Highlights

- Union Budget 2026 focuses on boosting India’s tech, energy, and digital ecosystem through incentives for renewable energy, semiconductor manufacturing, data centres, cloud services, and emerging technologies.

- The government announced major customs duty rationalisation and tax benefits, including lower personal import duties, extended exemptions for lithium-ion battery manufacturing, and long-term tax holidays for foreign cloud and data centre companies until 2047.

- Strong emphasis has been placed on the creator and AVGC economy, agriculture-focused AI tools like Bharat Vistar, and skill development.

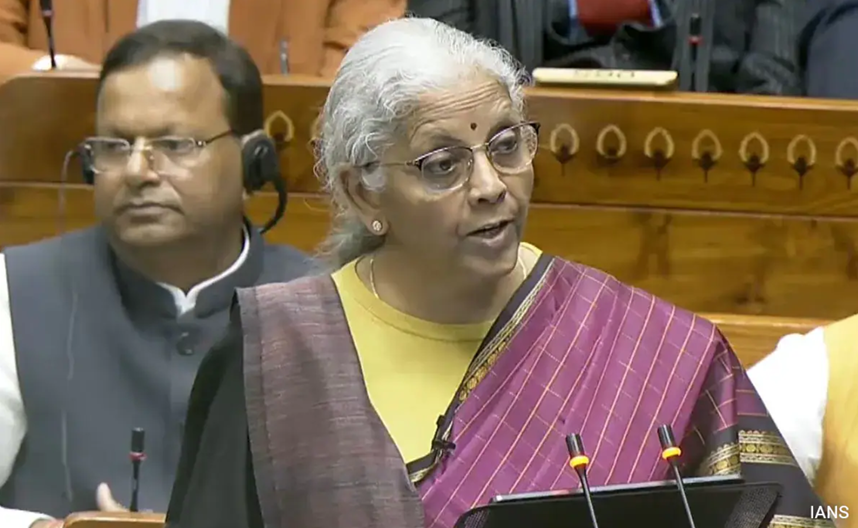

(Union Budget 2026)

Finance Minister Nirmala Sitharaman presented the Union Budget 2026-27 in the Lok Sabha on Sunday, February 1. In this year’s budget, the Government of India unveiled a wide-ranging set of fiscal measures aimed at strengthening domestic energy security, streamlining customs duties, and accelerating the expansion of India’s technology and digital infrastructure.

The proposals place strong emphasis on energy transition, personal import tariffs, semiconductor manufacturing, and fresh tax incentives for data centres and cloud service providers. Technology, artificial intelligence, and the fast-growing creator economy also feature prominently in the announcements.

Focus on Energy Transition and Energy Security

One of the central themes of Union Budget 2026-27 is the push towards renewable energy and domestic manufacturing of energy storage solutions. To support India’s clean energy goals, the government has proposed extending the basic customs duty exemption on capital goods used for manufacturing lithium-ion cells for batteries, a benefit that was introduced in last year’s budget. This extension is aimed at reducing production costs for battery storage systems, which are critical for large-scale renewable energy adoption.

The budget also proposes a basic customs duty exemption on the import of sodium antimonate, a key raw material used in the production of solar glass, to further boost the solar energy sector.

In the consumer electronics space, the government has proposed exempting basic customs duty on certain parts used in the manufacturing of microwave ovens. This step aligns with the broader objective of promoting higher value addition and local manufacturing within the domestic appliances industry.

Tax Incentives for Data Centres and Cloud Services

To strengthen India’s position as a global digital services hub, the budget introduces major tax benefits for the cloud computing and data centre ecosystem.

Foreign companies offering cloud services to global customers through data centres located in India will be eligible for tax holidays extending until 2047. This long-term incentive is intended to attract sustained foreign investment into India’s digital infrastructure.

Additionally, related entities providing data centre services from India will now qualify for a “safe-harbour” margin of 15 percent on cost. This measure is designed to offer tax certainty, reduce transfer pricing disputes, and simplify compliance for multinational technology companies operating in the country.

Customs Duty Rationalisation Under ‘Ease of Living’

As part of the government’s ‘Ease of Living’ initiative, the budget proposes a major simplification of the customs duty framework for individuals. The tariff rate on all dutiable goods imported for personal use is set to be reduced from 20 percent to 10 percent.

The move aims to simplify the duty structure while lowering costs for individuals importing goods for personal consumption.

India Semiconductor Mission 2.0 Announced

Building on the groundwork laid under India Semiconductor Mission (ISM) 1.0, the government has announced the launch of ISM 2.0. While the first phase focused on establishing initial semiconductor capabilities, the second phase aims to expand the ecosystem more comprehensively.

ISM 2.0 will focus on three major pillars: encouraging domestic production of semiconductor equipment and materials, developing full-stack Indian intellectual property to move beyond assembly into design, and strengthening supply chain resilience. The mission will also prioritise industry-led research and training centres to build proprietary technologies and develop a skilled workforce to meet growing industry demand.

Electronics Components Manufacturing Scheme Gets a Boost

The Finance Minister highlighted the strong response from industry to the Electronics Components Manufacturing Scheme, launched in April 2025 with an initial outlay of ₹22,919 crore. According to the budget speech, investment commitments under the scheme have already reached double the original targets.

To capitalise on this momentum, the government has proposed increasing the total outlay to ₹40,000 crore. The additional funding is expected to further accelerate domestic electronics component manufacturing, reduce reliance on imports, and strengthen India’s overall electronics ecosystem.

Welcoming the budget, India Cellular and Electronics Association (ICEA) said in a statement that, “the sustained focus on electronics manufacturing, the launch of India Semiconductor Mission (ISM) 2.0, and the significant expansion of the Electronics Component Manufacturing Scheme (ECMS) reaffirm the government’s long-term commitment to building resilient domestic supply chains and strengthening India’s position in global value chains.”

ICEA also welcomed “the announcement of a tax holiday till 2047 for foreign companies offering global cloud services using India-based data centres, describing it as a forward-looking measure that provides long-term policy certainty, anchors global digital infrastructure in India, and enhances the country’s credibility as a trusted hub for data, cloud, and AI-led services. Long-term predictability as provided in this measure will be a sure win for our nation.”

According to the statement issued by the ICEA, “additional measures such as the five-year income tax exemption for foreign suppliers of capital equipment in bonded zones, the Safe Harbour framework for non-resident component warehousing, customs decriminalisation, and extended validity of advance rulings are expected to improve ease of doing business, reduce compliance friction, and strengthen investor confidence.”

Talking about the budget, Pankaj Mohindroo, Chairman, ICEA, said, “Budget 2026-27 reinforces the government’s commitment to manufacturing-led growth, particularly in electronics and semiconductors, through continuity, scale, and targeted reforms. Measures such as the expansion of ECMS, support for ISM 2.0, and long-term incentives for cloud and data infrastructure send a strong signal of strategic intent and policy stability.”

Push for New Technologies and AI Innovation

The government reiterated its commitment to emerging technologies through initiatives such as the AI Mission, National Quantum Mission, Anusandhan National Research Fund, and the Research and Development and Innovation Fund (RDI). These programmes are aimed at advancing research, fostering innovation, and building a skilled workforce capable of supporting next-generation technologies.

Bharat Vistar – AI-Powered Support for Agriculture

A notable new announcement in Budget 2026-27 is Bharat Vistar, an AI-based multilingual tool designed for farmers. Integrated with the Agristack portal and ICAR agricultural resources, the platform will provide personalised advisory services to help farmers make better decisions, improve productivity, and reduce risks. The initiative reflects the government’s focus on applying AI to transform key sectors such as agriculture.

Investing in the Orange Economy

For the first time, the government has formally recognised the Orange Economy as a significant contributor to India’s GDP. This sector includes areas such as live events, animation, gaming, and digital content creation.

In her speech, the Finance Minister underlined the employment potential of the sector, stating that ‘India’s AVGC sector is growing fast, and to keep this growth going, the country needs to train enough people to fill about two million jobs by 2030.’

Institutional Support for the Creator Economy via Content Creator Labs

Under the Union Budget 2026, the government announced support for the Indian Institute of Creative Technologies in Mumbai to establish AVGC content creator labs in 15,000 secondary schools and 500 colleges across the country.

These labs will provide students with access to high-performance tools required for animation and digital storytelling. The Finance Minister noted that the initiative is intended to democratise access to professional-grade creative and computing tools. “We are seeing a clear shift from people treating creativity as a hobby to building it as a professional industry,” a senior official said, backing the government’s vision for the sector.

Strategic Cloud Infrastructure and Long-term Tax Certainty

To offset the high operational costs associated with rendering and creative workloads, the government has announced a landmark tax holiday until 2047 for foreign cloud service providers setting up data centres in India.

Explaining the move, the Finance Minister said, ‘“To support the intensive data needs of our creative industries and encourage global tech leaders to make in India, we are offering a long-term tax certainty. This will ensure our local creators have access to global-standard computing power at competitive costs.”

Targeting Global AVGC Leadership by 2030

The government has set an ambitious target of making India a global hub for the AVGC industry by 2030. The budget outlines a long-term talent pipeline strategy that identifies and nurtures creative talent from a young age, ensuring a steady supply of skilled professionals to meet the projected demand for two million jobs and making the creative economy a pillar of national prosperity.

Will Smartphones and Electronics Become Cheaper?

With these announcements, many consumers are wondering whether smartphones, TVs, and other electronic devices will see price cuts. While the changes appear consumer-friendly at first glance, the impact is more complex. The Finance Minister clarified in the Lok Sabha that the intent behind the customs duty changes is to promote local manufacturing and reduce import dependence, particularly for materials used in lithium-ion cells and microwave oven components.

This change is expected to lower electric vehicle battery costs, support India’s green energy goals, encourage local battery manufacturing, and attract greater investment into clean energy production.

Lower duties could help manufacturers reduce production costs, which may eventually translate into lower prices for some electronics. However, such reductions are unlikely to be immediate or guaranteed.

Finance Minister Nirmala Sitharaman said, “To provide further impetus to green mobility and energy security, we have extended the basic customs duty exemption on capital goods for manufacturing lithium-ion cells to include those used for battery energy storage systems.” She added that “these steps, alongside the launch of India Semiconductor Mission 2.0, will support jobs, innovation, and help build a resilient domestic supply chain, making our industries more globally competitive.”

Industry experts note that duty exemptions on battery materials and electronic components do help reduce manufacturing costs. However, analysts caution that lower costs do not automatically result in sharp retail price cuts. “Price changes depend on how domestic makers and importers adjust their pricing,” industry insiders said.

FAQs

Q1. What are the key priorities of the Union Budget 2026?

Answer. The budget focuses on energy transition, technology growth, semiconductor manufacturing, AI, and digital infrastructure.

Q2. How does the Union Budget 2026 support renewable energy and EVs?

Answer. It extends customs duty exemptions on lithium-ion battery manufacturing and energy storage systems, making clean energy solutions cheaper.

Q3. What benefits are offered to data centres and cloud service providers in the Union Budget 2026?

Answer. Foreign cloud companies setting up data centres in India get tax holidays until 2047 and relaxed safe-harbour norms.

Q4. Will smartphones and electronics become cheaper after Budget 2026?

Answer. Union Budget 2026 initiatives will definitely reduce manufacturing costs, but immediate price cuts for consumers are not guaranteed.

Q5. What is the government’s plan for the creator and AVGC economy as per the Union Budget 2026?

Answer. The budget supports AVGC labs in schools and colleges and aims to create about two million jobs by 2030.