaomi maintained the third position with a 14% shipment share and 2% YoY growth, bolstered by growing mid-to-premium demand in emerging markets across Southeast Asia, the Middle East, Africa, and Latin America.

OPPO registered the highest ASP increase among the top five brands at 3.4% YoY, supported by the Reno 14 series and an expanded premium lineup, while vivo recorded the fastest revenue growth at 12% YoY, powered by strong shipments in India and other Asian regions.

Senior Analyst Shilpi Jain said, “The value growth remained ahead of volume growth despite persistent macro challenges and trade tensions. The global Average Selling Price (ASP) hit the highest ever Q3 level, reaching $351, driven by sustained premiumization across regions due to the growing mix of mature users who are upgrading to more expensive devices. Trade-in offers, growing financing and aggressive bundling have lowered the upgrade barrier, pushing smartphone ASPs to the higher side, especially in emerging markets.”

FAQs

Q1. How did Apple perform in India’s smartphone market in Q3 2025?

Answer. Apple entered India’s top five smartphone brands by shipment volume for the first time, driven by strong iPhone 16 and 15 sales and festive offers. It also led the premium segment with a 28% revenue share.

Q2, What were the key trends in India’s smartphone market during Q3 2025?

Answer. India saw 5% YoY growth in shipments and 18% YoY growth in value, driven by premiumisation. The average selling price rose 13% YoY, reaching an all-time high.

Q3. How did the global smartphone market perform in Q3 2025?

Answer. Global smartphone revenue grew 5% YoY to $112 billion, with shipments up 4% YoY. Apple, Samsung, and Xiaomi led the market, with Apple posting its best-ever Q3 revenue.