Highlights

- India’s smartphone market hit record highs in Q2 2025 with an 18% YoY increase in wholesale value.

- The growth is mainly driven by the booming ultra-premium segment above ₹45,000 and the highest-ever average selling price.

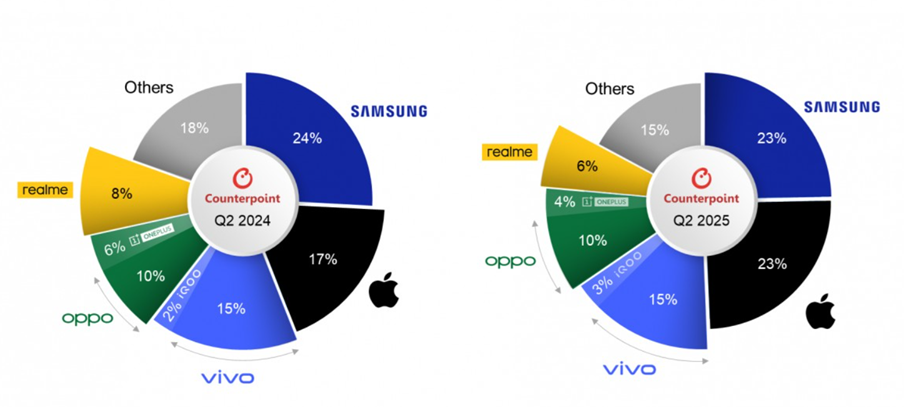

- iPhone 16 led shipments as Apple recorded its best-ever Q2 in India, Samsung topped wholesale value (23%) and ranked second in units.

India’s smartphone market saw a major rebound in Q2 following a slow start in Q1 with analysts at Counterpoint Research reporting record-breaking figures across several key areas.

The wholesale value of smartphones surged by 18% year-over-year, the highest ever recorded for a second quarter. Driving this growth was the ultra-premium segment, defined as devices priced above ₹45,000, which turned out to be the fastest-growing category.

This momentum also pushed the overall Average Selling Price (ASP) of smartphones in India to its highest level ever. Apple and Samsung emerged as the biggest beneficiaries of this trend.

Apple had a standout quarter with the iPhone 16 becoming the most-shipped smartphone in Q2. The company also recorded its highest-ever Q2 shipment volume in India this year.

Samsung captured the largest share (23%) of wholesale value. It ranked second in total unit shipments, fueled by strong demand for its Galaxy A and S series models.

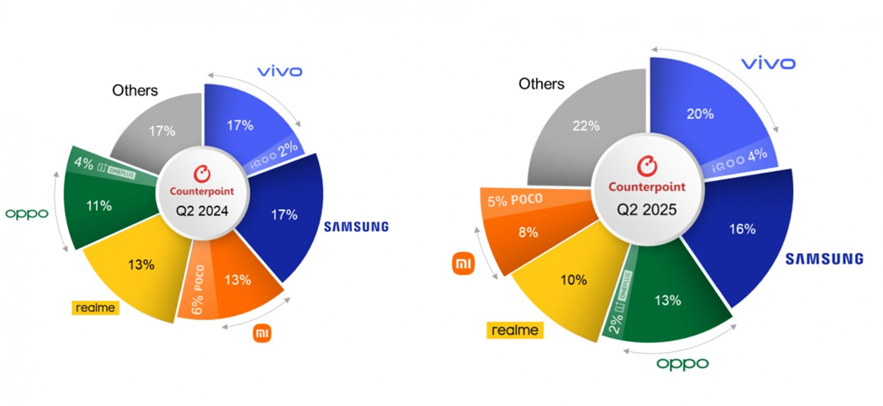

Vivo (excluding iQOO) led the market in unit shipments, thanks to strong performance in the ₹10,000–₹15,000 range, especially in its Y and T series. Oppo (excluding OnePlus) came in third, driven by solid demand for its A and K series smartphones.

OnePlus posted an impressive 75% year-on-year growth in the ultra-premium category, led by the OnePlus 13 and 13R. Early sales data also points to strong interest in the more compact OnePlus 13s. Realme also made a push into the ultra-premium segment with the GT 7 series, especially the Realme GT 7 Dream Edition co-branded with Aston Martin F1, which generated a lot of buzz.

Motorola saw an 86% increase in shipments, driven by the popularity of its G and Edge series and bolstered by a growing retail presence. In the sub-₹10,000 segment, Lava stood out as the fastest-growing brand with a staggering 156% year-on-year growth, credited to its stock Android experience and enhanced after-sales service.

Nothing emerged as the fastest-growing brand overall for the sixth straight quarter, a feat no other brand has matched. Its Q2 shipments jumped 146% with the CMF Phone 2 Pro performing particularly well.

On the chipset front, MediaTek maintained its lead in India with a 47% market share. However, Qualcomm made significant gains, growing 28% year-on-year to secure a 31% share in Q2.

FAQs

Q1. What drove the growth of India’s smartphone market in Q2 2025?

Answer. The Indian smartphone market experienced strong growth in Q2 2025 primarily due to rising demand in the ultra-premium segment, which includes devices priced above ₹45,000. This surge led to an 18% year-on-year increase in wholesale value and pushed the average selling price to an all-time high.

Q2. Which smartphone brands and models led the market during Q2 2025?

Answer. Apple led the market with the iPhone 16 becoming the most-shipped smartphone in Q2, marking its best-ever quarter in India. Samsung captured the largest share of wholesale value at 23% and ranked second in unit shipments, driven by strong sales of its Galaxy A and S series. Vivo topped total unit shipments, especially in the ₹10,000–₹15,000 range.

Q3. Who were the fastest-growing smartphone brands in Q2 2025?

Answer. Nothing was the fastest-growing brand overall, recording a 146% increase in shipments for the sixth consecutive quarter. Lava stood out in the sub-₹10,000 segment with 156% year-on-year growth, while Motorola saw an 86% rise in shipments, boosted by demand for its G and Edge series.

Also Read: iPhone 16 could help Apple create a record $400B revenue this year: Counterpoint