Highlights

- iPhones made up about 25% of all active smartphones worldwide in 2025.

- This dominance was driven by strong demand for the iPhone 16 and 17 series and Apple’s ecosystem loyalty.

- Apple and Samsung each surpassed one billion active devices, together holding 44% of the market.

The global smartphone market witnessed a steady year in 2025, but Apple emerged as the standout performer. According to a new report by Counterpoint Research, nearly one in four smartphones currently in use worldwide is an iPhone. Driven by strong demand for its iPhone 16 and iPhone 17 series, this highlights Apple’s growing dominance in a market where long-term user retention is becoming more important than annual shipments. Here’s more on the recent report.

Global Installed Base Grows, But Apple Extends Its Lead

Counterpoint Research reports that the global active installed base of smartphones increased by 2 percent in 2025. The “active installed base” refers to smartphones that are currently in use, offering a clearer picture of user loyalty, ecosystem engagement and replacement cycles. The industry is basically looking beyond just shipment numbers.

In 2025, replacement cycles extended to almost four years. This trend has been driven by incremental hardware improvements and a thriving second-hand smartphone market, which is giving devices a longer lifespan.

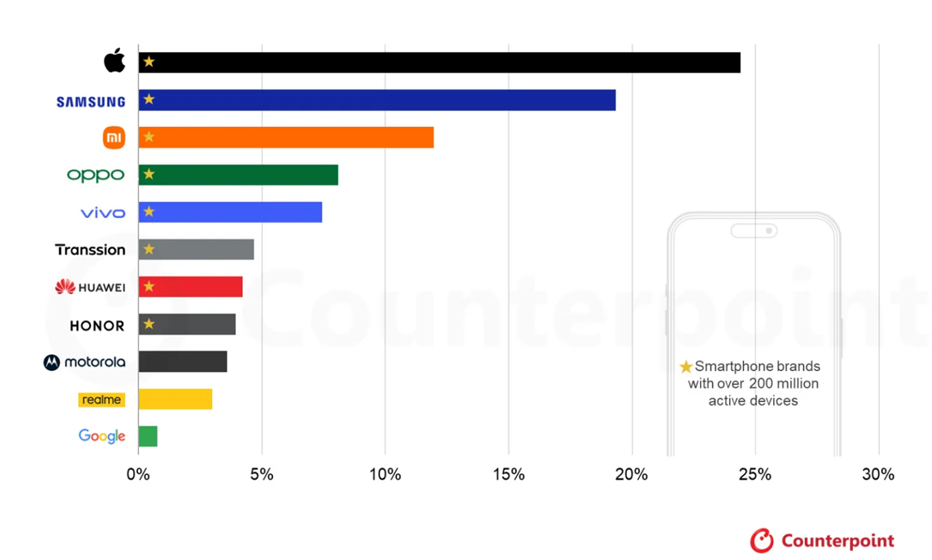

Global Active Smartphone Installed Base by Brand Share, 2025. (Credit – Counterpoint Research)

Despite the modest overall market growth, Apple widened its advantage. Around 25 percent of all active smartphones globally are now iPhones. Notably, Apple added more net new active smartphones in 2025 than the next seven largest OEMs combined, even as overall market growth slowed.

Apple and Samsung Cross One Billion Active Devices

Apple and Samsung continue to dominate the global smartphone ecosystem. Both companies have surpassed the milestone of one billion active devices, a level no other smartphone manufacturer has achieved so far. Together, the two brands accounted for 44 percent of the global active installed base last year.

Karn Chauhan, senior analyst, Counterpoint, said, “Apple leads the global active installed base, with about one in four active smartphones being an iPhone. This is driven by strong user loyalty, a deep iOS ecosystem and tightly integrated services.”

Samsung holds the second position with approximately one-fifth of the global installed base. Its wide-ranging portfolio, covering entry-level to premium smartphones along with its strong presence across global markets has helped it maintain scale.

However, Counterpoint notes that Apple’s edge lies in its tightly integrated ecosystem, higher resale values and extended software support, which collectively lengthen device lifespans and promote multi-owner usage.

“Only Apple and Samsung have surpassed the one-billion active devices milestone, showing their ability to keep users engaged over time,” said Tarun Pathak, research director, Counterpoint Research.

Xiaomi, OPPO, Vivo and Others Cross 200 Million Mark

Beyond Apple and Samsung, several brands have built significant active user bases. Xiaomi, OPPO and Vivo have each crossed 200 million active devices by focusing on the mid-range and upper mid-range segments.

Meanwhile, Transsion Group has expanded rapidly in price-sensitive markets such as Africa and Southeast Asia with its affordable smartphone offerings.

HONOR has also joined the 200 million active devices club recently, while Motorola and Realme are close to reaching the same milestone.

Premium Android Market Faces Growing Challenges

The report highlights increasing pressure on Android brands in the premium smartphone category. In 2025, only Apple and Samsung maintained meaningful market share in the $600-plus wholesale price segment. Six other OEMs collectively remained in single-digit territory.

Rising component costs, memory shortages and limited supply of higher-spec models have slowed premium adoption. As a result, users are holding on to their devices for longer periods.

Smartphone brands are shifting focus toward software, services and on-device AI capabilities to differentiate themselves. Features like advanced camera intelligence, productivity enhancements and seamless cross-device integration are playing a larger role in building customer loyalty.

Apple continues to stand out as the only OEM consistently converting its installed base into high-margin services revenue, which is still growing at a double-digit rate.

Counterpoint suggests that the future of the industry will depend less on annual sales volumes and more on how effectively brands retain users within their ecosystems. In that context, Apple’s growing iPhone installed base presents a widening gap that competitors may find increasingly difficult to bridge.

FAQs

Q1. How many active smartphones worldwide are iPhones in 2025?

Answer. According to Counterpoint Research, about one in four active smartphones globally, roughly 25%, are iPhones, driven by strong demand for the iPhone 16 and 17 series and Apple’s ecosystem loyalty.

Q2. Which smartphone brands have surpassed one billion active devices?

Answer. Only Apple and Samsung have crossed the milestone of one billion active devices. Together, they account for 44% of the global active installed base, highlighting their dominance in user retention and ecosystem engagement.

Q3. What challenges are Android brands facing in the premium smartphone market?

Answer. Premium Android makers are struggling with rising component costs, limited supply of high-spec models, and longer replacement cycles. As a result, only Apple and Samsung hold meaningful market share in the $600+ segment, while others remain in single-digit territory.