Highlights

- Apple’s restrained AI investments may prove beneficial in 2026 with a major Siri overhaul expected.

- Holding over $130 billion in cash gives Apple room for acquisitions if AI valuations drop, while leadership shifts signal a refocus on product-driven AI development.

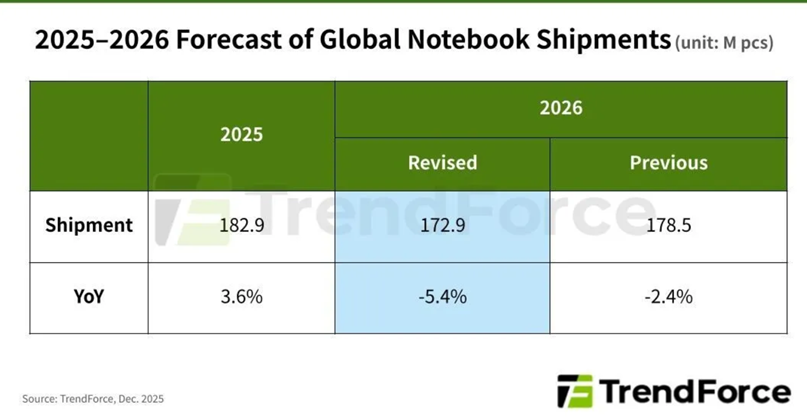

- TrendForce forecasts a 5.4% decline in global notebook shipments in 2026 due to rising memory costs.

- It suggests Apple’s strong supply chain, pricing power, and upcoming low-cost MacBook position it better than competitors.

Apple’s AI approach so far has faced criticism for not matching rivals.

Apple’s measured approach to artificial intelligence could start delivering tangible benefits in 2026, driven by a long-awaited Siri overhaul and growing doubts around massive AI investments, according to a new report by The Information.

The report suggests that while Apple has been criticised for lagging behind rivals such as OpenAI, Google, and Meta in the AI race, its restrained strategy may prove advantageous as concerns emerge about an AI investment “bubble” bursting. Competitors are currently spending hundreds of billions of dollars on data centres, custom chips, and large language model training, raising questions about whether such heavy investments can generate meaningful near-term revenue.

Apple’s conservative AI spending has drawn criticism, particularly because Siri has fallen behind more advanced conversational assistants in terms of capability and reliability.

However, the report argues that market sentiment around AI is beginning to shift with increasing scepticism over the sustainability of runaway AI capital expenditure. In this context, Apple’s decision to limit AI-specific investments has left the company holding more than $130 billion in cash and marketable securities. This gives the Cupertino Giant flexibility to pursue acquisitions or partnerships if the valuations of AI startups decline.

Siri Overhaul Expected in 2026

Apple Siri.

Apple’s most significant AI-related development in 2026 is expected to be the much-anticipated revamp of Siri, which is reportedly slated for a spring launch. The upgraded assistant is said to be more conversational and capable of handling multi-step tasks. To support these improvements, Apple is believed to be adopting Google’s Gemini, reflecting an internal belief that large language models could become commoditised and may not justify the cost of large-scale in-house development.

The report also highlights the iPhone as a major strategic advantage for Apple. Unlike AI-focused companies that rely on standalone apps or web-based services, Apple can deploy AI features directly through software updates and deep system-level integrations across its devices.

Meanwhile, attempts by AI companies to develop competing hardware face hurdles in manufacturing, distribution and ecosystem building.

Apple Leadership Changes Signal AI Refocus

The Information also points to internal leadership changes as part of Apple’s broader effort to realign its AI strategy. Siri has been placed under the leadership of Mike Rockwell, best known for overseeing the launch of the Vision Pro headset, following repeated delays to Siri’s overhaul. Additionally, Apple’s AI chief John Giannandrea announced his retirement earlier in December, with parts of his organisation being redistributed into product-focused teams amid internal concerns about a lack of clear product direction.

Despite Apple’s uneven AI history including the original launch of Siri in 2011, the report notes that these shortcomings have not significantly harmed the company’s core businesses.

Apple Better Positioned as Notebook Shipments Decline in 2026: TrendForce

Separately, a new TrendForce report outlines challenges facing notebook manufacturers in 2026. It notes that rising memory prices will emerge as a major pressure point. Apple, however, is expected to be less affected than its competitors.

TrendForce has revised its global notebook shipment forecast for 2026 to around 173 million units, representing a 5.4% year-on-year decline compared to 2025. The report states, “TrendForce’s recent findings show that, amid a sluggish economic recovery and cautious consumer spending, surging memory prices are squeezing notebook brands’ profit margins and pricing freedom. Consequently, TrendForce has reduced its 2026 global projection for notebook shipments to a 5.4% YoY decrease, totaling around 173 million units. This shift indicates a more conservative approach by brands toward inventory management, promotions, and product setups in response to increasing cost pressures.”

The report adds that if memory supply constraints fail to ease, the decline in shipments could deepen to 10.1%. However, Apple is expected to be better insulated. TrendForce notes, “Despite increasing memory costs, [Apple’s] integrated supply chain and robust pricing power allow for greater flexibility in adjusting its product lineup. Additionally, Apple’s substantial and steady procurement volumes, along with a clear product release schedule and highly predictable demand planning, facilitate securing priority cooperation with memory suppliers.”

Despite the challenging market conditions, Apple is expected to benefit from “ongoing supply chain efficiencies, scale benefits” when it introduces what has been reported as a low-cost MacBook in the spring of 2026.

TrendForce also notes that while global LCD panel shipments are projected to decline by 7.9% year over year in 2026, OLED notebook panel shipments are expected to continue growing, albeit at a slower pace.

IDC has also released a report on the anticipated drop in PC shipments. Projecting an up to 9% drop in shipments in 2026, the report said, “In the more moderate downside scenario, we could see the PC market contract by 4.9% compared with a 2.4% year-on-year decline in the November forecast. Under a more pessimistic scenario, the decline could deepen to 8.9%. The severity of each scenario will largely depend on how long the current supply constraints persist through 2026. Under these downside scenarios, PC average selling prices would likely rise, increasing by 4% to 6% in a moderate scenario, and by 6% to 8% in a pessimistic scenario.”

FAQs

Q1. Why is Apple taking a cautious approach to AI?

Answer. Apple has limited AI-specific investments compared to rivals, holding over $130 billion in cash. This strategy may prove advantageous if the AI investment “bubble” bursts, giving Apple flexibility for acquisitions or partnerships.

Q2. What major AI development is expected from Apple in 2026?

Answer. Apple is planning a significant Siri overhaul in spring 2026, making the assistant more conversational and capable of handling multi-step tasks.

Q3. How will Apple be affected by declining notebook shipments in 2026?

Answer. While global notebook shipments are forecast to decline 5.4% due to rising memory costs, Apple is expected to be better insulated thanks to its integrated supply chain, strong pricing power, and predictable demand planning.

Also Read –

https://www.mymobileindia.com/apple-intelligence-to-get-major-overhaul-with-ios-27-says-report/