Highlights

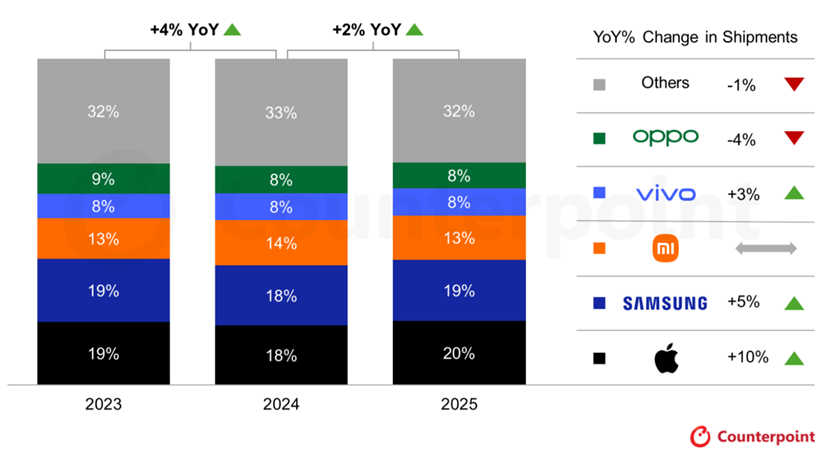

- Apple led global smartphone shipments in 2025 with a 20% market share and 10% growth.

- Samsung secured second place and Xiaomi held third, while Vivo ranked fourth and Oppo slipped to fifth due to weaker demand.

- Analysts expect slower growth in 2026 amid rising memory prices and component shortages.

According to preliminary figures released by Counterpoint Research, Apple has emerged as the world’s top smartphone brand by shipments in 2025. The Cupertino-based company captured a 20% share of the global smartphone market, recording a 10% year-over-year growth. It is the strongest performance among the top five manufacturers. Here’s more on recently released data.

Global Smartphone Shipment Trends in 2025

Global smartphone shipments rose by 2% in 2025, marking the second straight year of recovery for the industry. Counterpoint attributes this growth to strong demand for premium devices, increasing 5G adoption in emerging markets, and flexible financing options that made high-end smartphones more accessible.

Apple benefited from robust demand for the iPhone 17 series in the fourth quarter. Meanwhile, the iPhone 16 continued to perform well in markets such as India, Japan, and Southeast Asia.

Commenting on Apple’s performance, Senior Analyst Varun Mishra said, “Apple’s growth in 2025 was driven by its expanding presence and rising demand across emerging and mid‑size markets, supported by a stronger product mix. The iPhone 17 series gained significant traction in Q4 following its successful launch, while the iPhone 16 continued to perform exceptionally well in Japan, India and Southeast Asia. This dual momentum was further amplified by the COVID‑era upgrade cycle reaching its inflection point, as millions of users were due for replacement.”

Samsung Holds Second Place and Xiaomi Remains Third

Samsung ranked second globally with a 19% market share and posted 5% annual growth. The company’s Galaxy A series continued to drive volumes in the mid-range segment, while the Galaxy S25 and Fold 7 helped maintain momentum in the premium category. Samsung saw shipment gains in Japan but faced challenges in Latin America and Western Europe.

Xiaomi retained its third-place position with a 13% market share. The brand witnessed consistent demand across Southeast Asia and Latin America, supported by a well-balanced lineup spanning premium and mid-range smartphones. Based on Counterpoint’s methodology, Xiaomi is also believed to have topped smartphone shipments in China in 2025.

Vivo finished fourth in the global rankings, aided by growth in the premium segment and strong offline sales performance in India. Oppo dropped to fifth place after recording a 4% decline in shipments, impacted by weaker demand in China and intensifying competition across the Asia-Pacific region. Combined shipments of Oppo and Realme accounted for an 11% market share in 2025.

What to Expect in 2026?

Counterpoint analysts have shared a guarded outlook for 2026. The first is forecasting slower smartphone market growth due to rising memory prices and potential component shortages as chipmakers increasingly divert capacity toward AI data centres.

While Apple and Samsung are expected to remain relatively resilient, Chinese smartphone brands could face mounting supply-side pressures in the coming year.

Commenting on it, Research Director Tarun Pathak said, “The global smartphone market is set to soften in 2026 amid DRAM/NAND shortages and rising component costs, as chipmakers prioritize AI data centers over smartphones. Price hikes in smartphones have already begun to surface. Against this backdrop, we have revised our forecast for 2026 by reducing shipment estimates by 3%. Though the supply crunch will weigh on shipments, Apple and Samsung are likely to remain resilient, supported by stronger supply chain capabilities and premium market positioning, whereas Chinese OEMs concentrated in lower‑price segments will face greater pressure.”

FAQS

Q1. Which company led global smartphone shipments in 2025?

Answer. Apple led with a 20% market share and 10% year-over-year growth, driven by strong iPhone 17 and iPhone 16 sales.

Q2. How did Samsung and Xiaomi perform in 2025?

Answer. Samsung ranked second with a 19% share and 5% growth, while Xiaomi held third place with a 13% share, performing strongly in Southeast Asia and Latin America.

Q3. What is the outlook for the smartphone market in 2026?

Answer. Analysts expect slower growth due to rising memory prices and component shortages, with Apple and Samsung likely to be resilient but Chinese brands facing supply pressures.